- Reaction score

- 2,450

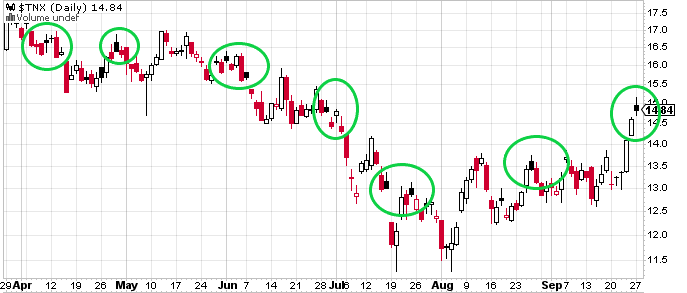

Is this a contrarian buy signal, or a warning for caution?

Investors believe it’s time to get very conservative in the stock market, CNBC survey shows

https://www.cnbc.com/2021/09/22/inv...ve-in-the-stock-market-cnbc-survey-shows.html

Investors believe it’s time to get very conservative in the stock market, CNBC survey shows

https://www.cnbc.com/2021/09/22/inv...ve-in-the-stock-market-cnbc-survey-shows.html