robo

TSP Legend

- Reaction score

- 471

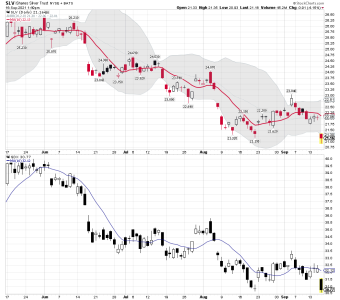

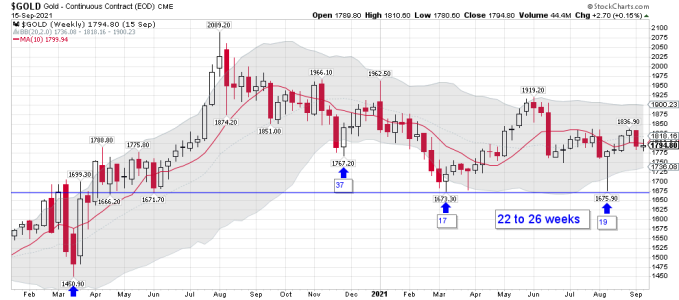

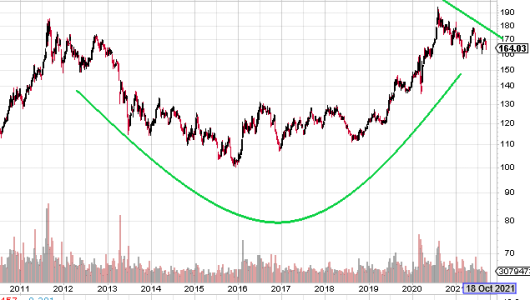

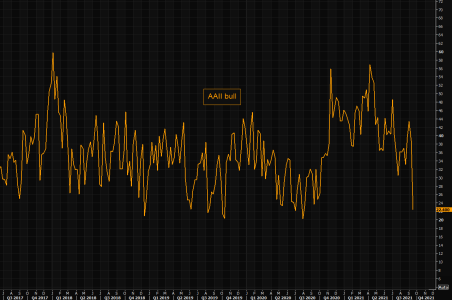

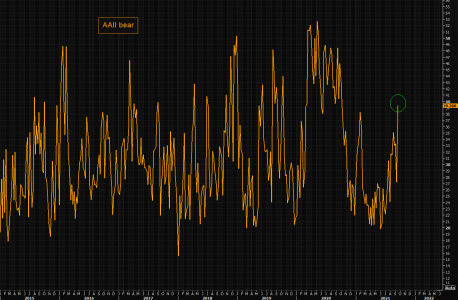

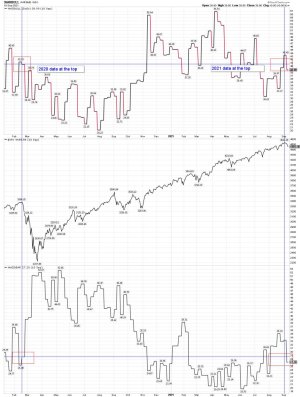

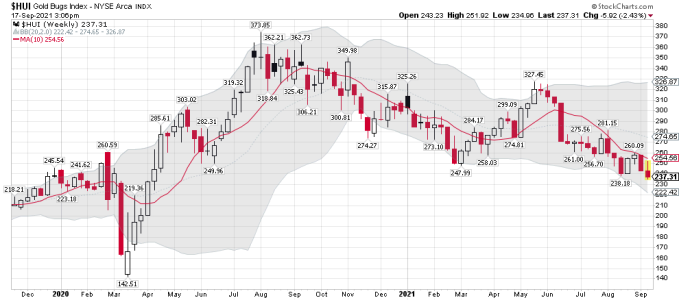

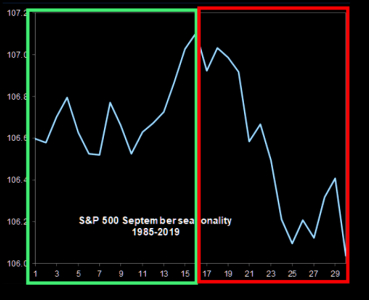

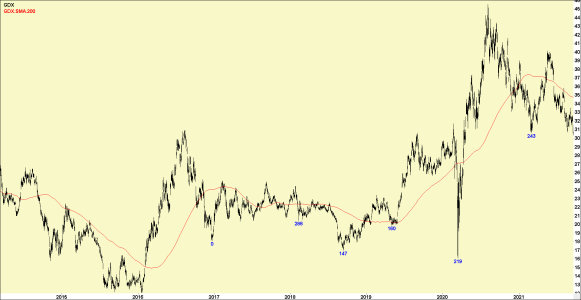

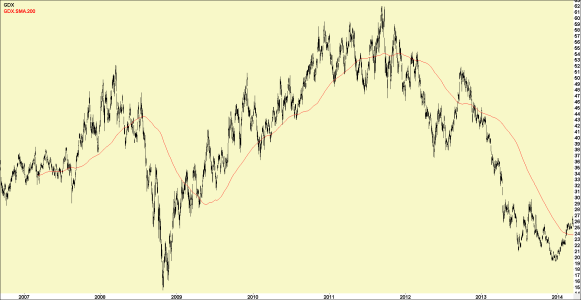

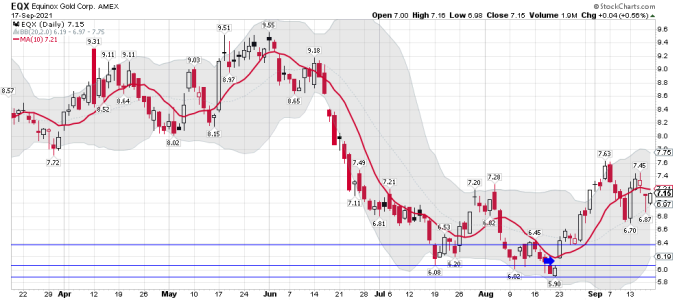

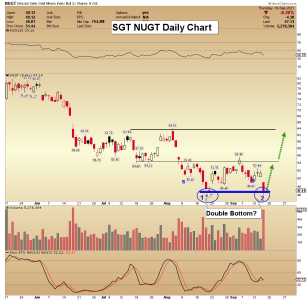

Long GDX and SLV for a trade. Checked into the old site I use to post at, and as usually useless info if you are trading the miners. Someone posted gold is down today, and some other comments from the gap guy. I normally don't even read comments from him, but thought he might have something useful ( A gold nugget) to look over. No such luck.... This is why I trend trade the miners now, and use cycles. The rest to me is just noise. I wasted lots of time posting over there to folks that use tools I sure don't use. I'm not saying they don't make money, but you never know since they don't post their trades. Some folks just post their market thoughts , which is fine. However, I like to track folks that have skin in the game. LOL.... Yeah, I use the KISS system and post my trades in real-time. That doesn't mean this trade will be a winner, but at least I post my trades based on the data/tools I use. All I can say is this trade has better then average odds for making some money. We shall see if it keeps moving lower into the FOMC meeting.

Bottom Line : Long GDX and SVL for a ST trade - Win, lose or Draw..... This could turn into a MT trade, "IF" I get a weekly buy signal in the days ahead.

Bottom Line : Long GDX and SVL for a ST trade - Win, lose or Draw..... This could turn into a MT trade, "IF" I get a weekly buy signal in the days ahead.