robo

TSP Legend

- Reaction score

- 471

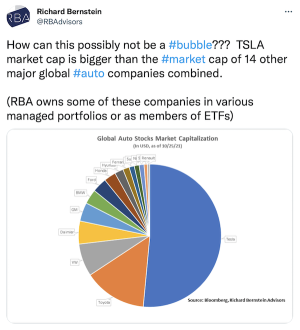

You think! I say very low right now.....

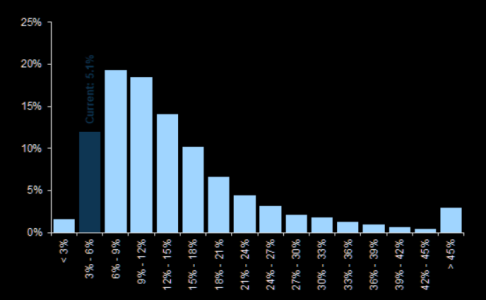

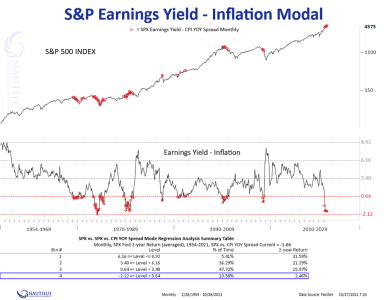

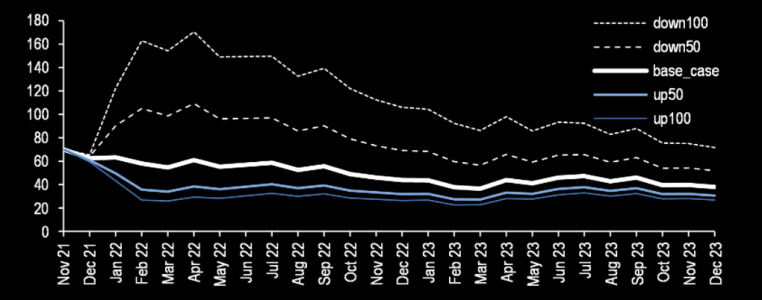

Realized Volatility Is Low

S&P 500 5-day realized volatility is below its 10th percentile since 1970. S&P 500 5-day realized volatility since 1970.

https://themarketear.com/

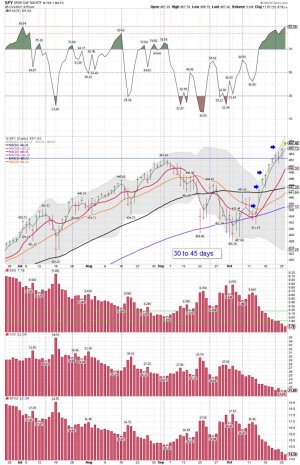

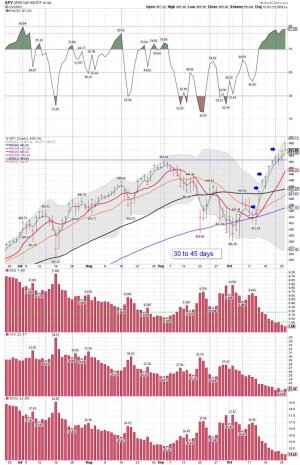

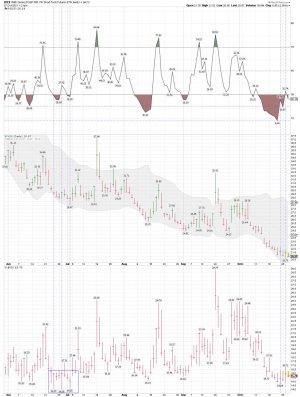

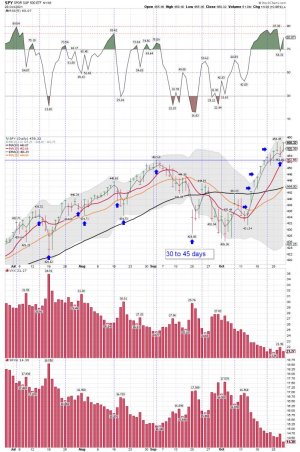

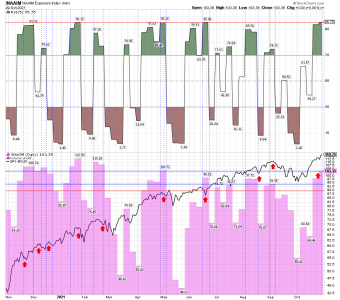

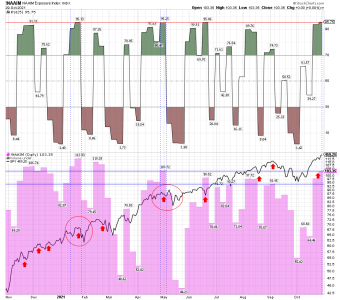

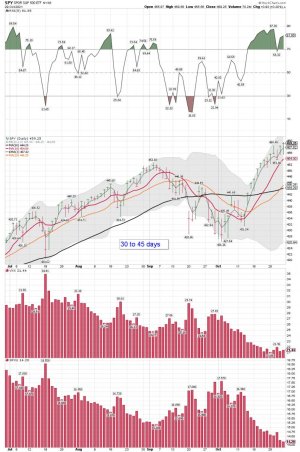

SPY daily: Day 10 since my buy signal.....

Good trading!

Realized Volatility Is Low

S&P 500 5-day realized volatility is below its 10th percentile since 1970. S&P 500 5-day realized volatility since 1970.

https://themarketear.com/

SPY daily: Day 10 since my buy signal.....

Good trading!