TopNotch

Investor

- Reaction score

- 1

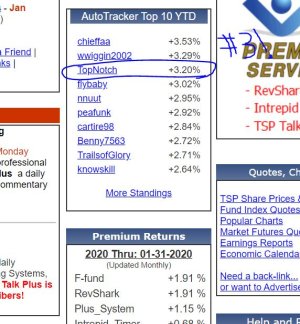

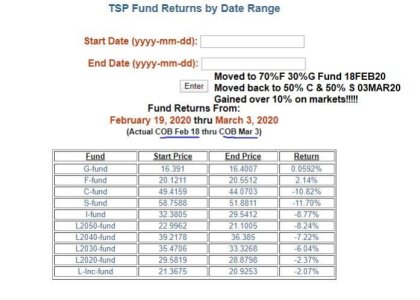

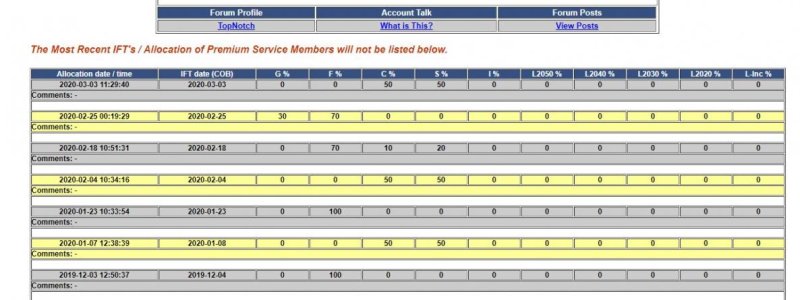

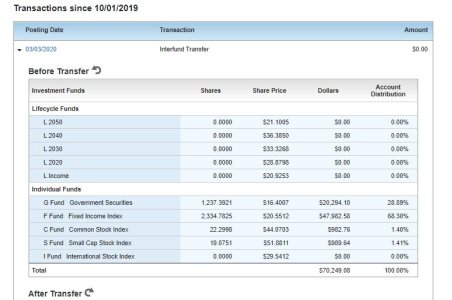

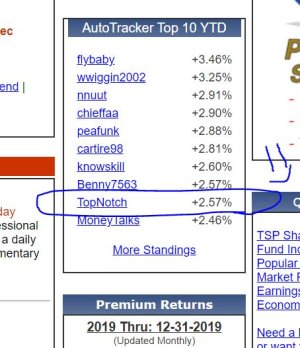

What a week. Got really lucky with my IFT move this week and ended up on the top ten list for TSP talk! Really cool a first for me. I think we were for sure due for a little break after markets have been up up up. Hoping to get back in around the 2% mark but with 1% gone already not sure if I will get caught not having any more moves for the month. Really happy to still have over 3% for the month that is a great gain for me. Video and screen shot below. Hope this virus thing doesn't take a hit on markets

Number #9!

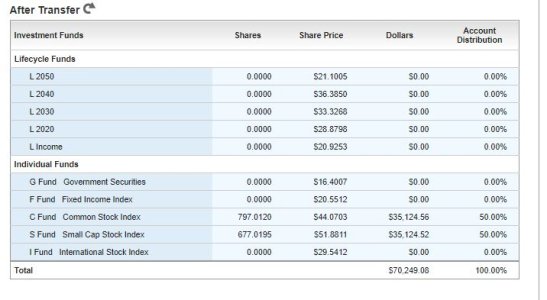

Currently 100% F

IFT's left for JAN 0

Yearly return 2.57% (auto-tracker) 3.23% (my tracker)

-Top

Number #9!

Currently 100% F

IFT's left for JAN 0

Yearly return 2.57% (auto-tracker) 3.23% (my tracker)

-Top