crommie

Market Tracker

- Reaction score

- 9

Uptrend,

Thank you very much for all of your hard work educating all of us!

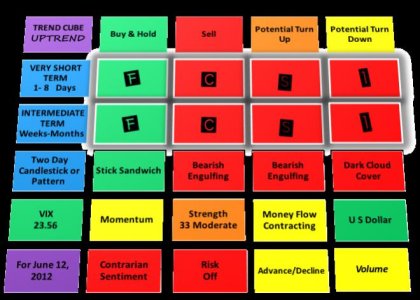

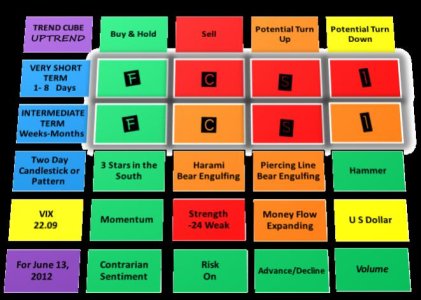

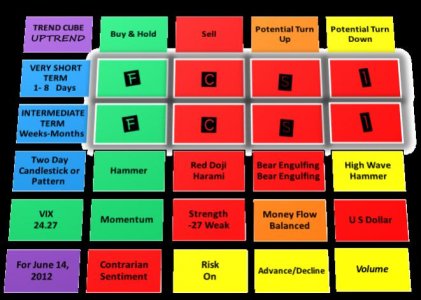

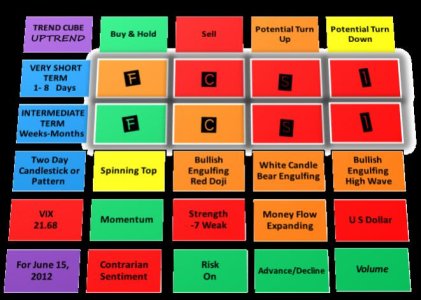

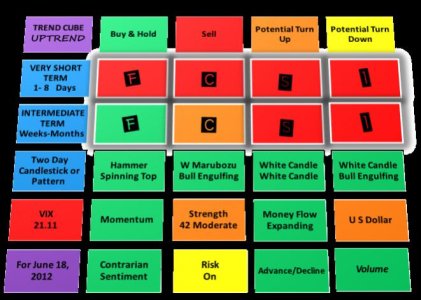

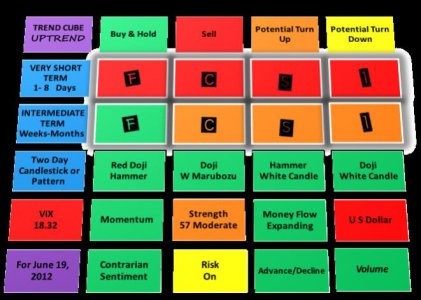

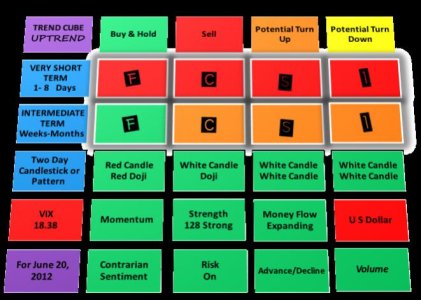

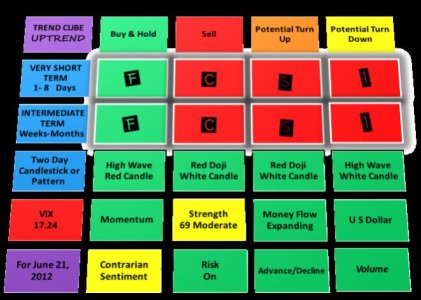

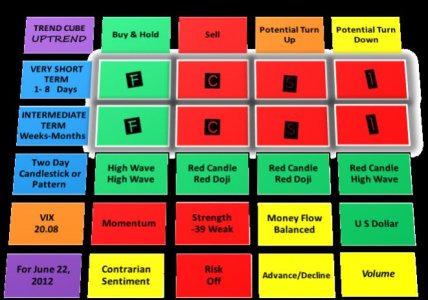

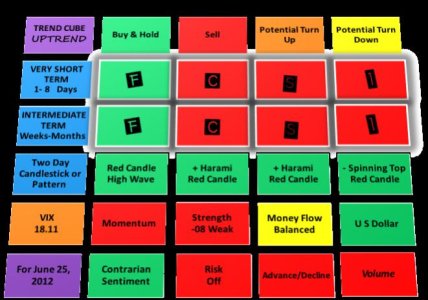

I have been studying your new cube and am confused as to why C/S/I are all red/sell, but Risk is green/risk on and many others of the lower half of the cube look to be positive?

Thanks again.

Thank you very much for all of your hard work educating all of us!

I have been studying your new cube and am confused as to why C/S/I are all red/sell, but Risk is green/risk on and many others of the lower half of the cube look to be positive?

Thanks again.