Cyclicals Clock In

Defensives Clock Out

And I'm Clocking Back: Europe switches to standard time tonight, Sunday Oct 26, 2025.

♗ Weekly Recap

● WTD Overview: Risk-on: SPX rose +1.92%, wide participation as mid and small caps joined. Cyclicals drew bids, defensives lagged; the dollar firmed.

● Key Takeaway: A calmer VIX with long-end yields steady would confirm this risk-on tone.

$↗︎ Net Flows $↘︎ — Wednesday Series

● Fund Inflows — Wednesday Series (ici.org)

● Equity (mutual funds): Above vs 4-wk median — −$16.41B (week ended Oct 15, 2025). ICI ICI

● Bonds (mutual funds): Below vs 4-wk median — −$0.33B total; −$1.25B taxable; +$0.92B muni (week ended Oct 15, 2025). ICI ICI

● ETFs (net issuance): Softness — +$29.97B (week ended Oct 15, 2025). ICI ICI

● Combined (MF + ETF): Net inflows — +$11.23B (week ended Oct 15, 2025). ICI ICI

● Money Market Funds: Up w/w — +$30.37B to $7.40T (week ended Oct 22, 2025). ICI ICI

● ● Key Takeaway: Equity MF outflows improved; bond MF flipped to mild outflows; ETF tone softened; cash balances up. ICI×3

● ● ● Compared to last week: equity MF outflows improved; bond MF inflows cooled; ETF inflows softened; cash inflows accelerated.

● Put simply:

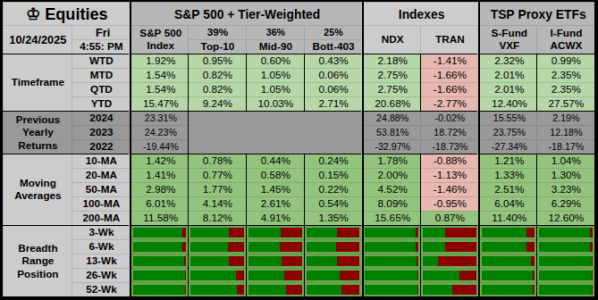

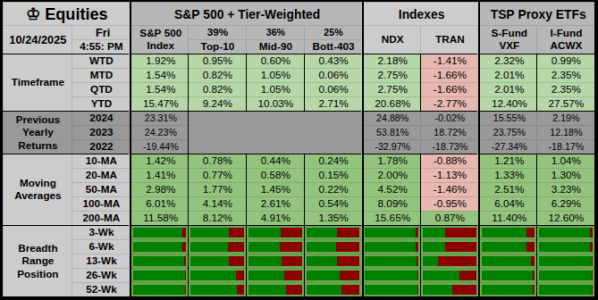

♔ Equities

WTD Overview: SPX advanced +1.92% as leadership broadened beyond megacaps; VXF outperformed while transports lagged. Defensives were soft, cushioning came from cyclicals and growth pockets.

● Key Takeaway: A softer dollar or further VIX slide would strengthen the risk-on case.

Leaders & Relative Holds

● Risk Bias: Risk-on. Mid and small caps worked; defensives underperformed.

● Breadth: Participation widened; cyclicals and growth led while transports and staples lagged.

