Mcqlives

Market Veteran

- Reaction score

- 24

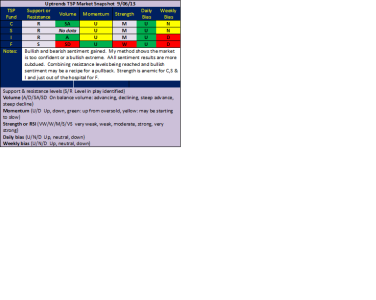

Oops!! Since the SPX price fell below and closed below 1632, the hourly chart has now morphed into a downward sloping channel as shown below. All other patterns are nixed and thrown out the window. That is sometimes the way it is with TA, revise, revise and revise. Some of my model info suggests that the move from 1710 is either halfway over or a little more. The target area for a major reversal is now somewhere between 1570 and 1604. The 1600 area is also a heavy price by volume area, and a 61.8% Fibonacci retracement from the April low, which may give this area extra weight. So don't rush out and buy much right now. Patience is key to investing (and I had to learn this the hard way!). The CNBC talking heads are using the Syrian crisis as an excuse for selling, but I saw this coming last week, and sold all my long positions. Sometimes the market just needs a little push to go over the edge. We could have a "dead cat" type bounce here, but I don't expect much more than 15 points; perhaps to the 1645 to 1649 area tops, and then continue on the free fall to more major support. If you find yourself somehow holding the bag; get out on the next tiny push up. You just can't argue with channels. They go up and they go down. My nonstop trend model continues on the sidelines: please review my post #2872. There have been five previous buy signals this year, and after this carnage is over, there will be another one. Polish your G money in the meantime. View attachment 25039

So far this is dead on! Great job!