-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Uptrend's Account Talk

- Thread starter Uptrend

- Start date

Uptrend

TSP Pro

- Reaction score

- 74

Despite the recent 60 point SPX exurberance the market remains weak and my nonstop trend model says no way. The weekly SPX chart suggests we visit 1525 before this is all over. Sold my remaining blackberry position yesterday before the close and am glad I did, as it got slammed with a missed earnings report this AM. The bears were all over it. Goes to show that one of the rules of individual stock trading is to never play earnings. One can always buy their shares back. Gold is down to $1200/oz but cant get a bid. Just crazy! Some chartists suggest this is the acceleration phase of the decline and 700 to 900 is not to far off.

Uptrend

TSP Pro

- Reaction score

- 74

A buy signal has been triggered for my non-stop model. This is only the 5th buy signal of the year. I have no idea whether it will hve staying power, as there was a short term buy in April and then failure a few days later, but profit overall. (See post #2857). The daily is now approaching overbought (but can stay overbought for long periods of time) and the weekly is still moving down, and I suspect this uptrend might fail. However, we have the holiday week which is usually positive in the very short term. Except that Friday jobs report might kill everything. Perhaps a small return, perhaps moe? Going with my system. Moving to 100% S

Uptrend

TSP Pro

- Reaction score

- 74

Uptrends Chartspeak The chart is a weekly timeframe for the SPX. The stochastic is indicating a buy, but time-wise is still early for a buy. However, the RSI reversed at 50 and looks bullish. The 3 ema is holding above the 13 ema and that is bullish. A failure with the 3 ema going under the 13 ema would be bearish with a good support zone near 1525. My non-stop model is indicating a buy today. Hope this paints a picture.

Uptrend

TSP Pro

- Reaction score

- 74

The uptrend is underway and my non-stop model is gaining upside traction, being on a buy since July 1 . Looking at the chart for Alcoa (AA), I see an oversold condition that is in a holding pattern. An upside surprise may await or at least a meet of expectations when AA reports tomorrow. The Banks that report this Friday are stronger, WFC and JPM, so I expect a beat of expectations. Based on what I am observing, I would not be surprised to see SPX 1680 taken out during July. Have been researching dividend paying stocks that are also oversold. Might as well get the rebound and the dividend for an extra kick. Besides, somebody has to chase Birchtree.

Uptrend

TSP Pro

- Reaction score

- 74

The market grinds higher and today a hole was poked in the previous SPX 1654 high and closing just under it at 1652. Certainly the previous bull market high at SPX 1687 made in May is now within striking distance. Mr. Market is now overbought, but can stay overbought for quite a while. I see some slight negative divergences developing as well as sentiment getting more bullish, but not reaching an extreme - yet (bearish for stocks). I see this wave concluding somewhere around SPX 1690 or a little higher and then a retracement back to around the SPX 1640 area, which would be about a 0.382 Fibonacci. Gold futures took off this PM with the Fed announcement of continuing QE and the US dollar taking a fall. Based on support and resistance on charts, gold could bounce back up to between 1336 and 1425, but not sure if it will go straight up there. Took positions in NGD, EGO and GDX yesterday. The I fund should now hold up with the falling US dollar. Bonds are oversold and due for a bounce, but the RSI is weak and this is concerning. IMO stay away. My non-stop trend model is holding the buy signal since 7/1 and I am 100% S.

Uptrend

TSP Pro

- Reaction score

- 74

I don't see a top yet. The divergences in the indicators are only slight. My 2 hour SPX chart shows an upward sloping channel, rather than a bearish rising wedge, while my weekly charts show way more upside potential. Sentiment is more bullish and is on the front side of extreme, but has more room to run. Also, we have not seen a break-away gap up shooting star type day. Plus the US dollar chart suggests that it will trade down. So I think the climb is still on. My trading system rests in the buy zone for C,S & I. My trading system has a hard time evaluating F, as it is not specifically built for it.

Uptrend

TSP Pro

- Reaction score

- 74

All the market toppers have missed, so far, on calling the current summit. Despite the negative divergences in may timeframes, my system has not flashed the sell signal. I would like to believe that it's close, but just don't know. It took me a long time to learn that one cannot form an opinion which way the market might go and then go out and find information and data to support that position. This kind of reasoning can has plagued many IRA accounts. The better alternative is to listen to the market and believe the indicators. The US dollar is still weak and this is related to the current SPX advance, gold, and the commodities advance. When the current dollar decline ends I think the big SPX run-up will be over. This is based on chart work rather than opinion. Of course it is an opinion of what the chart means and the relationships between market sectors. But chart work is more straight forward than just plan rationalizing.

Uptrend

TSP Pro

- Reaction score

- 74

My Non-stop model has flashed a sell on the close today.

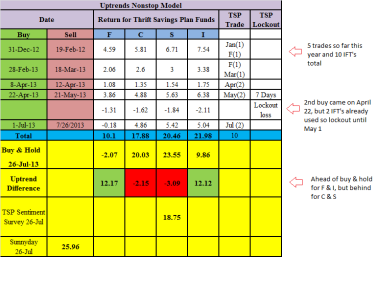

The current trade started on July 1 and ends on July26. Here are the results for my system thus far this year. I realize that tomorrows change must be added; but it is close. My Non-stop model is slightly behind Buy & Hold for C & S, but ahead for F and I. Keep in mind that the model has much less market exposure and market days than Buy & Hold. My Non-stop model is slightly ahead of the TSPTalk Sentiment system, but the exit must be added in tomorrow, so we shall see.

[TABLE="class: MsoTableGrid"]

[TR]

[TD="colspan: 8"]

[/TD]

[/TR]

[TR]

[TD="colspan: 2"]

[/TD]

[TD="colspan: 4"]

[/TD]

[TD]

[/TD]

[TD="width: 16%"]

[/TD]

[/TR]

[TR]

[TD="width: 17%"]

[/TD]

[TD="width: 13%"]

[/TD]

[TD="width: 8%"]

[/TD]

[TD="width: 10%"]

[/TD]

[TD="width: 10%"]

[/TD]

[TD="width: 9%"]

[/TD]

[TD="width: 14%, bgcolor: transparent"][/TD]

[TD="width: 16%, bgcolor: transparent"][/TD]

[/TR]

[TR]

[TD="width: 17%"]

[/TD]

[TD="width: 13%"]

[/TD]

[TD="width: 8%, bgcolor: transparent"]

[/TD]

[TD="width: 10%, bgcolor: transparent"]

[/TD]

[TD="width: 10%, bgcolor: transparent"]

[/TD]

[TD="width: 9%, bgcolor: transparent"]

[/TD]

[TD="width: 14%, bgcolor: transparent"]

[/TD]

[TD="width: 16%, bgcolor: transparent"][/TD]

[/TR]

[TR]

[TD="width: 17%"]

[/TD]

[TD="width: 13%"]

[/TD]

[TD="width: 8%, bgcolor: transparent"]

[/TD]

[TD="width: 10%, bgcolor: transparent"]

[/TD]

[TD="width: 10%, bgcolor: transparent"]

[/TD]

[TD="width: 9%, bgcolor: transparent"]

[/TD]

[TD="width: 14%, bgcolor: transparent"]

[/TD]

[TD="width: 16%, bgcolor: transparent"][/TD]

[/TR]

[TR]

[TD="width: 17%"]

[/TD]

[TD="width: 13%"]

[/TD]

[TD="width: 8%, bgcolor: transparent"]

[/TD]

[TD="width: 10%, bgcolor: transparent"]

[/TD]

[TD="width: 10%, bgcolor: transparent"]

[/TD]

[TD="width: 9%, bgcolor: transparent"]

[/TD]

[TD="width: 14%, bgcolor: transparent"]

[/TD]

[TD="width: 16%, bgcolor: transparent"][/TD]

[/TR]

[TR]

[TD="width: 17%"]

[/TD]

[TD="width: 13%"]

[/TD]

[TD="width: 8%, bgcolor: transparent"]

[/TD]

[TD="width: 10%, bgcolor: transparent"]

[/TD]

[TD="width: 10%, bgcolor: transparent"]

[/TD]

[TD="width: 9%, bgcolor: transparent"]

[/TD]

[TD="width: 14%, bgcolor: transparent"]

[/TD]

[TD="width: 16%, bgcolor: transparent"]

[/TD]

[/TR]

[TR]

[TD="width: 17%"][/TD]

[TD="width: 13%"][/TD]

[TD="width: 8%, bgcolor: transparent"]

[/TD]

[TD="width: 10%, bgcolor: transparent"]

[/TD]

[TD="width: 10%, bgcolor: transparent"]

[/TD]

[TD="width: 9%, bgcolor: transparent"]

[/TD]

[TD="width: 14%, bgcolor: transparent"][/TD]

[TD="width: 16%, bgcolor: transparent"]

[/TD]

[/TR]

[TR]

[TD="width: 17%"]

[/TD]

[TD="width: 13%"]

[/TD]

[TD="width: 8%, bgcolor: transparent"]

[/TD]

[TD="width: 10%, bgcolor: transparent"]

[/TD]

[TD="width: 10%, bgcolor: transparent"]

[/TD]

[TD="width: 9%, bgcolor: transparent"]

[/TD]

[TD="width: 14%, bgcolor: transparent"]

[/TD]

[TD="width: 16%, bgcolor: transparent"][/TD]

[/TR]

[TR]

[TD="width: 17%"]

[/TD]

[TD="width: 13%"][/TD]

[TD="width: 8%"]

[/TD]

[TD="width: 10%"]

[/TD]

[TD="width: 10%"]

[/TD]

[TD="width: 9%"]

[/TD]

[TD="width: 14%"]

[/TD]

[TD="width: 16%"][/TD]

[/TR]

[TR]

[TD="width: 17%"]

Buy & Hold

[/TD]

[TD="width: 13%"][/TD]

[TD="width: 8%"]

[/TD]

[TD="width: 10%"]

[/TD]

[TD="width: 10%"]

[/TD]

[TD="width: 9%"]

[/TD]

[TD="width: 14%"][/TD]

[TD="width: 16%"][/TD]

[/TR]

[TR]

[TD="width: 17%"]

[/TD]

[TD="width: 13%"][/TD]

[TD="width: 8%"]

[/TD]

[TD="width: 10%"]

[/TD]

[TD="width: 10%"]

[/TD]

[TD="width: 9%"]

[/TD]

[TD="width: 14%"][/TD]

[TD="width: 16%"][/TD]

[/TR]

[TR]

[TD="width: 17%"]

[/TD]

[TD="width: 13%"][/TD]

[TD="width: 8%"][/TD]

[TD="width: 10%"][/TD]

[TD="width: 10%"]

[/TD]

[TD="width: 9%"][/TD]

[TD="width: 14%"][/TD]

[TD="width: 16%"][/TD]

[/TR]

[TR]

[TD="width: 17%"]

[/TD]

[TD="width: 13%"]

[/TD]

[TD="width: 8%"][/TD]

[TD="width: 10%"][/TD]

[TD="width: 10%"][/TD]

[TD="width: 9%"][/TD]

[TD="width: 14%"][/TD]

[TD="width: 16%"][/TD]

[/TR]

[/TABLE]

The current trade started on July 1 and ends on July26. Here are the results for my system thus far this year. I realize that tomorrows change must be added; but it is close. My Non-stop model is slightly behind Buy & Hold for C & S, but ahead for F and I. Keep in mind that the model has much less market exposure and market days than Buy & Hold. My Non-stop model is slightly ahead of the TSPTalk Sentiment system, but the exit must be added in tomorrow, so we shall see.

[TABLE="class: MsoTableGrid"]

[TR]

[TD="colspan: 8"]

Uptrends Nonstop Model

[/TR]

[TR]

[TD="colspan: 2"]

Date

[TD="colspan: 4"]

Return for Thrift Savings Plan Funds

[TD]

TSP Trade

[TD="width: 16%"]

TSP Lockout

[/TR]

[TR]

[TD="width: 17%"]

Buy

[TD="width: 13%"]

Sell

[TD="width: 8%"]

F

[TD="width: 10%"]

C

[TD="width: 10%"]

S

[TD="width: 9%"]

I

[TD="width: 14%, bgcolor: transparent"][/TD]

[TD="width: 16%, bgcolor: transparent"][/TD]

[/TR]

[TR]

[TD="width: 17%"]

31-Dec-12

[TD="width: 13%"]

19-Feb-12

[TD="width: 8%, bgcolor: transparent"]

4.59

[TD="width: 10%, bgcolor: transparent"]

5.81

[TD="width: 10%, bgcolor: transparent"]

6.71

[TD="width: 9%, bgcolor: transparent"]

7.54

[TD="width: 14%, bgcolor: transparent"]

Jan(1) F(1)

[TD="width: 16%, bgcolor: transparent"][/TD]

[/TR]

[TR]

[TD="width: 17%"]

28-Feb-13

[TD="width: 13%"]

18-Mar-13

[TD="width: 8%, bgcolor: transparent"]

2.06

[TD="width: 10%, bgcolor: transparent"]

2.6

[TD="width: 10%, bgcolor: transparent"]

3.0

[TD="width: 9%, bgcolor: transparent"]

3.38

[TD="width: 14%, bgcolor: transparent"]

F(1) Mar(1)

[TD="width: 16%, bgcolor: transparent"][/TD]

[/TR]

[TR]

[TD="width: 17%"]

8-Apr-13

[TD="width: 13%"]

12-Apr-13

[TD="width: 8%, bgcolor: transparent"]

1.08

[TD="width: 10%, bgcolor: transparent"]

1.35

[TD="width: 10%, bgcolor: transparent"]

1.54

[TD="width: 9%, bgcolor: transparent"]

1.75

[TD="width: 14%, bgcolor: transparent"]

Apr(2)

[TD="width: 16%, bgcolor: transparent"][/TD]

[/TR]

[TR]

[TD="width: 17%"]

22-Apr-13

[TD="width: 13%"]

21-May-13

[TD="width: 8%, bgcolor: transparent"]

3.86

[TD="width: 10%, bgcolor: transparent"]

4.88

[TD="width: 10%, bgcolor: transparent"]

5.63

[TD="width: 9%, bgcolor: transparent"]

6.38

[TD="width: 14%, bgcolor: transparent"]

May(2)

[TD="width: 16%, bgcolor: transparent"]

7 Days

[/TR]

[TR]

[TD="width: 17%"][/TD]

[TD="width: 13%"][/TD]

[TD="width: 8%, bgcolor: transparent"]

-1.31

[TD="width: 10%, bgcolor: transparent"]

-1.62

[TD="width: 10%, bgcolor: transparent"]

-1.84

[TD="width: 9%, bgcolor: transparent"]

-2.11

[TD="width: 14%, bgcolor: transparent"][/TD]

[TD="width: 16%, bgcolor: transparent"]

Lockout loss

[/TR]

[TR]

[TD="width: 17%"]

01-Jul-13

[TD="width: 13%"]

7-25-13

[TD="width: 8%, bgcolor: transparent"]

-0.04

[TD="width: 10%, bgcolor: transparent"]

4.78

[TD="width: 10%, bgcolor: transparent"]

5.75

[TD="width: 9%, bgcolor: transparent"]

5.33

[TD="width: 14%, bgcolor: transparent"]

Jul (2)

[TD="width: 16%, bgcolor: transparent"][/TD]

[/TR]

[TR]

[TD="width: 17%"]

Total

[TD="width: 13%"][/TD]

[TD="width: 8%"]

10.24

[TD="width: 10%"]

17.80

[TD="width: 10%"]

20.79

[TD="width: 9%"]

22.27

[TD="width: 14%"]

10

[TD="width: 16%"][/TD]

[/TR]

[TR]

[TD="width: 17%"]

Buy & Hold

25-Jul-13

[TD="width: 13%"][/TD]

[TD="width: 8%"]

-2.29

[TD="width: 10%"]

19.93

[TD="width: 10%"]

23.94

[TD="width: 9%"]

10.16

[TD="width: 14%"][/TD]

[TD="width: 16%"][/TD]

[/TR]

[TR]

[TD="width: 17%"]

Uptrend Difference

[TD="width: 13%"][/TD]

[TD="width: 8%"]

7.95

[TD="width: 10%"]

-2.13

[TD="width: 10%"]

-3.15

[TD="width: 9%"]

12.11

[TD="width: 14%"][/TD]

[TD="width: 16%"][/TD]

[/TR]

[TR]

[TD="width: 17%"]

TSP Sentiment Survey 25-Jul

[TD="width: 13%"][/TD]

[TD="width: 8%"][/TD]

[TD="width: 10%"][/TD]

[TD="width: 10%"]

19.13

[TD="width: 9%"][/TD]

[TD="width: 14%"][/TD]

[TD="width: 16%"][/TD]

[/TR]

[TR]

[TD="width: 17%"]

Remark

25-Jul

25-Jul

[TD="width: 13%"]

26.04

[TD="width: 8%"][/TD]

[TD="width: 10%"][/TD]

[TD="width: 10%"][/TD]

[TD="width: 9%"][/TD]

[TD="width: 14%"][/TD]

[TD="width: 16%"][/TD]

[/TR]

[/TABLE]

RealMoneyIssues

TSP Legend

- Reaction score

- 101

Uptrend, thank you for sharing your results.

Stupid questions:

What is your actual return?

What are your fund trades (may be on another part of the spreadsheet you didn't screen capture)?

If it is a nonstop model, I am assuming you are either in S or F (possibly G if you are out of IFTs), correct?

Sorry to bother you with these, I could probably read through this years posts to get the information and if you don't have time, just tell me. I will check out the posts.

Thanks for all you are doing to help educate us (some of us are denser than others)...

Have a great week-end!

Stupid questions:

What is your actual return?

What are your fund trades (may be on another part of the spreadsheet you didn't screen capture)?

If it is a nonstop model, I am assuming you are either in S or F (possibly G if you are out of IFTs), correct?

Sorry to bother you with these, I could probably read through this years posts to get the information and if you don't have time, just tell me. I will check out the posts.

Thanks for all you are doing to help educate us (some of us are denser than others)...

Have a great week-end!

Uptrend

TSP Pro

- Reaction score

- 74

Thanks for the questions RMI. #1 My actual return is what you see on the tracker (#585 6.33%). Keep in mind I did not trade my model while it was under development. The first TSP trade I have completed with this current model started on July 1 and ended July 26 and was 100 % S. (I meant to move to G on Friday on the tracker, but forgot, but will on Monday.) Since I turned 59.5 recently, I used TSP form 75 and rolled a large portion of my TSP account to an IRA that I am electronically trading on one of the advertised platforms out there. What I am trading and how I do the picks and entry/exit points is another story (going well!). For TSP, I plan on using my nonstop trend model going forward. #2 All fund results are shown except for G. There would be a slight + adjustment for being in G, while not in an active trade and this is not shown, but will be added in the future. There is no emphasis of one fund over the other (F,C,S,I). This is left to the user and user risk tolerance. #3. Yes At this time it is either an active fund (s) (and I would suggest either 100% S or 80% S, 20% C) or 100% G. There are opportunities at times to go 100% F, or 100% I (such as when the US dollar is falling), but these are not indicated at this time. My nonstop model is basically for the NYSE and the NASDAQ and do not include all the relationships necessary to do this kind of fine tuning. This "trend type" nonstop model was a hobby to develop and is for educational purposes only.Uptrend, thank you for sharing your results.

Stupid questions:

What is your actual return?

What are your fund trades (may be on another part of the spreadsheet you didn't screen capture)?

If it is a nonstop model, I am assuming you are either in S or F (possibly G if you are out of IFTs), correct?

Have a great week-end!

clogletn

Rising Member

- Reaction score

- 1

So, are you using this at all in your IRA trades? I ask because I have rolled my TSP over also. Thanks.

Thanks for the questions RMI. #1 My actual return is what you see on the tracker (#585 6.33%). Keep in mind I did not trade my model while it was under development. The first TSP trade I have completed with this current model started on July 1 and ended July 26 and was 100 % S. (I meant to move to G on Friday on the tracker, but forgot, but will on Monday.) Since I turned 59.5 recently, I used TSP form 75 and rolled a large portion of my TSP account to an IRA that I am electronically trading on one of the advertised platforms out there. What I am trading and how I do the picks and entry/exit points is another story (going well!). For TSP, I plan on using my nonstop trend model going forward. #2 All fund results are shown except for G. There would be a slight + adjustment for being in G, while not in an active trade and this is not shown, but will be added in the future. There is no emphasis of one fund over the other (F,C,S,I). This is left to the user and user risk tolerance. #3. Yes At this time it is either an active fund (s) (and I would suggest either 100% S or 80% S, 20% C) or 100% G. There are opportunities at times to go 100% F, or 100% I (such as when the US dollar is falling), but these are not indicated at this time. My nonstop model is basically for the NYSE and the NASDAQ and do not include all the relationships necessary to do this kind of fine tuning. This "trend type" nonstop model was a hobby to develop and is for educational purposes only.

Uptrend

TSP Pro

- Reaction score

- 74

Yes I am. Basically as a first rule of trading, only trade in the prevailing market direction. It is very dangerous to go against the grain. Now I realize that different stocks are in different stages of highs and lows and one needs to factor this in, but the first rule stands. Currently SPX is near resistance (1699) and market weakness is beginning to appear. However, IMO, it is too dangerous to short at this juncture, as higher highs are not off the table. Therefore for individual stock trades, I am holding mostly cash at this point waiting for the market to tell me which way it is going. A drop below SPX 1684 would open a short ETF position, such as SPXU. Now dividend paying stable stocks are always an option for part of ones portfolio; ie AT&T and the like. Like Crammer says: "Buy them and forget them."So, are you using this at all in your IRA trades? I ask because I have rolled my TSP over also. Thanks.

Uptrend

TSP Pro

- Reaction score

- 74

Market weakness today as expected. My TSP is in cash (G), and my simple IRA is mostly in cash, except for long AMD, S, T and BBRY and short TZA. Thinking about entering DUST, but do not have confirmation - yet. Keep in mind in the leveraged long and short gold ETF's (NUGT and DUST) one can either make money or get burned in a hurry, as daily 20% swings are not uncommon! Opened a position in TZA, as confirmation occurred. Bonds look sick, so IMO stay away.

clogletn

Rising Member

- Reaction score

- 1

Thanks. Your knowledge and your willingness to share are both greatly appreciated.

Yes I am. Basically as a first rule of trading, only trade in the prevailing market direction. It is very dangerous to go against the grain. Now I realize that different stocks are in different stages of highs and lows and one needs to factor this in, but the first rule stands. Currently SPX is near resistance (1699) and market weakness is beginning to appear. However, IMO, it is too dangerous to short at this juncture, as higher highs are not off the table. Therefore for individual stock trades, I am holding mostly cash at this point waiting for the market to tell me which way it is going. A drop below SPX 1684 would open a short ETF position, such as SPXU. Now dividend paying stable stocks are always an option for part of ones portfolio; ie AT&T and the like. Like Crammer says: "Buy them and forget them."

Uptrend

TSP Pro

- Reaction score

- 74

Nothing has changed; as my nonstop uptrend model remains on sell (G fund). The ES SPX futures have been trading choppy the last few days, indicating a sideways and lack of direction. I expect a positive market flash tomorrow (August 1) and then a fade through Friday or Monday. There could be one last push to SPX 1699 or even 1717 (lower probability), before a broader continuing rollover. Negative divergences were again appearing on the charts today. My nonstop model indicates a decline is in progress, and the price action has not negated it so far. I have studied gold quite a bit and believe that it will trade down to $1275 or even a double bottom below $1200. Looking for an entry point into the leveraged fund DUST tomorrow, depending on what gold does on the open. Meanwhile the US dollar chart (tracking with UUP) should break out of a bullish falling wedge, and this should put pressure on equities and metals prices.

Similar threads

- Replies

- 0

- Views

- 112

- Replies

- 0

- Views

- 233

- Replies

- 0

- Views

- 168

- Replies

- 1

- Views

- 235