-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

amoeba's Account Talk

- Thread starter amoeba

- Start date

ripped off by TSP mis-timing my IFT

As if anyone cared except me:

The reason I did what looks like a 2nd IFT at 1% (6 to 7% S fund), that's because TSP ripped me off on the first IFT.

I made it last friday (7/29) at 20 minutes to 9 am (12 noon deadline), and they say I did it at noon. By the way, the deadline is NOT 12 noon, it is 11:59:45 seconds. Normally, I would have checked the confirmation that evening, but with a week of field work coming up and it didn't occur to me since I wasn't close to the deadline.

Actually, what I did on 7/29 was try to increase I/S from 1% to 2% each, which would have produced a 0.1% loss anyway if it had occurred on time. As it was, I missed the big loss on 8/1 and got a smidgeon of a gain on 8/2.

I had intended to do an average in to the S-fund, with a small move, then a big one - but since the TSP RIPPED ME OFF, I could not.

I'm hovering around dead even for this month....I may revise my IFT depending on the move monday morn. There are some calls that the volatility is over - - - which I think are premature. Could be a retest depending on whether upside resistence ~1,200 is breached.

Until next month.........I guess I won't be doing much until then.

Out.

As if anyone cared except me:

The reason I did what looks like a 2nd IFT at 1% (6 to 7% S fund), that's because TSP ripped me off on the first IFT.

I made it last friday (7/29) at 20 minutes to 9 am (12 noon deadline), and they say I did it at noon. By the way, the deadline is NOT 12 noon, it is 11:59:45 seconds. Normally, I would have checked the confirmation that evening, but with a week of field work coming up and it didn't occur to me since I wasn't close to the deadline.

Actually, what I did on 7/29 was try to increase I/S from 1% to 2% each, which would have produced a 0.1% loss anyway if it had occurred on time. As it was, I missed the big loss on 8/1 and got a smidgeon of a gain on 8/2.

I had intended to do an average in to the S-fund, with a small move, then a big one - but since the TSP RIPPED ME OFF, I could not.

I'm hovering around dead even for this month....I may revise my IFT depending on the move monday morn. There are some calls that the volatility is over - - - which I think are premature. Could be a retest depending on whether upside resistence ~1,200 is breached.

Until next month.........I guess I won't be doing much until then.

Out.

Re: ripped off by TSP mis-timing my IFT

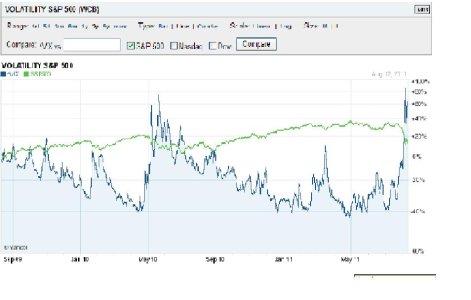

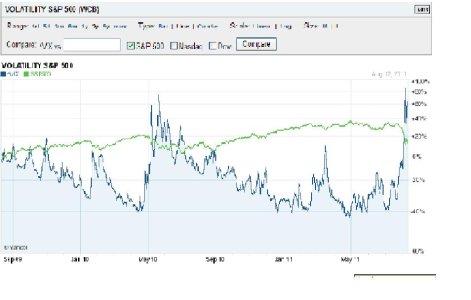

when the vix moves north of 30 like this, it usually takes 4-8 weeks before the market settles and hits a true bottom, as has been the case the last couple such instances; let's see if this works - what I'm looking at here is the direction of change in the SPY in relation to the direction of the VIX, this is comparing last July-Sept, 2010, to this latest move - I wouldn't expect anything different until, say late september at the earliest - so I'm thinking sidelines for now:

when the vix moves north of 30 like this, it usually takes 4-8 weeks before the market settles and hits a true bottom, as has been the case the last couple such instances; let's see if this works - what I'm looking at here is the direction of change in the SPY in relation to the direction of the VIX, this is comparing last July-Sept, 2010, to this latest move - I wouldn't expect anything different until, say late september at the earliest - so I'm thinking sidelines for now:

Phooey:

Volumes did NOT pick up monday; and market is flopping around, just under 1,200 in the SPY and well under the 20 ema in the S-fund.