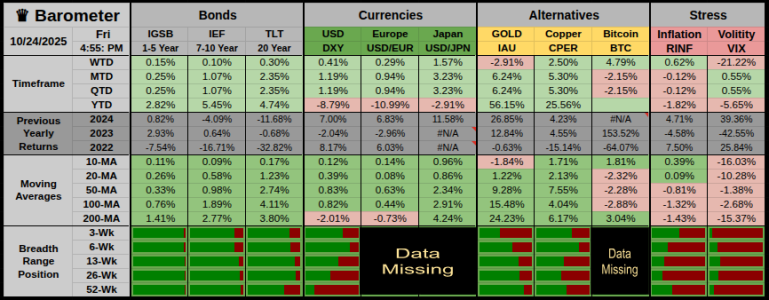

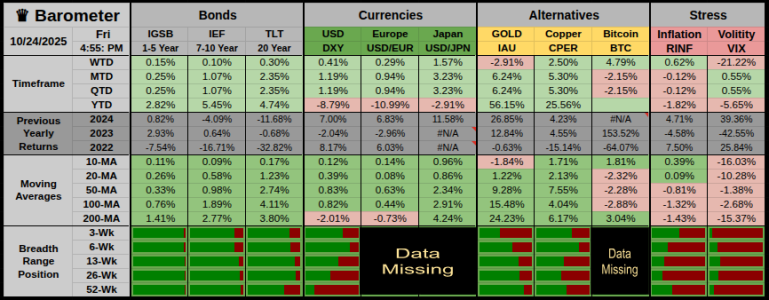

♛ Barometer

WTD Overview: Bonds steadied as yields eased. The dollar stayed firm, gold slipped, and copper and crypto rallied while volatility fell..

● Key Takeaway: Rates steadied and vol eased: risk-on, but conviction improves if the dollar cools or long-end stays tame.

Hedges & Risk Bias

● Risk Bias: Risk-on. Curve firmed a touch; gold lagged industrials; inflation proxy mixed; stronger USD slightly capped global risk.

● Breadth: Safety trades narrow; cyclic proxies strong; participation tilt: offense.

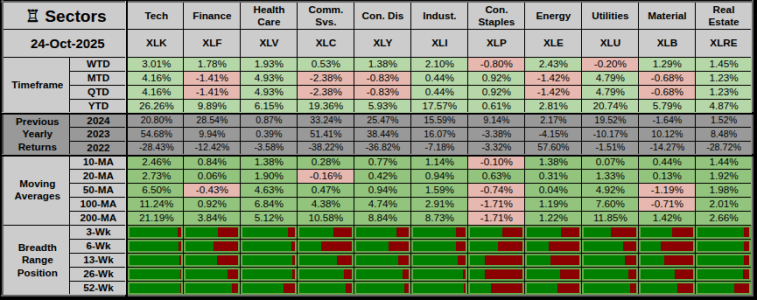

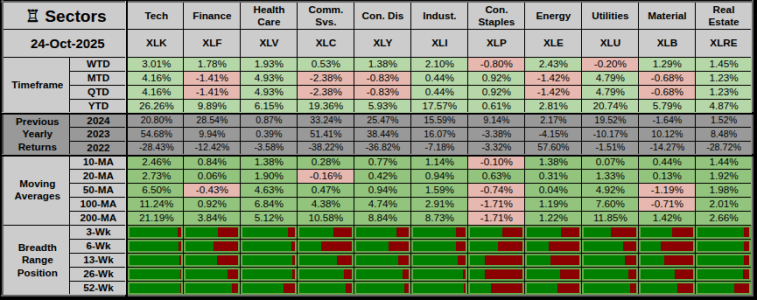

♖ Sectors & Rotation

Weekly Sector Overview: Cyclicals outperformed; breadth wide.

• Key Takeaway: If XLK and XLI keep leading while defensives trail, this rotation can extend.

Offensive Assets

● Top WTD gainers: XLK +3.01%, XLE +2.43% — tech leadership with energy tailwind.

● Cyclicals > SPX; participation widened.

Defensive Assets

● Standout laggards: XLP −0.80%, XLU −0.20% — rates firm kept yield plays muted.

● Result: Defensives < Cyclicals (breadth: offensive).

4-6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

● Primary: Mid — mixed spread; trend mixed; breadth neutral.

● ● Alternate: Late — leadership narrow; trend weakening; breadth late tilt.

● ● ● Confidence: High — Timeframe and Trend lenses are Neutral together.

● 4–6 week outlook:

● ● ● ● 47% — Down: Late/Contraction risk stays elevated as defensives stabilize.

● ● ● ● 30% — Up: Early tilt returns if tech and cyclicals carry with calmer rates.

● ● ● ● 23% — Sideways: Range trading persists with rotations inside the tape.

