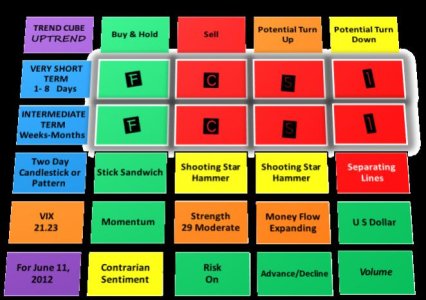

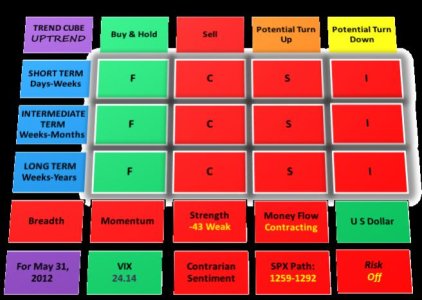

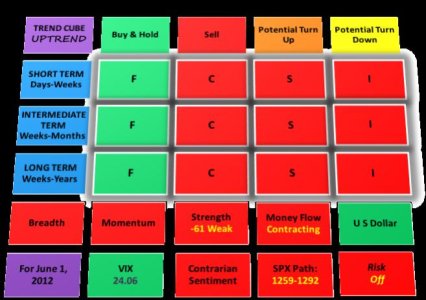

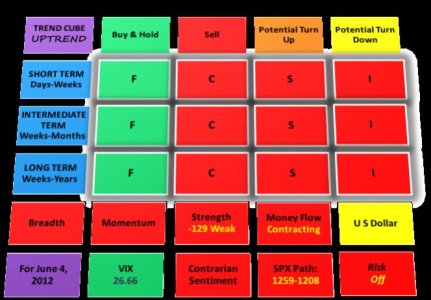

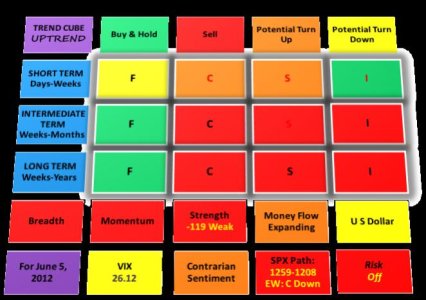

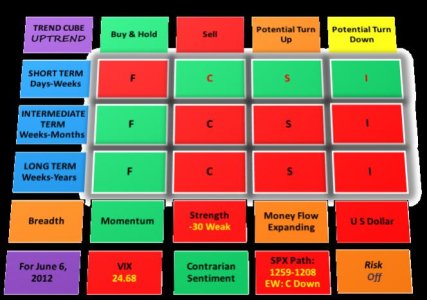

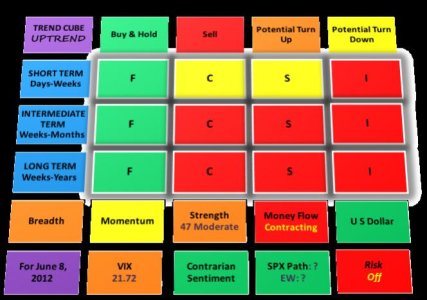

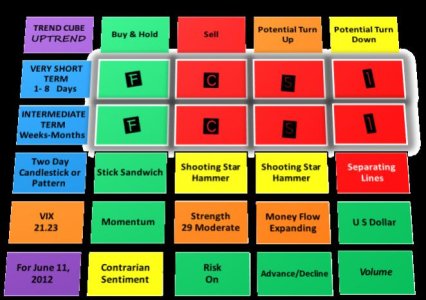

Below is the Uptrend cube with another redesign. Why? Because although some of the trend information was interesting, you just can't trade it with our limited TSP 2X month IFT's. So here is what I did.

The first trade is very short term, usually 1-8 (max) days. The triggers are set for oversold market bounces. Further, the sell signal can arrive while the market is still rising. However, by repeating this trade over and over has shown really good results. It works in bull and bear markets, but would be more risky in the latter. Time in the market is minimal, as you would be on the sidelines most of the time. The objective would be a gain of 1-5% per trade (except for the F fund). You can't really call it a trend.

The second trade is the intermediate term trend as before. Nothing has changed. This trade only come around 2-5 times a year, and holds for weeks to months. It has not shown up since I introduced the cube in March. The last occurence was late December 2011 to early February 2012. This trade has longer hold times in the market, and therefore carries more risk. However, you are not laying down in fromt of the train (what it feels like) as in the short term trade. In other words, buying while the market is declining under certian conditions. When the intermediate trend is in force, it is the one to follow, unless it does not meet your time in market risk tolerance levels.

I have added a 2 day candlestick and pattern line. For each for the F,C,S and I funds above, the respective AGG, SPX, Wilshire 4500, and EFA charts show the last 2 days of candlesticks and or the last multi-day pattern and the color interpretation of what it could mean. If not a pattern, the bottom candlestick is the most recent.

Advance/decline and volume have been added. That is part of breath.

I really don't wish to tweak this much more in the future, but am results orientated, so let's see what happens. After a month goes by, I will start posting the results.