jkenjohnson

Market Veteran

- Reaction score

- 24

Make that a buy on TZA.

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

Ditto! I was happy to see your post today...and I'll take it as boding well for this weeks markets.

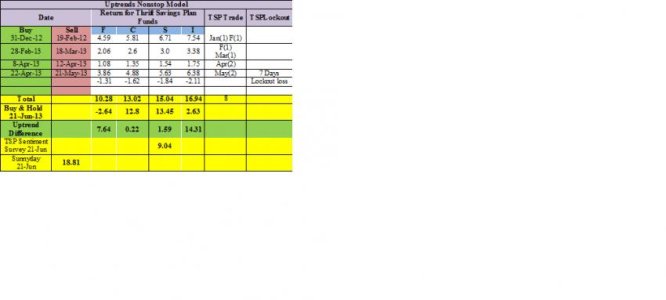

Glad you are posting again.The SPX hourly and daily timeframes are overbought, but the weekly stochastic is just starting to turn up, but no cross yet. My nonstop models for the NYSE and NASDAQ are starting to turn, but no "buy" yet. The NASDAQ ia ahead of the NYSE.

Blackberry (BBRY) is rocking up and down the past few days. Yesterday up over 3%, today down over 3%. The stock is heavily shorted with an apparent good earnings that may beat coming up. Various opinions and research reports are moving it; some may be protecting clients and their short positions, or else they are accumulating.

Glad you are posting again.