True to current form, the market's upside tenacity put the hurt on the bears once again as the market shook off early weakness quickly and rallied into the close for some moderate gains. Even as yesterday's Seven Sentinels sell signal is foretelling intermediate term weakness, sentiment continues to be generally supportive of higher prices. But nothing is a given in the stock market. The sell signal issued yesterday should be taken as a warning, even if it turns out to be an early one.

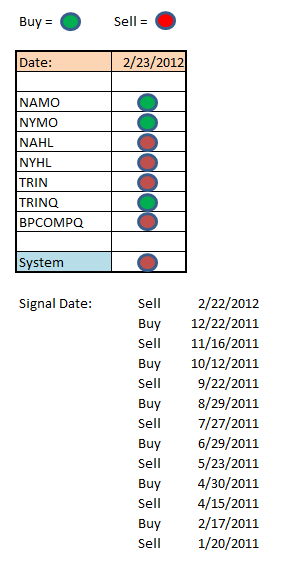

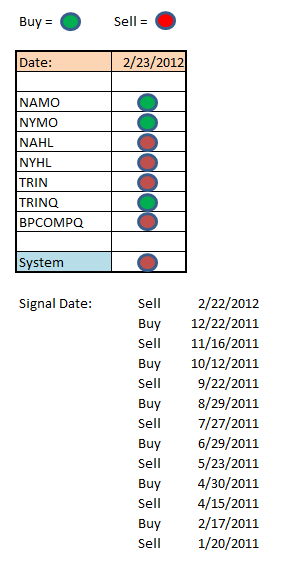

You'll notice I have added all the buy and sell signals from last year for reference.

The system remains in a sell condition and every signal is not far from its trigger point. Internals had been deteriorating the past few trading days and that deterioration eventually triggered yesterday's sell signal. And while today's bounce firmed things up technically, it's hardly enough to take risks on any further upside (in my opinion). We may be seeing some final topping action before a drop lower.

So we'll see how it plays out.

You'll notice I have added all the buy and sell signals from last year for reference.

The system remains in a sell condition and every signal is not far from its trigger point. Internals had been deteriorating the past few trading days and that deterioration eventually triggered yesterday's sell signal. And while today's bounce firmed things up technically, it's hardly enough to take risks on any further upside (in my opinion). We may be seeing some final topping action before a drop lower.

So we'll see how it plays out.