Talking heads say this is waiting for a Merkel meeting tomorrow; I say baloney - and it is upward momentum towards the 20 ema's.

I noted JTH's comment on the transports, and I also noted the rising bond prices today - which I cashed partly in on (well - diminished a loss, since I believe I bought in on the 1 yr high last wednesday), but sitting on 33% F, and 7% S.

After prices are posted tonight, I may do yet another 1% move. But mainly, standing pat for a better test of upward resistance. I still think this is a "no rush" scenario, with nothing big to happen either way until after labor day and most likely a month later (early october).

Volumes did NOT pick up monday; and market is flopping around, just under 1,200 in the SPY and well under the 20 ema in the S-fund.

Talking heads say this is waiting for a Merkel meeting tomorrow; I say baloney - and it is upward momentum towards the 20 ema's.

I noted JTH's comment on the transports, and I also noted the rising bond prices today - which I cashed partly in on (well - diminished a loss, since I believe I bought in on the 1 yr high last wednesday), but sitting on 33% F, and 7% S.

After prices are posted tonight, I may do yet another 1% move. But mainly, standing pat for a better test of upward resistance. I still think this is a "no rush" scenario, with nothing big to happen either way until after labor day and most likely a month later (early october).

Boghie

Market Veteran

- Reaction score

- 363

Re: ripped off by TSP mis-timing my IFT

Amoeba,

I got wiped out of a 2011/08/04 trade to safety as well. I have no proof - just my faulty memory. I do remember typing in my email twice. I did it around 0830 PST - about the same time you did. I did not receive confirmation so I don't think it will count against me this month.

For today's IFT I printed out the confirmation sheet.

LateR

As if anyone cared except me:

The reason I did what looks like a 2nd IFT at 1% (6 to 7% S fund), that's because TSP ripped me off on the first IFT.

I made it last friday (7/29) at 20 minutes to 9 am (12 noon deadline), and they say I did it at noon. By the way, the deadline is NOT 12 noon, it is 11:59:45 seconds. Normally, I would have checked the confirmation that evening, but with a week of field work coming up and it didn't occur to me since I wasn't close to the deadline.

Actually, what I did on 7/29 was try to increase I/S from 1% to 2% each, which would have produced a 0.1% loss anyway if it had occurred on time. As it was, I missed the big loss on 8/1 and got a smidgeon of a gain on 8/2.

I had intended to do an average in to the S-fund, with a small move, then a big one - but since the TSP RIPPED ME OFF, I could not.

I'm hovering around dead even for this month....I may revise my IFT depending on the move monday morn. There are some calls that the volatility is over - - - which I think are premature. Could be a retest depending on whether upside resistence ~1,200 is breached.

Until next month.........I guess I won't be doing much until then.

By the way, why burn an IFT for such a small move. You are talking about a difference of 1% on the S and 1% on the I. A growth/decline of 0.1% is almost undetectable.

Out.

Amoeba,

I got wiped out of a 2011/08/04 trade to safety as well. I have no proof - just my faulty memory. I do remember typing in my email twice. I did it around 0830 PST - about the same time you did. I did not receive confirmation so I don't think it will count against me this month.

For today's IFT I printed out the confirmation sheet.

LateR

do I hear 1,260 C fund/SPY, 640 S fund/4500 wilshire?, and 57 Ifund/EFA

Oooooh:

wouldn't it be nice to resist selling and recapture the 50 ema's (see title)? just before the next round of selling and the true bottom?

I say yes...looks like ~3-5% still left in this bounce.....no need to be greedy and get it all.....but the promise of a potentially non-negative month is a good feeling......OK.....better feeling than losing 10% or more.

See ya.

Oooooh:

wouldn't it be nice to resist selling and recapture the 50 ema's (see title)? just before the next round of selling and the true bottom?

I say yes...looks like ~3-5% still left in this bounce.....no need to be greedy and get it all.....but the promise of a potentially non-negative month is a good feeling......OK.....better feeling than losing 10% or more.

See ya.

now what?

And once again, I'm right......but nobody cares when I'm losing money, just less than they are.

Huge increase in volatility today. I see nothing good.....as the hope of Q3 or any other further intervention waning.....what this means is the market, finally, will reach a natural bottom.

