-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Uptrend's Account Talk

- Thread starter Uptrend

- Start date

Uptrend

TSP Pro

- Reaction score

- 74

Now SPX 1291 is the level to beat and close above for a short term positive. And if the 1285 area where the 200 sma is coming in is taken out and closed below for a few days; well that will be a bear. Also, the 50 and 200 sma are only about 25 points apart and closing. If the 50 crosses under the 200 in the coming days that will be the death cross. The 50 sma has taken on a steep downward slope in the last few sessions.

Possible scenario: Move sideways about the 200 sma for the next 1-2 days, go up and backtest the 1291 broken resistance, and then fall to the SPX 1175 area. Think I am kidding? Well consider this: by Elliot wave theory, we have wave 1 down from SPX 1370 to 1258 for 112 points that has already happened. Theory allows downward wave 3 to extend if 1 and 5 are similar. Assuming wave 3 is the longest wave as usually is, and using mathmatical fibonacci relationships we project 112 x 1.618 = 182 points. The last high at 1356-182 = 1174. This lines up with a strong resistance area on the charts for May, November -December 2010.

There also is a head and shoulders pattern projecting to 1147 from a sloping neckline. Take your pick.

Either the market gets legs soon or gets destroyed.

And Fridays jobs number is ??? And the Italian bond yield is??? And who else is announcing summer layoffs with earnings?

Possible scenario: Move sideways about the 200 sma for the next 1-2 days, go up and backtest the 1291 broken resistance, and then fall to the SPX 1175 area. Think I am kidding? Well consider this: by Elliot wave theory, we have wave 1 down from SPX 1370 to 1258 for 112 points that has already happened. Theory allows downward wave 3 to extend if 1 and 5 are similar. Assuming wave 3 is the longest wave as usually is, and using mathmatical fibonacci relationships we project 112 x 1.618 = 182 points. The last high at 1356-182 = 1174. This lines up with a strong resistance area on the charts for May, November -December 2010.

There also is a head and shoulders pattern projecting to 1147 from a sloping neckline. Take your pick.

Either the market gets legs soon or gets destroyed.

And Fridays jobs number is ??? And the Italian bond yield is??? And who else is announcing summer layoffs with earnings?

Uptrend

TSP Pro

- Reaction score

- 74

Big haircut! Still believe that we are starting a downtrend and that we are in EWT downwave 3 of 5, the terrible wave. The turn date for wave 4 should be in the August 15 timeframe, still +/- 8 trading days away. Remember in a downtrend that the market can remain very oversold, just like in an uptrend. I am not sure how much rebound wave 4 will be, but will post ideas as it gets closer. There is a chance the market will reverse tomorrow and go backtest the broken 200 sma coming in at SPX 1285. However, I believe it will be sold and am thinking the Friday jobs report for July will sink the market again, and perhaps could see 1240 by then. Or perhaps the jobs report has leaked today and is being priced in? Who knows what who knows?

This downtrend was in the charts as early as June 1. I will post tonight, what I saw, just using the SPX as an example.

This downtrend was in the charts as early as June 1. I will post tonight, what I saw, just using the SPX as an example.

FAB1

Market Veteran

- Reaction score

- 34

Big haircut! Who knows what who knows?

This is worth quoting, I wont forget it.

Uptrend

TSP Pro

- Reaction score

- 74

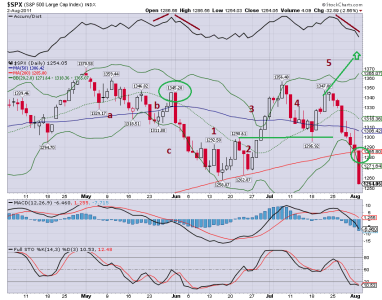

Using SPX as an example, here are some reasons I was thinking a uptrend failure was coming.

Concern #1. On May 31 the market was in the b upwave of the corrective ABC from the May highs. The next day, June 1 the market reversed without warning. Notice there is no upper shadow on the candlestick on May 31. A sudden reversal, without an upper shadow (showing buying pressure is easing), is rare on the charts. Also the reversal candle retraced 4 days of uptrend, and distribution was taking place as seen above on the Accum/Dist line.

Concern #2. A uptrend wave failure in June/July. In an uptrend advances go in sets of 5 waves and perhaps subdivisions. Waves 1, 3 and 5 advance, while waves 2 and 4 go against the trend. However, waves 2 and 4 cannot overlap. We see that there is an overlap because wave 4 at 1295.92 fell below wave 2 at 1298.61. This means that it is probably not an uptrend at all and the elliot wave count needs to be recounted differently.

Concern #3. Wave 5 did not exceed wave 4. Instead a nasty sell-off started on July 25. Therefore this cannot be an uptrend.

Concern #4. Today the market fell decisively below the 200 sma. Game over; it's a downtrend confirmation.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

Game over; it's a downtrend confirmation.

What if SPX closes above the 200 sma today? Not likely, but what if?

malyla

TSP Analyst

- Reaction score

- 36

View attachment 14801

Using SPX as an example, here are some reasons I was thinking a uptrend failure was coming.

Concern #1. On May 31 the market was in the b upwave of the corrective ABC from the May highs. The next day, June 1 the market reversed without warning. Notice there is no upper shadow on the candlestick on May 31. A sudden reversal, without an upper shadow (showing buying pressure is easing), is rare on the charts. Also the reversal candle retraced 4 days of uptrend, and distribution was taking place as seen above on the Accum/Dist line.

Concern #2. A uptrend wave failure in June/July. In an uptrend advances go in sets of 5 waves and perhaps subdivisions. Waves 1, 3 and 5 advance, while waves 2 and 4 go against the trend. However, waves 2 and 4 cannot overlap. We see that there is an overlap because wave 4 at 1295.92 fell below wave 2 at 1298.61. This means that it is probably not an uptrend at all and the elliot wave count needs to be recounted differently.

Concern #3. Wave 5 did not exceed wave 4. Instead a nasty sell-off started on July 25. Therefore this cannot be an uptrend.

Concern #4. Today the market fell decisively below the 200 sma. Game over; it's a downtrend confirmation.

Thanks Uptrend for sharing. Your analysis is on my must read and any correct guesses on my part about the market has you and others to thank.

Uptrend

TSP Pro

- Reaction score

- 74

I would like to say go out and buy, but my system says no. The descent has been steep. The reversal candle today is probably will not have any holding power. It kind of looked as if the PPT was trying to prop up the market and push SPX back above the H&S neckline. But by my calculations the sloping necklines comes in about 1262 and the close was 1260, so oops. What if the jobs report Friday has a negative print? What will the PPT do then?

- Reaction score

- 857

I would like to say go out and buy, but my system says no. The descent has been steep. The reversal candle today is probably will not have any holding power. It kind of looked as if the PPT was trying to prop up the market and push SPX back above the H&S neckline. But by my calculations the sloping necklines comes in about 1262 and the close was 1260, so oops. What if the jobs report Friday has a negative print? What will the PPT do then?

If the news includes more doom and gloom a 3% plus drop could be possible.

Last edited:

Uptrend

TSP Pro

- Reaction score

- 74

What do you see as the downside support? Or potential?

SPX 1227 should be a pause and then 1175 be the end of wave 3. This is also solid support. Wave 1 1370 to 1258 is 112 points. Then 1.618 x 112 is 181 points. 1356 minus 181 is 1175.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

This is also solid support.

We have ripped through 4 other support levels... Why is this one any more solid than the others???

Uptrend

TSP Pro

- Reaction score

- 74

Bad day to be in the market! But this was not unexpected; as it was in the charts. Of course this mini-crash day wasn't. But the move was identified. Studying TA can give one a general sense of turning points and degrees of movement one way or the other. It like playing clue. Anyway, I am not saying the market will stop at the SPX 1175 area, but it is a higher probability. Based on EWT and fibonacci math we can develop the following ratios and projections. .236 SPX 1218 (taken out today), .382 SPX 1201 (closed at today), .486 SPX 1190, .618 SPX 1173, .786 SPX 1156. Notice that the market stopped at the 1.382 fibonacci relationship to EWT 1 today. I have no clue how the human brain, organized in a herd, inherently stops at a mathematical level. But it happens. The blue are the more common fib turns; lets just say there is a higher probability. And iwth terrible wave 3's the .618 is more common. Examine a number of charts if you don't believe it.

We will need to wait till the smoke clears. The market could turn right here, or spike down in the next few days. I am just watching from the sidelines. Cheers.

We will need to wait till the smoke clears. The market could turn right here, or spike down in the next few days. I am just watching from the sidelines. Cheers.

T

Taller

Guest

What do you think about going into the F fund. I've been sitting in the G for years.

rcknfrewld

TSP Pro

- Reaction score

- 8

F fund is maxing out now. Better to go into c or s fund or l2050 fund at bargain prices

Similar threads

- Replies

- 0

- Views

- 119

- Article

- Replies

- 0

- Views

- 116

- Replies

- 0

- Views

- 235

- Replies

- 0

- Views

- 178

- Replies

- 1

- Views

- 245