-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Uptrend's Account Talk

- Thread starter Uptrend

- Start date

Uptrend

TSP Pro

- Reaction score

- 74

Thanks for your questions. I usually don't play the 3x long NUGT gold play. Why? Because it is extremely volatile and can reverse intraday, and since I am working full time, cannot take the risk. I have seen NUGT make up or down 10-20% moves in one day! Yippee or ouch! I usually don't play the GDX because it moves slower than some of the best of the best gold mining companies. In the gold and silver world, here is my pick of the week, Endeavor Silver Corp, ticker EXK, with price objectives, based on todays closing price, on the enclosed chart. I am waiting for a pullback to the recent low of 4.09 or even lower near trend line support near 4.00. My propriety chart setup (not shown) indicates that there could possibly be one more low, before the upswing. Notice the recent gap has been filled and the money wave stochastic is turning up. I have shown with green vertical lines, what has happened with price when the stochastic previously turned up from oversold. The A/D line has turned sideways recently, which may be a bullish development. Also for EXK there is 1 day to cover short interest, which means hardly anybody is shorting it. This means that there will likely not be any short squeezes, but at the same time price will not get systematically depressed. Institutions own 26% of the company, so they see something in it. The company has reported new higher estimates in silver production for the year. You can check out all the details and fundamentals on Yahoo. In the TSP world, my nonstop model refused to buy from the recent SPX low of 1627, late last month, based on various market data that threw down red flags overriding momentum data. Currently the market is at a BIG resistance area and turning point that should turn hard either up or down. There are some negative divergences at the moment. If SPX declines and finds support near 1685 and reverses up, a trend buy signal will trigger. If 1685 is taken out to the downside, no action will be taken (sidelines). If the market stays above 1700 for more than 3 trading days a buy may trigger. In that regard, today is day 1. Thanks for reading.Uptrend, How about GDX or NUGT for gold miners play ?? I read GDX is core holding of many hedge funds.. Thanks.

Uptrend

TSP Pro

- Reaction score

- 74

Although I would like to believe that the market will keep trading up this week, we have the following things to consider. First on the negative side: 1)Seasonality is against it, based on past data, 2) INDU is trading down hard, followed by SPX. Nasdaq is thinking about following, 3) The ten year treasury note ($TNX) is thinking about ticking up and this should put pressure on stocks. BTW, besides the decision not to taper by the FED, TNX has been ticking up since July 22. Now some of the move may have been the anticipation of a taper, but some of the move may be "undisclosed" inflation and the markets way of dealing with it. TNX is in an uptrend, and the move down last Wednesday did not invalidate that trend , 4) The US dollar is due for a bounce in the daily timeframe and this should put pressure on stocks, 5) Total volume and total issues are down, and 6) Sentiment (the way I figure it on a contrarian basis) is in the "no buy" zone. On the positive side: 1) There is strong SPX support near 1699-1700 and then 1685, so weakness may be limited, 2) There is limited resistance above SPX 1730, so we might have a run-away freight train, 3) The institutions were buying last Friday at a frantic pace on select issues, and 4) Sentiment (the way I figure it), could change to a buy anytime soon. Also gold is in a downtrend, and it is unclear whether there will be a bounce this week or not. A 0.5 Fibonacci retracement from the last swing low to high, puts a retracement to 1306 and a 0.618 puts the limit at 1276. IMO, this is a good week to watch gold, but not play, unless support is found at one of the two levels. Also if the market falls below SPX 1685, gold should trade down, and if the market rebounds big past SPX 1730 gold should trade down.

Uptrend

TSP Pro

- Reaction score

- 74

My non-stop trend model is giving a buy signal today!! Everything is now set-up for a bit of a climb of the wall of worry. The 1695 -1700 pivot area appears to be holding with the 13 ema adding underlying support. If this support area breaks, there is another solid support area near SPX 1680. The market should now take out the SPX 1730 high. The 10 year treasury note has broke a trend line from the July 22 lows, so this means yields are down, so QE may be having an effect. Whether bond holders will now be more reluctant to pull money from bonds and put into stocks remains to be seen. However, bonds are overbought. The financials are oversold (XLF) and may lead the next advance. Further proof includes the fact that I see the big boys taking shorts off of FAZ; the 3x inverse ETF. I picked up some MS and HBAN today. Gold is near a 0.50 retracement from the last swing low to swing high. This is a volatile market, but has huge payoffs. I like to dollar cost average the miners near suspected turns as indicated by Fibonacci and other indicators. And they are really oversold. So this AM I have been picking up gold miners NGD, MUX, EGO and silver miner SSRIAs usual your summary is dead on. Keep it up! We could see this level hold (the 1699 area is showing good support this morning). I think/hope that it, or the 1685ish area, will solidly hold and we will bounce past 1728 soon.

skycophigh

Market Tracker

- Reaction score

- 3

ty Uptrend, question from a rookie, what happens to the dollar, in your opinion, on monday, if they dont reach a deal about funding the gov't..?? would it sink? making the I fund a good play??? just wondering.

Uptrend

TSP Pro

- Reaction score

- 74

See post #2923 for why I don't play NUGT. For the three bull 3x you mentioned, I would prefer either TNA or TQQQ.Thanks for posting your BUY signal. Question.. Which has more upside potential ? SPXL, TQQQ or TNA ??

What about buying GDX or NUGT ?? Thanks !

Uptrend

TSP Pro

- Reaction score

- 74

Read my blog today. I would not expect much of any effect on the USD. It is trying to head up, but a weak bounce.ty Uptrend, question from a rookie, what happens to the dollar, in your opinion, on monday, if they dont reach a deal about funding the gov't..?? would it sink? making the I fund a good play??? just wondering.

Uptrend

TSP Pro

- Reaction score

- 74

My TSP trend nonstop model is on "buy" since Tuesday. You probably noticed that the small cap stayed overbought and never really did correct, while the INDU and SPX traded down. However, there is some evidence that large cap stocks do better late in a bull market. Apparently there are differences in large and small cap stocks with valuations and forward looking price/earnings ratios (P/E), where some large cap stocks are now under valued. Examples are Intel and Visa. GS put out an article on this valuation discrepancy on Business Insider yesterday, and say they have not seen such huge difference in 25 years. So, (translating) I expect the large cap and the C fund to potentially pick up, but that will depend on the relative weighting in the index and the way our Barclays money manger for the TSP picks their winners. I think financials other than JPM, may lead this current rally. Gold looks weak, and I am out. Did a quick BBRY trade for +6% in about 10 minutes this AM. Bonds are overheated.

Khotso

Market Veteran

- Reaction score

- 27

My TSP trend nonstop model is on "buy" since Tuesday. You probably noticed that the small cap stayed overbought and never really did correct, while the INDU and SPX traded down. However, there is some evidence that large cap stocks do better late in a bull market. Apparently there are differences in large and small cap stocks with valuations and forward looking price/earnings ratios (P/E), where some large cap stocks are now under valued. Examples are Intel and Visa. GS put out an article on this valuation discrepancy on Business Insider yesterday, and say they have not seen such huge difference in 25 years. So, (translating) I expect the large cap and the C fund to potentially pick up, but that will depend on the relative weighting in the index and the way our Barclays money manger for the TSP picks their winners. I think financials other than JPM, may lead this current rally. Gold looks weak, and I am out. Did a quick BBRY trade for +6% in about 10 minutes this AM. Bonds are overheated.

Wow! You bought and sold BBRY in 10 minutes and made 6%?

Uptrend

TSP Pro

- Reaction score

- 74

Answer to previous post. Yes bear market blackberry (BBRY). The once flagship phone and secure email is now so despised by the market. Short interest has gone crazy on this Canadian company. However, with a buyout bid to go private now on the table at $9 share, the shorter's better be careful. Some say $9 is a floor, others say it is a ceiling. Meanwhile the market is trying to figure it out. Anyway, I bought yesterday at 7.76 and sold at 8.20, all in the space of 10-15 minutes for a gain of 5.67% Rebought my position at the end of the trading day at 7.93 BBRY is at 8.05 in premarket at the moment.

I like to trade on TNA too. Late couple days, bought TNA at $62.25 and sold it at $64.00. You could repeat the trades for 2-3 times. Next Monday TNA has to choose the direction.

See post #2923 for why I don't play NUGT. For the three bull 3x you mentioned, I would prefer either TNA or TQQQ.