The question is now what? (where is the bottom). Personally, I don't think this is a one-day selling pony (if for no other reason, than tomorrow is friday), but also the economics are at best disappointing.....and not getting better.....and the sentiment is running out of excuses and hopes.

So maybe we're there (the bottom), or maybe there's another 15% down to go.

light volume, all indices traded near daily lows, 50 ema's not recaptured. Not good if you are in the CSI right now.

And once again, I'm right......but nobody cares when I'm losing money, just less than they are.

Huge increase in volatility today. I see nothing good.....as the hope of Q3 or any other further intervention waning.....what this means is the market, finally, will reach a natural bottom.

The question is now what? (where is the bottom). Personally, I don't think this is a one-day selling pony (if for no other reason, than tomorrow is friday), but also the economics are at best disappointing.....and not getting better.....and the sentiment is running out of excuses and hopes.

So maybe we're there (the bottom), or maybe there's another 15% down to go.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

Re: now what?

Dang, I hope not... :nuts:So maybe we're there (the bottom), or maybe there's another 15% down to go.

JTH

TSP Legend

- Reaction score

- 1,158

Re: now what?

For once we can agree on something Yes a -6% day is not the norm, clearly there are forces at work beyond our comprehension this isn't a Birch-Tree train, this is a high-speed train, when you step in front of it you get demolished....

Yes a -6% day is not the norm, clearly there are forces at work beyond our comprehension this isn't a Birch-Tree train, this is a high-speed train, when you step in front of it you get demolished....

And once again, I'm right......but nobody cares when I'm losing money, just less than they are.

Huge increase in volatility today. I see nothing good.....as the hope of Q3 or any other further intervention waning.....what this means is the market, finally, will reach a natural bottom.

The question is now what? (where is the bottom). Personally, I don't think this is a one-day selling pony (if for no other reason, than tomorrow is friday), but also the economics are at best disappointing.....and not getting better.....and the sentiment is running out of excuses and hopes.

So maybe we're there (the bottom), or maybe there's another 15% down to go.

For once we can agree on something

8/18/11 another warning, smarten up....

High volumes, selling across the board, no end in sight in Asia, futures, poor economic data, and no goins on from Congress or Euro-heads.

Pardon me if I wait for the next time there are any three updays out of five consecutive days in the S-fund before throwing any more money away on this mess.

High volumes, selling across the board, no end in sight in Asia, futures, poor economic data, and no goins on from Congress or Euro-heads.

Pardon me if I wait for the next time there are any three updays out of five consecutive days in the S-fund before throwing any more money away on this mess.

8/22/11 warning; poor economic predictions all week - more selling certain.

Well - this may start getting redundant:

But the forecast for the economic data next week, durables ex-transp., job claims, GDP (!!!), and sentiment; are all weak to poor. If met, selling certain; if missed - selling certain; and no chance of a beats anywhere.

I can't fathom heads-of-state throwing their currencies into the drink by announcing any further stimuli; but if they do - it's just confirmation that they can't think of anything else, and the economy is in worse shape than we even thought it was - so more selling there too.

There could be a fake-out; sellers holding to the sidelines for a day or two - resulting in a low volume blip up; nice time to get the efff out of dodge if you haven't already. A few have ventured in on the recent IFT's; not many.

Well - this may start getting redundant:

But the forecast for the economic data next week, durables ex-transp., job claims, GDP (!!!), and sentiment; are all weak to poor. If met, selling certain; if missed - selling certain; and no chance of a beats anywhere.

I can't fathom heads-of-state throwing their currencies into the drink by announcing any further stimuli; but if they do - it's just confirmation that they can't think of anything else, and the economy is in worse shape than we even thought it was - so more selling there too.

There could be a fake-out; sellers holding to the sidelines for a day or two - resulting in a low volume blip up; nice time to get the efff out of dodge if you haven't already. A few have ventured in on the recent IFT's; not many.

Birchtree

TSP Talk Royalty

- Reaction score

- 143

Re: 8/22/11 warning; poor economic predictions all week - more selling certain.

Got a few facts from Howdy - the benchmark M2 gauge of money supply, which includes cash in circulation plus bank deposits and retail money-market funds jumped by $159 billion in the week ended Aug. 1. That seasonally adjusted 1.7% increase is the third biggest on record since 1980. Investors yanked a whopping $30 billion from equity mutual funds last week - the biggest weekly outflow since October 2008 and much of that money will return to the market soon in my opinion.

