Yesterday I had reiterated that while the Seven Sentinels were technically still in buy mode, they had issued an unconfirmed sell signal earlier this week, which I took as a warning, but not necessarily one that would see confirmation. Especially given BPCOMPQ had made a bullish move higher yesterday.

Today the action was fairly robust and several indexes hit new 2-year highs as a result. So it would seem we've broken out to the upside. Again.

European debt offerings are being cited as the catalyst for today's bullish action, and that positive tone whacked the dollar to the tune of about 1%. That was particularly noticeable given the I funds superior performance today.

Getting back to that unconfirmed sell signal from Tuesday, it would appear today's action was enough to invalidate it as the Seven Sentinels reaffirmed the current buy signal with another buy signal. Here's the charts:

NAMO broke that string of lower highs by closing at its highest level since 27Dec. NYMO also moved higher. Both are in buy mode.

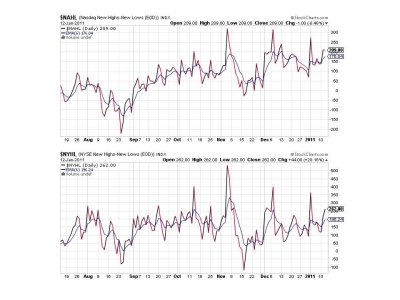

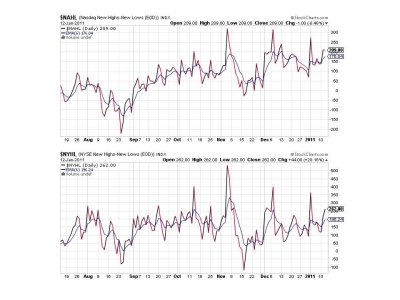

NAHL and NYHL are also flashing buys.

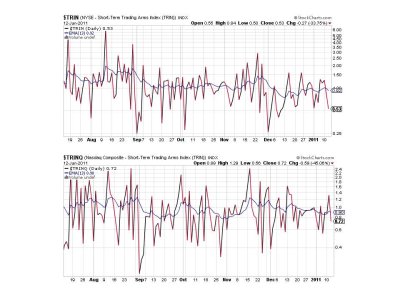

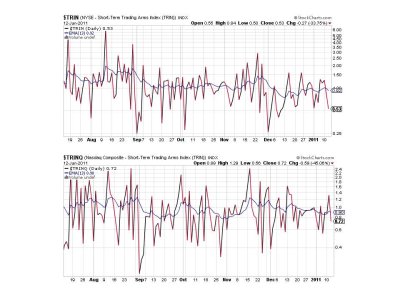

Two more buys for TRIN and TRINQ.

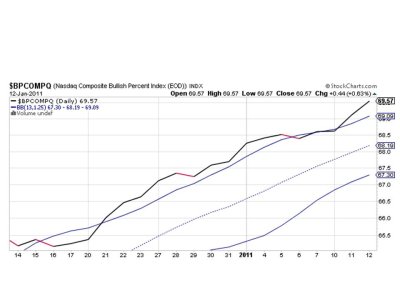

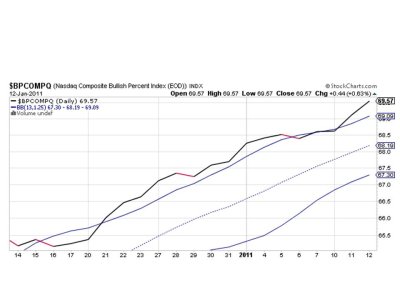

And BPCOMPQ elevated a bit more today and does look quite bullish. But it is closing in on overbought territory (over 70 is considered overbought).

So all signals are back in buy mode, which would appear to invalidate the unconfirmed sell. There's not as much shorting interest in this market as there once was, and it's small wonder given the almost relentless march higher since September 1st.

Danger signs are still out there, but this bull has an attitude and a good head of steam.

Lastly, Tom and I decided to add the 7-Sentinels to the tracker as of the first trading day of the month given it's been on a buy since 21Dec. I decided to allocate any buy signal with a 50/50 split between C and S funds. Sell signals will see a move to the G fund. As of last night the 7-Sentinels could be found at #76 on the tracker.

Today the action was fairly robust and several indexes hit new 2-year highs as a result. So it would seem we've broken out to the upside. Again.

European debt offerings are being cited as the catalyst for today's bullish action, and that positive tone whacked the dollar to the tune of about 1%. That was particularly noticeable given the I funds superior performance today.

Getting back to that unconfirmed sell signal from Tuesday, it would appear today's action was enough to invalidate it as the Seven Sentinels reaffirmed the current buy signal with another buy signal. Here's the charts:

NAMO broke that string of lower highs by closing at its highest level since 27Dec. NYMO also moved higher. Both are in buy mode.

NAHL and NYHL are also flashing buys.

Two more buys for TRIN and TRINQ.

And BPCOMPQ elevated a bit more today and does look quite bullish. But it is closing in on overbought territory (over 70 is considered overbought).

So all signals are back in buy mode, which would appear to invalidate the unconfirmed sell. There's not as much shorting interest in this market as there once was, and it's small wonder given the almost relentless march higher since September 1st.

Danger signs are still out there, but this bull has an attitude and a good head of steam.

Lastly, Tom and I decided to add the 7-Sentinels to the tracker as of the first trading day of the month given it's been on a buy since 21Dec. I decided to allocate any buy signal with a 50/50 split between C and S funds. Sell signals will see a move to the G fund. As of last night the 7-Sentinels could be found at #76 on the tracker.