- Reaction score

- 2,595

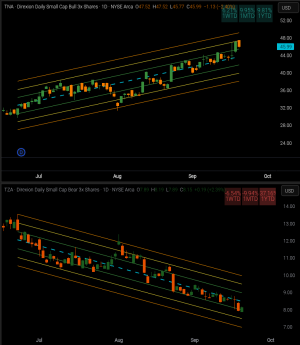

When will the 10% pullback hit? It’s overdue.

??

Odds of a government shutdown at the end of the month increased this week

Congress teeters toward shutdown with Democrats vowing to oppose stopgap

Odds of a government shutdown at the end of the month increased this week as Democrats vowed to oppose a stopgap spending measure to keep the government open.

I keep bringing this up. I'm not sure how we can ignore it...