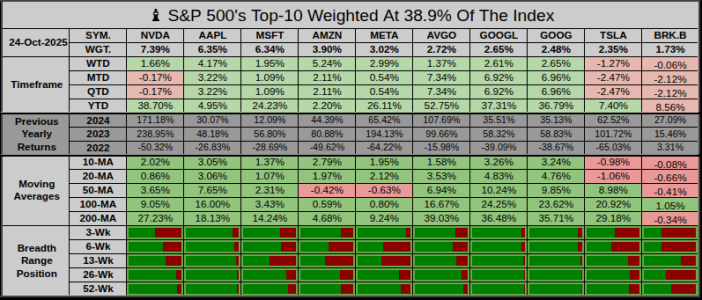

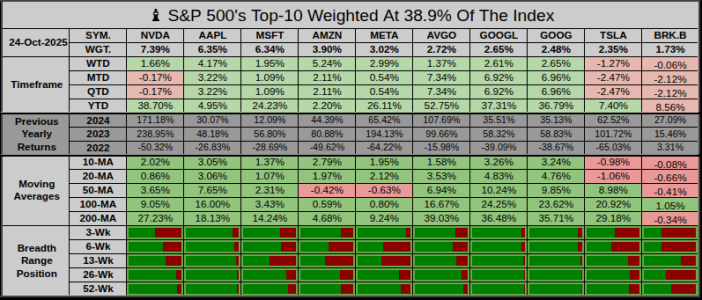

♗ S&P 500’s Weighted Top-10

Overview: Broadly strong: eight of ten were green; dispersion favored growth. AMZN led while TSLA lagged slightly.

● Key Takeaway: Leadership broadened beyond the heaviest weights, a constructive sign for the tape.

Offensive Leaders

● Winners: AMZN +5.24%, AAPL +4.17%, META +2.99% — retail, handset cycle, and ads momentum.

● Secondary: Search twins held up; semis steady; breadth inside the Top-10 improved.

Defensive Laggards

● Decliners: TSLA −1.27%, BRK.B −0.06%.

● Drag: autos slipped; diversified financials flat; concentration risk eased modestly.

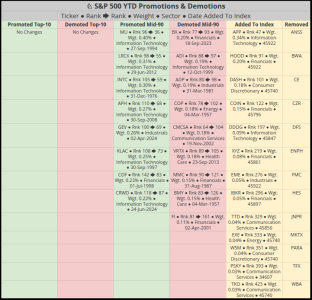

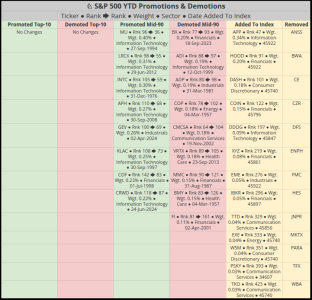

♘ S&P 500’s Tier-Weighted: Rank & Weight Changes

Overview: Few rank shifts across tiers; Top-10 steady, most action clustered in the Mid-90 and Bott-403.

● Key Takeaway: Promotions were selective; participation nudged wider.

● Participation: breadth widened modestly as mid-pack gained ground.

Next Week’s Projection:

Stay healthy, I hope everyone here is managing these circumstances as best they can, thanks for reading....Jason

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

Disclaimer: Any resemblance to actual outcomes is purely coincidental.

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

Defensives Clock Out

And I'm Clocking Back: Europe switches to standard time tonight, Sunday Oct 26, 2025.

♗ Weekly Recap

● WTD Overview: Risk-on: SPX rose +1.92%, wide participation as mid and small caps joined. Cyclicals drew bids, defensives lagged; the dollar firmed.

● Key Takeaway: A calmer VIX with long-end yields steady would confirm this risk-on tone.

$↗︎ Net Flows $↘︎ — Wednesday Series

● Fund Inflows — Wednesday Series (ici.org)

● Equity (mutual funds): Above vs 4-wk median — −$16.41B (week ended Oct 15, 2025). ICI ICI

● Bonds (mutual funds): Below vs 4-wk median — −$0.33B total; −$1.25B taxable; +$0.92B muni (week ended Oct 15, 2025). ICI ICI

● ETFs (net issuance): Softness — +$29.97B (week ended Oct 15, 2025). ICI ICI

● Combined (MF + ETF): Net inflows — +$11.23B (week ended Oct 15, 2025). ICI ICI

● Money Market Funds: Up w/w — +$30.37B to $7.40T (week ended Oct 22, 2025). ICI ICI

● ● Key Takeaway: Equity MF outflows improved; bond MF flipped to mild outflows; ETF tone softened; cash balances up. ICI×3

● ● ● Compared to last week: equity MF outflows improved; bond MF inflows cooled; ETF inflows softened; cash inflows accelerated.

