♗ Weekly Recap

● WTD Overview: Risk-on week: SPX +0.10% finished higher with narrow leadership, as growth outpaced the broader market.

● WTD Overview: Flows favored ETFs over mutual funds, while a firm dollar and falling volatility supported selective risk.

Key Takeaway: If volatility stays calm and yields remain contained, then upside can persist, but breadth must improve to confirm.

$↗︎ Net Flows $↘︎ — Wednesday Series

● Fund Inflows — Wednesday Series (ici.org)

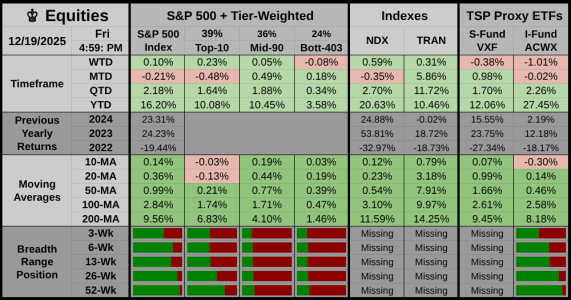

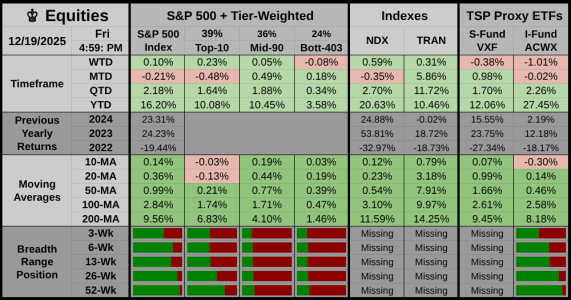

♔ Equities

WTD Overview: Risk-on: SPX +0.10% ended higher, but gains were concentrated in large-cap growth.

Leaders & Relative Holds

● Risk Bias: Risk-on. Growth and mega-cap leadership cushioned the tape as smaller names lagged.

● Breadth: Narrow-to-mixed: Top-10 +0.23%, Mid-90 +0.05%, Bott-403 −0.08%.

Key Takeaway: If participation does not broaden, then index gains may continue but feel uneven.

Key Takeaway: If participation does not broaden, then index gains may continue but feel uneven.

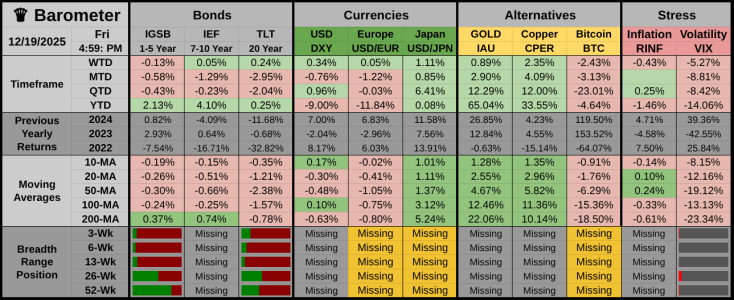

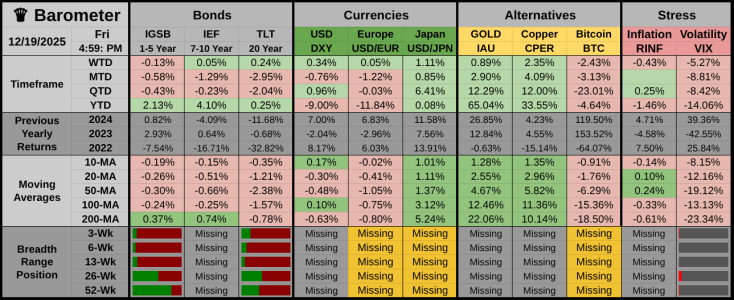

♛ Barometer

WTD Overview: Bonds were steady, the dollar firmed, and volatility eased, creating a supportive but selective risk backdrop.

Hedges & Risk Bias

● Risk Bias: Mixed. Long duration held firm while volatility declined.

● Breadth: Cyclic proxies split, with copper firm and inflation hedges softer.

Key Takeaway: If the dollar cools further while volatility stays low, risk appetite can expand.

Key Takeaway: If the dollar cools further while volatility stays low, risk appetite can expand.

