Uptrend

TSP Pro

- Reaction score

- 74

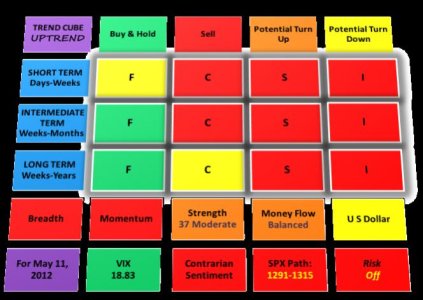

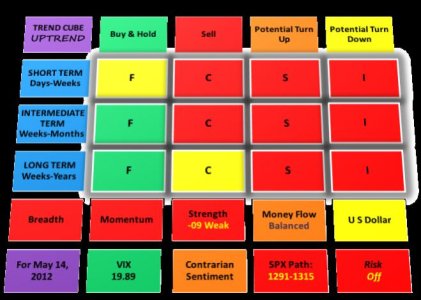

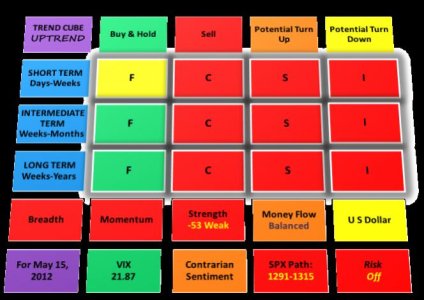

Certianly did not see this coming, as far as technicals. Usually, as many times in the past that I can show you, when breadth picks up, so does the market. So I expect this sell-off to be contained. SPX 1372 is support, and if that is breached, then a re-test of the 1359 lows. Not many warning signs, other than bonds and contrarian sentiment turning. The intermediate term trend, other than the I fund, has not given in to a sell "yet." Remember, investing is a long term process. The market is getting very oversold at the moment.