12/31/25

The year is wrapping up with some uneventful trading and a Santa Claus rally that leaves much to be desired. Stocks were modestly lower on Tuesday, and we now have mixed looking charts, plus a lot of business and geopolitical events circulating that make the short-term call rather intriguing, but not easy as we set our allocation for the New Year.

There's still three days left in the official Santa Claus rally period and that's certainly enough time for things to reverse back up, but the action on Friday, Monday and Tuesday are always interesting days being the first three trading days of a New Year, and they often set the tome for not only January, but for the year, as we discusses the other day.

So placing your bets today (setting your starting allocation), for those next three days may be a bet on how the stock market will do in 2026. There's a lot going on that could be pulling investors in either directions, but the outcome of those trading days will be a good tell.

I look at the charts and I see a reason to be optimistic... or pessimistic. That's not a great analysis, and it's why I am fairly neutral heading into 2026.

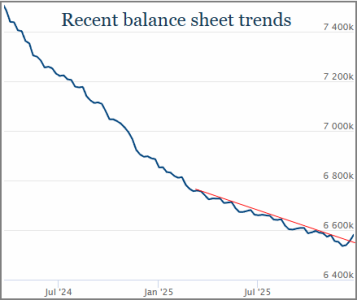

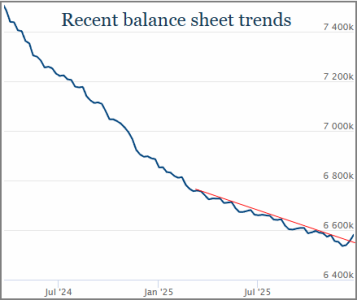

The credit market looks strong. The Fed cut rates and may have a couple more for us in 2026. They are also loosening their balance sheet after a long tightening period. The price of oil is below $60 a barrel. If inflation stays under control, what's not to like about that set up?

On the other hand, is the surge in the price of precious metals, plus the decline of the crypto-currencies, telling us something? Will the recent saber rattling going on between China / Taiwan, the looming January 30 deadline for the next government budget and potential shutdown, or perhaps the Supreme Court's decision on President Trump's tariffs, turn the market on its head next year? Things are stirring in Iran as well, but that may not be as market sensitive as China.

Again, place your bets.

The S&P 500 (C-fund) looks good. I love the inverted head and shoulders set up and this could, or historically should, be a big bullish development for the start of 2026. The recent failed breakout is not as encouraging, but it could be shenanigans of the failed Santa Claus rally (so far) - too many expected it, and the market doesn't make it that easy.

The indicators aren't as bullish, although overbought markets can stay overbought. The indicators do not have to rollover, and can stay pinned on the overbought side for a while. But it is overbought and that's usually more bearish than bullish.

DWCPF (S-fund) is a slight variation of the S&P 500, but it is actually more bearish looking after another failed attempt to get above the October highs. It's above the 50-day average so it's a stretch to say this looks bearish, but making lower highs out of an inverted head and shoulders pattern, during the most bullish time of the year, is concerning. Perhaps it is saving its energy for an early 2026 blast off?

The Russell 2000 small caps index is telling the same story, and the PMO indicator flashed another sell signal. But again, the index is above its 50-day average and any bearish speculation may be premature. It has the potential to get into some trouble, but right now it's just some weakening formations that have time to improve before potentially breaking down.

And another look at the Transportation Index shows a negative PMO crossover for the market leader, a double top, and it's a long way down to the 50-day average in this overbought index that is trying to consolidate before -- something.

From tsp.gov: Holiday Closing - Some financial markets will be closed on Thursday, January 1, in observance of New Year's Day. The Thrift Savings Plan will also be closed. Transactions that would have been processed Thursday night (January 1) will be processed Friday night (January 2) at Friday's closing share prices.

I'll be working on getting the AutoTracker ready for 2026 so there could be some downtime over the holiday and the weekend. If you are not an AutoTracker member, or you haven't logged in for a while, now is a good time to get started. Start an account | Log in

Happy New Year everybody! I'll be back on Friday.

More TSP Fund charts:

ACWX (I-fund) led the 2026 TSP funds and doesn't show any signs of letting up, although yesterday's action created a small negative reversal day suggesting a possible down day today. At about +33% after Tuesday, it would take a pretty bad day for this fund to end year with anything less than a 30% gain, so hats off to the winner!

Here's a chart I posted recently regarding the I-fund's history of leading, or not, in consecutive years. If the right column is positive, it means the I-fund outperformed the C-fund that year.