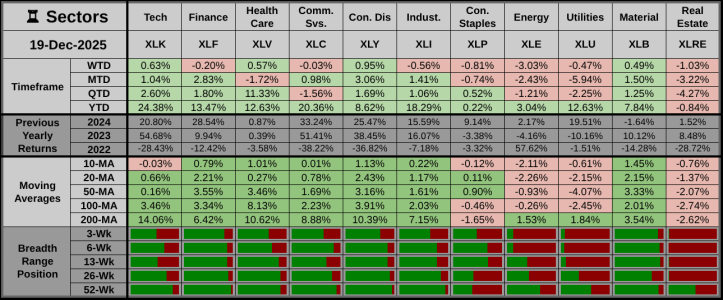

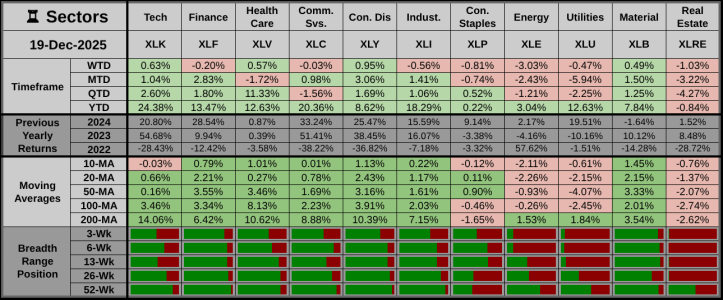

♖ Sectors & Rotation

Weekly Sector Overview: Cyclicals showed selective strength, but energy broke down and defensives did not lead.

Offensive Assets

● Top WTD gainers: XLY +0.95%, XLK +0.63%, supported by consumer and tech resilience.

● Result: Cyclicals outperformed; breadth mixed.

Defensive Assets

● Standout drag: XLE −3.03%, as oil weakness capped risk.

● Defensive laggards: XLRE −1.03%, XLP −0.81%.

Key Takeaway: If energy remains weak, leadership must rotate elsewhere to sustain upside.

Key Takeaway: If energy remains weak, leadership must rotate elsewhere to sustain upside.

4–6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

● Primary: Mid (Early tilt): cyclicals led; trend mixed; breadth neutral.

● ● Alternate: Early (Mid tilt): cyclicals led; trend firm; breadth early tilt.

● ● ● Confidence: Low: timeframe and breadth lenses disagree; only trend leans Mid.

Table Note: “Down = 0% means the data shows no evidence of a broader distribution phase. Pullbacks can occur, but they are more likely to be brief and bought.”

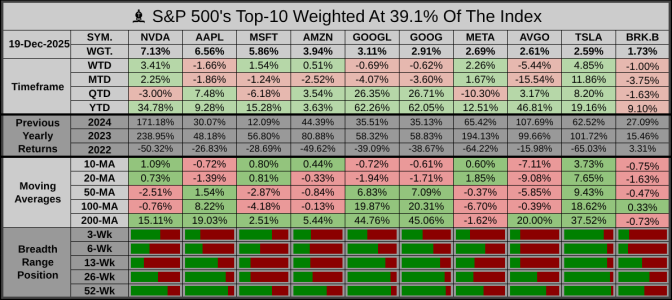

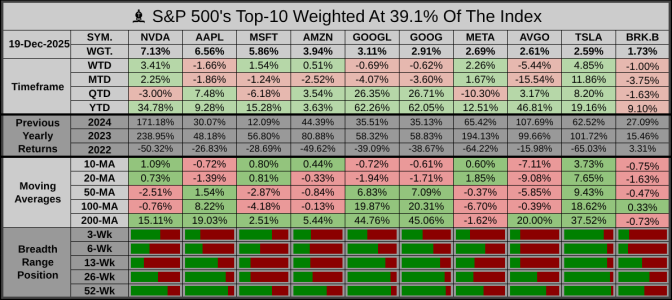

♗ S&P 500’s Weighted Top-10

Overview: Mixed performance: a few strong gainers offset a notable decliner, keeping dispersion elevated.

Offensive Leaders

● TSLA +4.85%, NVDA +3.41% led gains, reinforcing growth leadership.

● Secondary support came from META and MSFT.

Defensive Laggards

● Biggest decliners: AVGO −5.44%, AAPL −1.66%.

Key Takeaway: If Top-10 dispersion persists, index strength can hold even as participation stays uneven.

Key Takeaway: If Top-10 dispersion persists, index strength can hold even as participation stays uneven.

Next Week’s Projection

Next Week’s Projection

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

● WTD Overview: Risk-on week: SPX +0.10% finished higher with narrow leadership, as growth outpaced the broader market.

● WTD Overview: Flows favored ETFs over mutual funds, while a firm dollar and falling volatility supported selective risk.

Key Takeaway: If volatility stays calm and yields remain contained, then upside can persist, but breadth must improve to confirm.

$↗︎ Net Flows $↘︎ — Wednesday Series

● Fund Inflows — Wednesday Series (ici.org)

| Box | Category | Weekly Flow | 4-wk Median Read | Risk Tone |

|---|---|---|---|---|

| Equity mutual funds | −$30.81B | Below | Risk-off/de-risking | |

| Bond mutual funds | +$2.19B | Above | Mixed/neutral | |

| ETFs (net issuance) | +$43.57B | Above | Risk-on/supportive | |

| Combined MF + ETF | +$13.04B | Near | Mixed (ETF bid offsets MF selling) | |

| Money market funds | +$10.74B to $7.67T | Above | Risk-off/de-risking (cash build) |

♔ Equities

WTD Overview: Risk-on: SPX +0.10% ended higher, but gains were concentrated in large-cap growth.

Leaders & Relative Holds

● Risk Bias: Risk-on. Growth and mega-cap leadership cushioned the tape as smaller names lagged.

● Breadth: Narrow-to-mixed: Top-10 +0.23%, Mid-90 +0.05%, Bott-403 −0.08%.

♛ Barometer

WTD Overview: Bonds were steady, the dollar firmed, and volatility eased, creating a supportive but selective risk backdrop.

Hedges & Risk Bias

● Risk Bias: Mixed. Long duration held firm while volatility declined.

● Breadth: Cyclic proxies split, with copper firm and inflation hedges softer.

♖ Sectors & Rotation

Weekly Sector Overview: Cyclicals showed selective strength, but energy broke down and defensives did not lead.

Offensive Assets

● Top WTD gainers: XLY +0.95%, XLK +0.63%, supported by consumer and tech resilience.

● Result: Cyclicals outperformed; breadth mixed.

Defensive Assets

● Standout drag: XLE −3.03%, as oil weakness capped risk.

● Defensive laggards: XLRE −1.03%, XLP −0.81%.

4–6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

● Primary: Mid (Early tilt): cyclicals led; trend mixed; breadth neutral.

● ● Alternate: Early (Mid tilt): cyclicals led; trend firm; breadth early tilt.

● ● ● Confidence: Low: timeframe and breadth lenses disagree; only trend leans Mid.

Table Note: “Down = 0% means the data shows no evidence of a broader distribution phase. Pullbacks can occur, but they are more likely to be brief and bought.”

| Box | Bias | Probability | Narrative (4–6 Week Horizon) |

|---|---|---|---|

| Up | 70% | If yields stay calm and volatility stays low, then grind higher continues with narrow leadership. | |

| Sideways | 30% | If the dollar stays firm and breadth stays mixed, then range trade persists with quick reversals. | |

| Down | 0% | If energy weakness spreads and defensives fail to catch bids, then pullbacks stay brief and bought. |

♗ S&P 500’s Weighted Top-10

Overview: Mixed performance: a few strong gainers offset a notable decliner, keeping dispersion elevated.

Offensive Leaders

● TSLA +4.85%, NVDA +3.41% led gains, reinforcing growth leadership.

● Secondary support came from META and MSFT.

Defensive Laggards

● Biggest decliners: AVGO −5.44%, AAPL −1.66%.

| Scenario | Probability | Evidence (Weekly-Based, conditional) |

|---|---|---|

| 35% | If volatility stays low and tech stays firm, then SPX drifts higher with narrow breadth. | |

| 45% | If the dollar stays firm and small caps lag, then SPX chops inside a tight range. | |

| 20% | If energy stays weak and defensives stay soft, then SPX slips as breadth thins. |

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.