● Put simply:

- “Outflows” = investors are withdrawing money (negative flow).

- “Improved” = the outflows are smaller than before (so the situation got better, even if it’s still negative).

♔ Equities

WTD Overview: SPX advanced +1.92% as leadership broadened beyond megacaps; VXF outperformed while transports lagged. Defensives were soft, cushioning came from cyclicals and growth pockets.

● Key Takeaway: A softer dollar or further VIX slide would strengthen the risk-on case.

Leaders & Relative Holds

● Risk Bias: Risk-on. Mid and small caps worked; defensives underperformed.

● Breadth: Participation widened; cyclicals and growth led while transports and staples lagged.

♛ Barometer

WTD Overview: Bonds steadied as yields eased. The dollar stayed firm, gold slipped, and copper and crypto rallied while volatility fell..

● Key Takeaway: Rates steadied and vol eased: risk-on, but conviction improves if the dollar cools or long-end stays tame.

Hedges & Risk Bias

● Risk Bias: Risk-on. Curve firmed a touch; gold lagged industrials; inflation proxy mixed; stronger USD slightly capped global risk.

● Breadth: Safety trades narrow; cyclic proxies strong; participation tilt: offense.

♖ Sectors & Rotation

Weekly Sector Overview: Cyclicals outperformed; breadth wide.

• Key Takeaway: If XLK and XLI keep leading while defensives trail, this rotation can extend.

Offensive Assets

● Top WTD gainers: XLK +3.01%, XLE +2.43% — tech leadership with energy tailwind.

● Cyclicals > SPX; participation widened.

Defensive Assets

● Standout laggards: XLP −0.80%, XLU −0.20% — rates firm kept yield plays muted.

● Result: Defensives < Cyclicals (breadth: offensive).

4-6 Week Rotation Cycle: Early ⟳ Mid ⟳ Late ⟳ Contraction

● Primary: Mid — mixed spread; trend mixed; breadth neutral.

● ● Alternate: Late — leadership narrow; trend weakening; breadth late tilt.

● ● ● Confidence: High — Timeframe and Trend lenses are Neutral together.

● 4–6 week outlook:

● ● ● ● 47% — Down: Late/Contraction risk stays elevated as defensives stabilize.

● ● ● ● 30% — Up: Early tilt returns if tech and cyclicals carry with calmer rates.

● ● ● ● 23% — Sideways: Range trading persists with rotations inside the tape.

♗ S&P 500’s Weighted Top-10

Overview: Broadly strong: eight of ten were green; dispersion favored growth. AMZN led while TSLA lagged slightly.

● Key Takeaway: Leadership broadened beyond the heaviest weights, a constructive sign for the tape.

Offensive Leaders

● Winners: AMZN +5.24%, AAPL +4.17%, META +2.99% — retail, handset cycle, and ads momentum.

● Secondary: Search twins held up; semis steady; breadth inside the Top-10 improved.

Defensive Laggards

● Decliners: TSLA −1.27%, BRK.B −0.06%.

● Drag: autos slipped; diversified financials flat; concentration risk eased modestly.

♘ S&P 500’s Tier-Weighted: Rank & Weight Changes

Overview: Few rank shifts across tiers; Top-10 steady, most action clustered in the Mid-90 and Bott-403.

● Key Takeaway: Promotions were selective; participation nudged wider.

● Participation: breadth widened modestly as mid-pack gained ground.

Next Week’s Projection:

| Scenario | Probability | Evidence (Weekly-Based, conditional) |

|---|---|---|

| 42% | If long-end yields stay calm and the dollar eases a bit and VIX holds low, then dip-buyers should keep control. | |

| 38% | If the dollar stays firm while bonds steady and leadership remains mixed, then the index likely chops inside a tight range. | |

| 20% | If yields rebound and the dollar firms and volatility lifts from lows, then a quick fade becomes likely. |

Stay healthy, I hope everyone here is managing these circumstances as best they can, thanks for reading....Jason

● Powered by AI-Intela: Sometimes thinking hard, sometimes hardly thinking.

Last edited: