-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

tsptalk's Market Talk

- Thread starter tsptalk

- Start date

- Reaction score

- 2,565

As JTH pointed out in his thread, Mondays (and Tuesdays) have been doing quite well for stocks and we had a gap up open this morning, however the S&P is only up a portion of Friday's losses, and the small caps are actually falling. Yields and the dollar are flat to slightly lower helping the I-fund keep pace with the S&P.

It's early and what we see near the open is always what we get by the close, but the less than enthusiastic response to the gap up, particularly in small caps, is a little concerning.

As the political drama continues to play out, all eyes will turn to the Mag 7 earnings after the bell tomorrow. Then there's Friday's PCE inflation report so we have enough catalysts this week to try to avoid the recent summer doldrums.

This High Yield Corporate Bond Fund may be the most encouraging chart we have: The credit market is looking fine.

It's early and what we see near the open is always what we get by the close, but the less than enthusiastic response to the gap up, particularly in small caps, is a little concerning.

As the political drama continues to play out, all eyes will turn to the Mag 7 earnings after the bell tomorrow. Then there's Friday's PCE inflation report so we have enough catalysts this week to try to avoid the recent summer doldrums.

This High Yield Corporate Bond Fund may be the most encouraging chart we have: The credit market is looking fine.

- Reaction score

- 2,565

Yields are down slightly this morning, but the dollar is up and that's holding the I-fund back while the US stock funds rally.

The price of oil has been helping stocks as well as it fell below $78 a barrel this week.

This chart is from COB 7/22 so I had to add this morning's move down to 77.49.

The EFA (I-fund) is down 0.60% with the dollar rallying and adding the pressure.

The S-fund opened lower but like yesterday, rebounded off the morning lows and eying the recent highs.

Gold is up, silver and bitcoin are down.

Of course it's early and everything could change by the close.

Alphabet and Tesla report earnings after the closing bell tonight.

The price of oil has been helping stocks as well as it fell below $78 a barrel this week.

This chart is from COB 7/22 so I had to add this morning's move down to 77.49.

The EFA (I-fund) is down 0.60% with the dollar rallying and adding the pressure.

The S-fund opened lower but like yesterday, rebounded off the morning lows and eying the recent highs.

Gold is up, silver and bitcoin are down.

Of course it's early and everything could change by the close.

Alphabet and Tesla report earnings after the closing bell tonight.

- Reaction score

- 2,565

Stocks got off to a rough start on Wednesday after Google and Tesla reported disappointing earnings, dragging the Nasdaq down 2%. The S&P 500 (C-fund) is obviously weighted heavily in Mag 7 / big tech and it is down 1.4% about an hour into the trading day.

The small caps and the I-fund are managing more modest losses, and the decline in the dollar this morning may be helping.

Yields are slightly lower but not much of a factor, but giving the F-fund a slight lift.

Gold, silver, and oil are all up on the weaker dollar, and bitcoin is rebounding after yesterday's big loss.

The next wave of Mag 7 earnings is not coming until next week when Microsoft reports after the bell on the 30th.

On Friday we get the important PCE Pricing inflation data before the opening bell.

The small caps and the I-fund are managing more modest losses, and the decline in the dollar this morning may be helping.

Yields are slightly lower but not much of a factor, but giving the F-fund a slight lift.

Gold, silver, and oil are all up on the weaker dollar, and bitcoin is rebounding after yesterday's big loss.

The next wave of Mag 7 earnings is not coming until next week when Microsoft reports after the bell on the 30th.

On Friday we get the important PCE Pricing inflation data before the opening bell.

JTH

TSP Legend

- Reaction score

- 1,170

Something is changing...

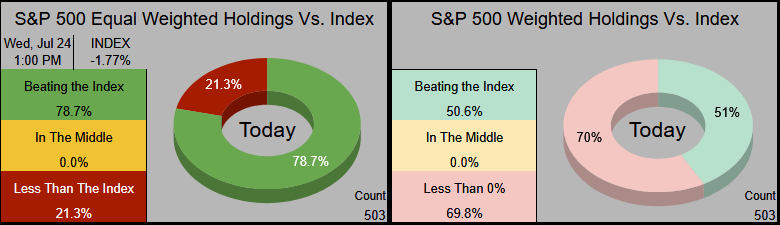

RSP contains the same stocks that are in the S&P 500 but the larger companies are not weighted more heavily.

This is a similar theme I've noticed the past few days.

On the left, 78.7% of equally weighted holdings are doing better than the Index's -1.79%

Ignore the right chart, I'm still tweaking the formulas....

- Reaction score

- 2,565

A sluggish but mixed start to the morning trading on Thursday after a bunch of economic data that was also mixed. Q2 GDP was much better than expected, yet yields are down this morning on some other weak data, like durable goods.

It feels like stocks are tired of going down in the short-term, but nobody seems to want to snatch up the big tech names yet. Small caps are catching a bid after Wednesday decline in sympathy with the tech wreck.

The S&P (C-fund) is nudging below some key moving averages and the close will be important. Meanwhile the DWCPF (S-fund) is up nicely in what looks like a possible bull flag, although it is a little steep.

I would have expected yields to move up on the big GDP number but that was just a first estimate of the 2nd quarter GDP so it's rear-view mirror data. The TNX is struggling to get back above the 200-day EMA in this down trending yield market.

Oil, gold, silver and bitcoin are all down this morning. The dollar is basically flat.

It feels like stocks are tired of going down in the short-term, but nobody seems to want to snatch up the big tech names yet. Small caps are catching a bid after Wednesday decline in sympathy with the tech wreck.

The S&P (C-fund) is nudging below some key moving averages and the close will be important. Meanwhile the DWCPF (S-fund) is up nicely in what looks like a possible bull flag, although it is a little steep.

I would have expected yields to move up on the big GDP number but that was just a first estimate of the 2nd quarter GDP so it's rear-view mirror data. The TNX is struggling to get back above the 200-day EMA in this down trending yield market.

Oil, gold, silver and bitcoin are all down this morning. The dollar is basically flat.

skycophigh

Market Tracker

- Reaction score

- 3

For the conservative investor, (old and retired) do you think the F fund would be a good play if the Fed starts cutting the Fed rate??cThe Dow and the small caps are making the biggest moves today while the S&P 500 and Nasdaq flounder a bit, although with good reason after the recent rallies to all time highs.

The Dow is up over 500-points this morning, blasting through resistance and looking impressive. There will be a day that it will likely come back to test that resistance line, but it could be days, weeks, or months - you never know, but overall this left lower corner to top right corner direction is tough to argue with.

Small caps have come to life after a long dormant period, and in this feast or famine Russell 2000 index, the feast is on as the chart start to look parabolic.

Yields are down slightly helping the F-fund to a gain in early trading, but the dollar is up putting some pressure on the I-fund in the early going.

Oil is down while gold and silver are up, and cryptos are mixed.

- Reaction score

- 2,565

I posted this in JTH's blog about August and September's seasonality, but thought I'd post it here as well...

Here's some recent charts of July - September and yup, it seems either August or September, or both, cannot escape a serious drawdown at some point...

Here's some recent charts of July - September and yup, it seems either August or September, or both, cannot escape a serious drawdown at some point...

- Reaction score

- 2,565

There are certainly enough catalysts next week to trigger a change, although for large caps, the change would be a rally I suppose, after the recent selling in July.

COB 7/30 - Microsoft earnings

COB 7/31 - META earnings

COB 8/01 - Apple and Amazon earnings

8/02 - July jobs report

COB 7/30 - Microsoft earnings

COB 7/31 - META earnings

COB 8/01 - Apple and Amazon earnings

8/02 - July jobs report

- Reaction score

- 2,565

Yields are down, the dollar is up and stocks are rallying in the first hour into the new trading week, although you can't always trust Monday gaps. It's a very busy week for the market and whether you are looking to buy or sell into the Mag 7 earnings, the Fed meeting and the jobs report, you are sure to get some volatility to help you try to get a better price. But who or what is going to disappoint? Who is going to surprise?

Can Mag 7 earnings bring back favor to the large caps of the C-fund, or will the small caps (S) continue their recent dominance?

Will the Fed surprise us with a cut on Wednesday or will they give clues to how many cuts come in future meetings?

Will the jobs report on Friday dictate what the Fed needs to do? Will a weak report means more cuts, or too strong mean fewer cuts or none?

So much on the line this week despite the first cut still likely two months away.

Oil is down slightly, gold and silver are up a bit, bitcoin and other cryptos area also up.

Can Mag 7 earnings bring back favor to the large caps of the C-fund, or will the small caps (S) continue their recent dominance?

Will the Fed surprise us with a cut on Wednesday or will they give clues to how many cuts come in future meetings?

Will the jobs report on Friday dictate what the Fed needs to do? Will a weak report means more cuts, or too strong mean fewer cuts or none?

So much on the line this week despite the first cut still likely two months away.

Oil is down slightly, gold and silver are up a bit, bitcoin and other cryptos area also up.

- Reaction score

- 2,565

Yields are down and the dollar is up, repeating yesterday's opening. It should be another slow day trading volume-wise as everyone awaits Microsoft's earnings after the bell.

Revshark pointed out this morning that a disappointing report may not be all that bad for the stock market since it has been rotating out of large caps anyway, and and MSFT miss could keep the movement going. Of course a strong report should boost the big caps indices but small caps would likely be fine, just maybe not outperforming in the short term.

We'll see. Of course that reaction will be overshadowed tomorrow when the Fed gives their policy statement, and then more big tech earnings come in. Did I mention July's jobs report is on Friday?

So it's a busy week and depending on the each individual outcome, the market may be pushed and pulled in several directions.

Gold is up, oil is down below $75 a barrel and bitcoin is down.

Revshark pointed out this morning that a disappointing report may not be all that bad for the stock market since it has been rotating out of large caps anyway, and and MSFT miss could keep the movement going. Of course a strong report should boost the big caps indices but small caps would likely be fine, just maybe not outperforming in the short term.

We'll see. Of course that reaction will be overshadowed tomorrow when the Fed gives their policy statement, and then more big tech earnings come in. Did I mention July's jobs report is on Friday?

So it's a busy week and depending on the each individual outcome, the market may be pushed and pulled in several directions.

Gold is up, oil is down below $75 a barrel and bitcoin is down.

- Reaction score

- 2,565

The market is throwing us a curveball today after Microsoft sold off after hours last night, indicating trouble for the S&P 500. Instead AMD reported strong earnings and that is lifting the semiconductors stocks, and Nvidia is leading the charge.

The dollar is also plummeting today after Japan raised interest rates, and that is boosting the I-fund.

All that is great but in a few hours the Fed will chime in with their new policy statement, and we can only wait to see if they have anything new to say.

META reports after the bell today. Apple and Amazon report tomorrow.

Today, before noon ET, is the last day to make an a July IFT. After noon it becomes an August IFT.

The dollar is also plummeting today after Japan raised interest rates, and that is boosting the I-fund.

All that is great but in a few hours the Fed will chime in with their new policy statement, and we can only wait to see if they have anything new to say.

META reports after the bell today. Apple and Amazon report tomorrow.

Today, before noon ET, is the last day to make an a July IFT. After noon it becomes an August IFT.

Similar threads

- Replies

- 0

- Views

- 45

- Replies

- 0

- Views

- 179

- Replies

- 0

- Views

- 133

- Replies

- 0

- Views

- 139