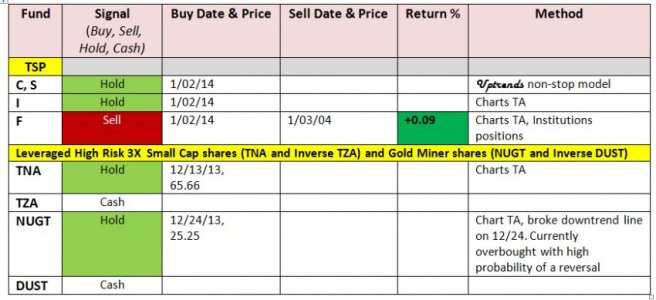

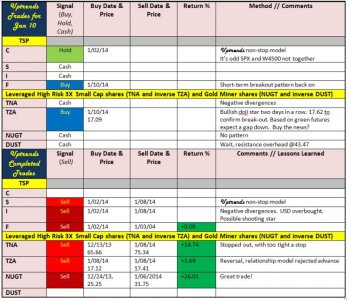

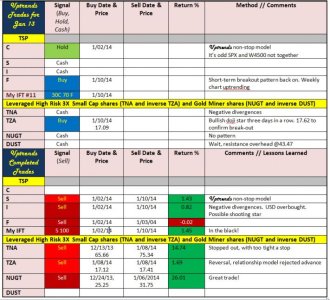

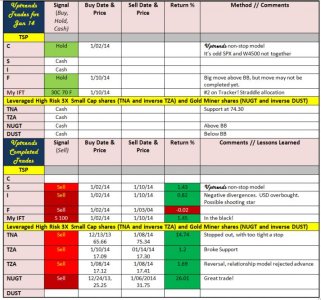

Signal update for week ending 1/03)14. To coincide with the tracker, all TSP funds start on 1/01/14. Small cap and gold miners leveraged instruments (TNA, TZA, NUGT, DUST) are tracked as well. Signals are either determined by my non-stop model or by TA. Trade at your own risk.

[TD="width: 102"]

Signal

(Buy, Sell, Hold, Cash)

[/TD]

[TD="width: 120"]

[/TD]

[TD="width: 120"]

[/TD]

[TD="width: 72"]

[/TD]

[TD="width: 186"]

[/TD]

[TD="width: 55"]

[/TD]

[TD="width: 102"][/TD]

[TD="width: 120"][/TD]

[TD="width: 120"][/TD]

[TD="width: 72"][/TD]

[TD="width: 186"][/TD]

[TD="width: 55, bgcolor: transparent"]

C, S

[/TD]

[TD="width: 102"]

[/TD]

[TD="width: 120, bgcolor: transparent"]

1/02/14

[/TD]

[TD="width: 120, bgcolor: transparent"][/TD]

[TD="width: 72, bgcolor: transparent"][/TD]

[TD="width: 186, bgcolor: transparent"]

Uptrends Non-stop model

[/TD]

[TD="width: 55, bgcolor: transparent"]

I

[/TD]

[TD="width: 102"]

[/TD]

[TD="width: 120, bgcolor: transparent"]

1/02/14

[/TD]

[TD="width: 120, bgcolor: transparent"][/TD]

[TD="width: 72, bgcolor: transparent"][/TD]

[TD="width: 186, bgcolor: transparent"]

Charts TA

[/TD]

[TD="width: 55, bgcolor: transparent"]

F

[/TD]

[TD="width: 102"]

[/TD]

[TD="width: 120, bgcolor: transparent"]

1/02/14

[/TD]

[TD="width: 120, bgcolor: transparent"]

1/03/04

[/TD]

[TD="width: 72"]

+0.09

[/TD]

[TD="width: 186, bgcolor: transparent"]

Charts TA, Institutions

[/TD]

[TD="width: 655, colspan: 6"]

Leveraged High Risk 3X Small Cap shares (TNA and Inverse TZA) and Gold Miner shares (NUGT and Inverse DUST)

[/TD]

[TD="width: 55, bgcolor: transparent"]

TNA

[/TD]

[TD="width: 102"]

[/TD]

[TD="width: 120, bgcolor: transparent"]

12/13/13, 65.66

[/TD]

[TD="width: 120, bgcolor: transparent"][/TD]

[TD="width: 72, bgcolor: transparent"][/TD]

[TD="width: 186, bgcolor: transparent"]

Charts TA

[/TD]

[TD="width: 55, bgcolor: transparent"]

TZA

[/TD]

[TD="width: 102, bgcolor: transparent"]

[/TD]

[TD="width: 120, bgcolor: transparent"][/TD]

[TD="width: 120, bgcolor: transparent"][/TD]

[TD="width: 72, bgcolor: transparent"][/TD]

[TD="width: 186, bgcolor: transparent"][/TD]

[TD="width: 55, bgcolor: transparent"]

NUGT

[/TD]

[TD="width: 102"]

[/TD]

[TD="width: 120, bgcolor: transparent"]

12/24/13, 25.25

[/TD]

[TD="width: 120, bgcolor: transparent"][/TD]

[TD="width: 72, bgcolor: transparent"][/TD]

[TD="width: 186, bgcolor: transparent"]

Chart TA, broke downtrend line

[/TD]

[TD="width: 55, bgcolor: transparent"]

DUST

[/TD]

[TD="width: 102, bgcolor: transparent"]

[/TD]

[TD="width: 120, bgcolor: transparent"][/TD]

[TD="width: 120, bgcolor: transparent"][/TD]

[TD="width: 72, bgcolor: transparent"][/TD]

[TD="width: 186, bgcolor: transparent"][/TD]