Uptrend

TSP Pro

- Reaction score

- 74

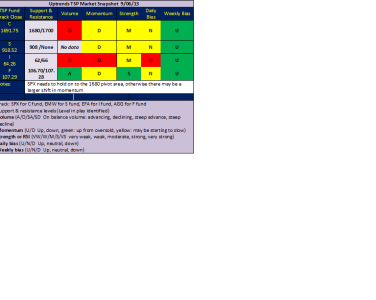

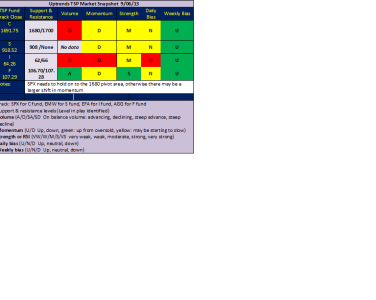

My nonstop trend model is still on a "buy". However, if the SPX 1680 pivot area slips (starts trading below), I suspect it will sell, because of a larger shift in momentum. One has to be suspect of any action today, or in the next few days, until the government CR is settled, because the political wrangling may suppress the trend. Here is my TSP market snapshot. As you can see the weekly timeframe for the TSP funds is still intact. The I fund is the weakest at the moment.

Uptrend

TSP Pro

- Reaction score

- 74

Good Morning. Enjoying the shutdown, while congress plays games? I am getting an indecision read from the markets. I have a short term "sell", but the intermediate term trend is still intact. For a general picture, a major reversal is a close below the SPX 1665 area. I suspect we are going to have noise here in the market for the next few days to weeks, depending what is happening on capitol hill. I have enclosed my chart of the week, which is JC Penny (JCP). This is possibly the buy & hold of the year - at least through the 4th quarter, where they are expected to turn a profit. I piled on and my target is 11.91, a 36.7% gain from current levels. Yes, there is some risk, but ask yourself -do you really believe that JC Penny is going broke tomorrow? If not, then this might be the trade for you. Last Friday, the company sold about 85 million shares to raise cash, and this diluted equity which made the share price tumble. Yes JCP has some risk of bankruptcy, or could be a buyout target. Goldman Sachs has equity and options on JCP, so it will be interesting to see what happens. See this article; if you buy JCP it's at a discount of about 0.40 on the dollar:J.C. Penney Company, Inc. (JCP): JCPennies: Buy For 40 Cents On The Dollar - Seeking Alpha

Uptrend

TSP Pro

- Reaction score

- 74

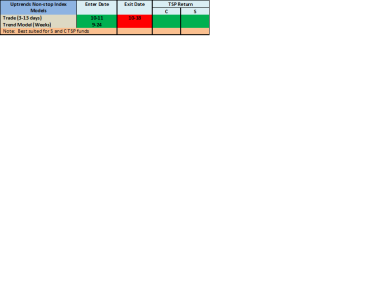

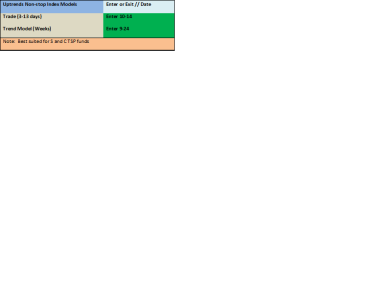

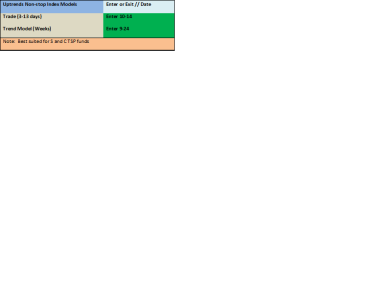

I am back, after the shutdown vacation. Was concentrating on home remodeling, rather than the markets. Now to my trade & trend analysis. I have developed non-stop index models, that I use for my IRA index trading, but can also apply to TSP funds trading; especially the S and C funds. There is a short-term model, that I call "Trade" and a longer term "Trend" model, as seen in the graphic. The trade model is generally suited to 3-13 trading days, depending on market conditions. The trend model covers weeks at a time once triggered. These models use relationships, momentum, and strength. The trend model also has sentiment built into it. Here are the last trigger points. I posted the Trend model buy for September 24, in a previous post, but now will show the Trade model triggers buy & sell as well. Green is for "buy" or go and red will be for "sell" or stop. Watch it for a while to see if you agree with the triggers and results.  .

.

.

.Uptrend

TSP Pro

- Reaction score

- 74

Similar threads

- Replies

- 0

- Views

- 110

- Replies

- 0

- Views

- 232

- Replies

- 0

- Views

- 167

- Replies

- 1

- Views

- 234