Got a few facts from Howdy - the benchmark M2 gauge of money supply, which includes cash in circulation plus bank deposits and retail money-market funds jumped by $159 billion in the week ended Aug. 1. That seasonally adjusted 1.7% increase is the third biggest on record since 1980. Investors yanked a whopping $30 billion from equity mutual funds last week - the biggest weekly outflow since October 2008 and much of that money will return to the market soon in my opinion.

Outflows and money supply are not what I was talking about; and based on today's moderate and flat trading, the market is overly optimistic and gave little credence to Gaddafi news:

Accordingly, sell now while the selling's good. You could be looking at 1,050 by week's end (or 1,200 if the GDP, and particularly the consumptive component, comes in high, but I doubt it will).

At the beginning of this decline, back in the day of 1,270, JTH termed those "exciting" times. We need some better contrarian investment for such times; if I recall our poll on this not too long ago, it was for a gold and a stock-shorting fund. Even the F-fund is taking a bit of a beating - no doubt due to the loss of hope in any Q3 (which bid it up); expect that to continue until BB says otherwise.

Accordingly, sell now while the selling's good. You could be looking at 1,050 by week's end (or 1,200 if the GDP, and particularly the consumptive component, comes in high, but I doubt it will).

At the beginning of this decline, back in the day of 1,270, JTH termed those "exciting" times. We need some better contrarian investment for such times; if I recall our poll on this not too long ago, it was for a gold and a stock-shorting fund. Even the F-fund is taking a bit of a beating - no doubt due to the loss of hope in any Q3 (which bid it up); expect that to continue until BB says otherwise.

JTH

TSP Legend

- Reaction score

- 1,158

Outflows and money supply are not what I was talking about; and based on today's moderate and flat trading, the market is overly optimistic and gave little credence to Gaddafi news:

Accordingly, sell now while the selling's good. You could be looking at 1,050 by week's end (or 1,200 if the GDP, and particularly the consumptive component, comes in high, but I doubt it will).

At the beginning of this decline, back in the day of 1,270, JTH termed those "exciting" times. We need some better contrarian investment for such times; if I recall our poll on this not too long ago, it was for a gold and a stock-shorting fund. Even the F-fund is taking a bit of a beating - no doubt due to the loss of hope in any Q3 (which bid it up); expect that to continue until BB says otherwise.

Yes pullbacks are exciting, especially if you're able to pounce from the sidelines, it stopped being as exciting when we broke through the June lows.

Hmmm:

A couple % appear out of no where for no good reason; I call that a selling opportunity; medium volumes, so can't call it noise. This could move further before friday; or snap back at the open tomorrow. Broad recapture of the 20 and 50 EMA's needs to happen before this is called over.

24/30 of the rank leaders are in G/F. Not alot of believers.

Out.

A couple % appear out of no where for no good reason; I call that a selling opportunity; medium volumes, so can't call it noise. This could move further before friday; or snap back at the open tomorrow. Broad recapture of the 20 and 50 EMA's needs to happen before this is called over.

24/30 of the rank leaders are in G/F. Not alot of believers.

Out.

Handballer

Market Veteran

- Reaction score

- 12

Most of the believers are at the other end of tracker.

Hmmm:

A couple % appear out of no where for no good reason; I call that a selling opportunity; medium volumes, so can't call it noise. This could move further before friday; or snap back at the open tomorrow. Broad recapture of the 20 and 50 EMA's needs to happen before this is called over.

24/30 of the rank leaders are in G/F. Not alot of believers.

Out.

Appatite

Market Tracker

- Reaction score

- 3

Big news day yesterday.

Ghadafi MIGHT be gone. Which increases oil output, apparently in maybe 3 years. So, of course the market reacted to this. And of course Ben will be making a statement this friday that will disappoint everybody.

There is going to be another sell off somewhere. I feel left out right now but someone told me patience is KEY.

Ghadafi MIGHT be gone. Which increases oil output, apparently in maybe 3 years. So, of course the market reacted to this. And of course Ben will be making a statement this friday that will disappoint everybody.

There is going to be another sell off somewhere. I feel left out right now but someone told me patience is KEY.

Similar threads

- Replies

- 7

- Views

- 347