March is now behind us and this market has been resilient to say the least, but how much longer can it levitate without a more serious pullback?

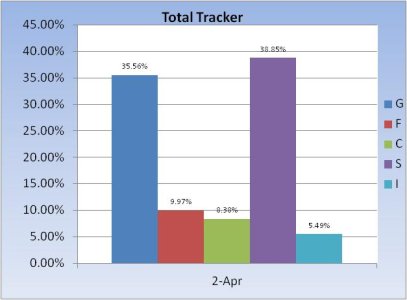

Here's this week's tracker charts:

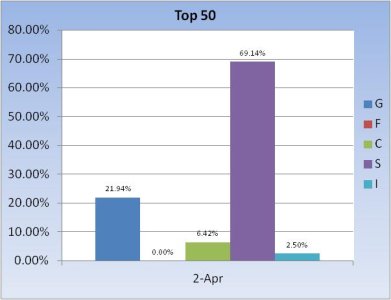

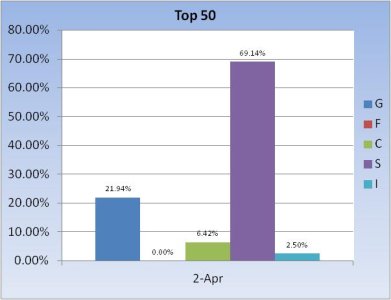

The Top 50 dropped their stock exposure by 8.14% to a total stock allocation of 78.06%. Longer term I think that's bullish given the high overall allocation, but caution is rising in the shorter term (days).

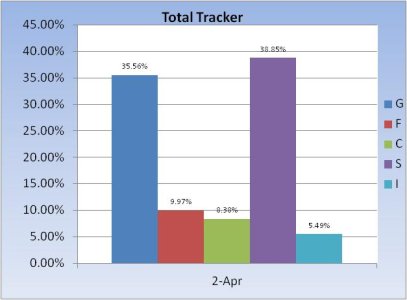

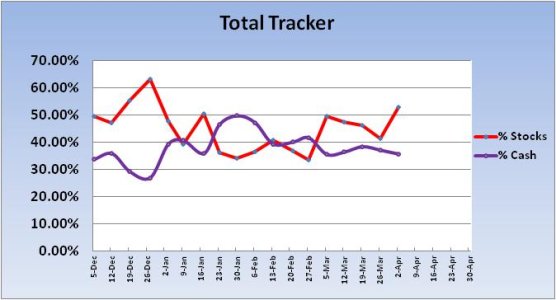

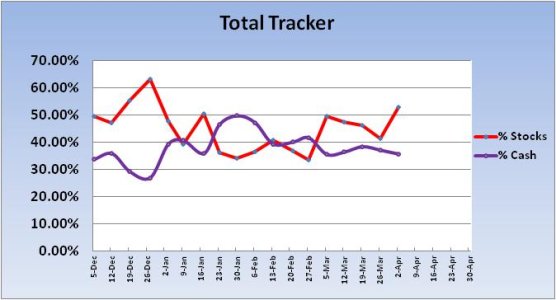

The Total Tracker shows that the herd has gotten at least short term bullish as total stock allocations rose this past week by 11.35% to a total stock allocation of 52.72%. The jump in bullishness for the new week may be bearish in the short term, but with total stock allocations only minimally above 50% I'd have to view that as longer term (months) bullish.

The Seven Sentinels remain in an Intermediate Term Sell condition.

Here's this week's tracker charts:

The Top 50 dropped their stock exposure by 8.14% to a total stock allocation of 78.06%. Longer term I think that's bullish given the high overall allocation, but caution is rising in the shorter term (days).

The Total Tracker shows that the herd has gotten at least short term bullish as total stock allocations rose this past week by 11.35% to a total stock allocation of 52.72%. The jump in bullishness for the new week may be bearish in the short term, but with total stock allocations only minimally above 50% I'd have to view that as longer term (months) bullish.

The Seven Sentinels remain in an Intermediate Term Sell condition.