BND (bonds / F-fund) was down slightly and it is stalling at the top of that old open gap. Support continues to rise and the 50-day average held test after test over the last two months. What would break this out to the upside? Perhaps some of those geopolitical concerns we talked above above.

Thanks so much for reading! Happy New Year! We'll see you back here on Friday.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

The year is wrapping up with some uneventful trading and a Santa Claus rally that leaves much to be desired. Stocks were modestly lower on Tuesday, and we now have mixed looking charts, plus a lot of business and geopolitical events circulating that make the short-term call rather intriguing, but not easy as we set our allocation for the New Year.

| Daily TSP Funds Return

More returns |

There's still three days left in the official Santa Claus rally period and that's certainly enough time for things to reverse back up, but the action on Friday, Monday and Tuesday are always interesting days being the first three trading days of a New Year, and they often set the tome for not only January, but for the year, as we discusses the other day.

So placing your bets today (setting your starting allocation), for those next three days may be a bet on how the stock market will do in 2026. There's a lot going on that could be pulling investors in either directions, but the outcome of those trading days will be a good tell.

I look at the charts and I see a reason to be optimistic... or pessimistic. That's not a great analysis, and it's why I am fairly neutral heading into 2026.

The credit market looks strong. The Fed cut rates and may have a couple more for us in 2026. They are also loosening their balance sheet after a long tightening period. The price of oil is below $60 a barrel. If inflation stays under control, what's not to like about that set up?

On the other hand, is the surge in the price of precious metals, plus the decline of the crypto-currencies, telling us something? Will the recent saber rattling going on between China / Taiwan, the looming January 30 deadline for the next government budget and potential shutdown, or perhaps the Supreme Court's decision on President Trump's tariffs, turn the market on its head next year? Things are stirring in Iran as well, but that may not be as market sensitive as China.

Again, place your bets.

The S&P 500 (C-fund) looks good. I love the inverted head and shoulders set up and this could, or historically should, be a big bullish development for the start of 2026. The recent failed breakout is not as encouraging, but it could be shenanigans of the failed Santa Claus rally (so far) - too many expected it, and the market doesn't make it that easy.

The indicators aren't as bullish, although overbought markets can stay overbought. The indicators do not have to rollover, and can stay pinned on the overbought side for a while. But it is overbought and that's usually more bearish than bullish.

DWCPF (S-fund) is a slight variation of the S&P 500, but it is actually more bearish looking after another failed attempt to get above the October highs. It's above the 50-day average so it's a stretch to say this looks bearish, but making lower highs out of an inverted head and shoulders pattern, during the most bullish time of the year, is concerning. Perhaps it is saving its energy for an early 2026 blast off?

The Russell 2000 small caps index is telling the same story, and the PMO indicator flashed another sell signal. But again, the index is above its 50-day average and any bearish speculation may be premature. It has the potential to get into some trouble, but right now it's just some weakening formations that have time to improve before potentially breaking down.

And another look at the Transportation Index shows a negative PMO crossover for the market leader, a double top, and it's a long way down to the 50-day average in this overbought index that is trying to consolidate before -- something.

From tsp.gov: Holiday Closing - Some financial markets will be closed on Thursday, January 1, in observance of New Year's Day. The Thrift Savings Plan will also be closed. Transactions that would have been processed Thursday night (January 1) will be processed Friday night (January 2) at Friday's closing share prices.

I'll be working on getting the AutoTracker ready for 2026 so there could be some downtime over the holiday and the weekend. If you are not an AutoTracker member, or you haven't logged in for a while, now is a good time to get started. Start an account | Log in

Happy New Year everybody! I'll be back on Friday.

More TSP Fund charts:

ACWX (I-fund) led the 2026 TSP funds and doesn't show any signs of letting up, although yesterday's action created a small negative reversal day suggesting a possible down day today. At about +33% after Tuesday, it would take a pretty bad day for this fund to end year with anything less than a 30% gain, so hats off to the winner!

Here's a chart I posted recently regarding the I-fund's history of leading, or not, in consecutive years. If the right column is positive, it means the I-fund outperformed the C-fund that year.

BND (bonds / F-fund) was down slightly and it is stalling at the top of that old open gap. Support continues to rise and the 50-day average held test after test over the last two months. What would break this out to the upside? Perhaps some of those geopolitical concerns we talked above above.

Thanks so much for reading! Happy New Year! We'll see you back here on Friday.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Last edited: