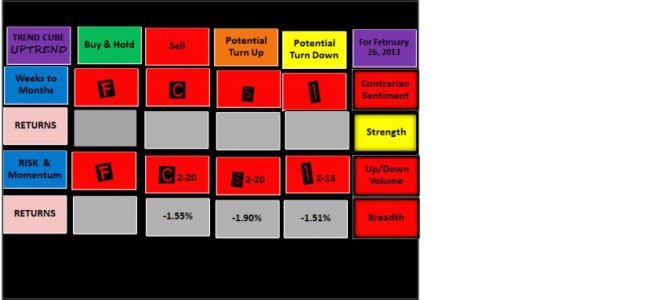

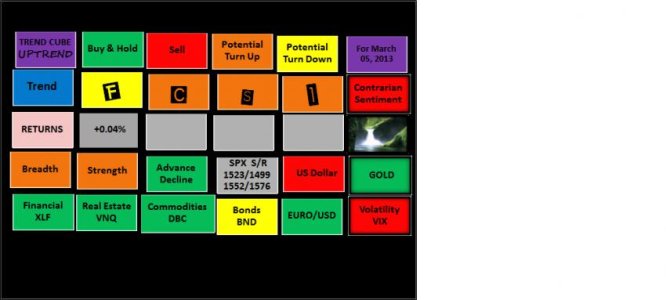

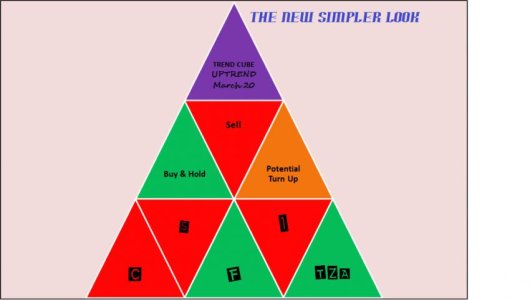

Uptrend....You probably wondered where uptrend went. Well it's not Hawaii, but that sounds good right now. Actually, I moved most of my TSP account, the one time age based option, over to Scott Trade. So, it's a new ball game; long and short with the leverged pairs: TNA/TZA, UPRO/SPXU, FAS/FAZ. I will only trade these short term, when the market is trending one way or the other. Will also invest in some large cap and midcap that get oversold and will hold these for 1-6 months as swing trades.

I had heard horror stories with TSP withdraewals, but the switch was faily painless & took about 3 weeks. Just filled out form TSP 75 (make darn sure everything is correct) and faxed it to Alabama. Got tired of not having control of the situation. But I am still maintaing a TSP account, so may just post a smaller cube; perhaps just the S fund up or down. Happy trading.