-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

TopNotch Account Talk

- Thread starter TopNotch

- Start date

TopNotch

Investor

- Reaction score

- 1

Took a break for much of 4th quarter! And what a crazy quarter to take a break for. Goes back to my saying that markets can do anything! I think it kept a lot of tech traders on their toes and I ended up doing better than the S fund but still in the red for 2018. Crazy year! Two 10% drops in a single year is almost unheard of until it happens.

This year we have been soaking up the gains in the S fund after the losses in December. With a 6% cap we moved 100% G to hopefully take advantage of those gains and not get greedy. I hope I don't get burned lol. Also this will be my first real year (full year) with auto tracker I am not super good at it but I will give it a go. Being able to compare to others is important for learning and growth.

Currently 100% G

ITF's left for JAN 1

Yearly return 7.60% (Auto track) 5.92% my tracker

-Top

This year we have been soaking up the gains in the S fund after the losses in December. With a 6% cap we moved 100% G to hopefully take advantage of those gains and not get greedy. I hope I don't get burned lol. Also this will be my first real year (full year) with auto tracker I am not super good at it but I will give it a go. Being able to compare to others is important for learning and growth.

Currently 100% G

ITF's left for JAN 1

Yearly return 7.60% (Auto track) 5.92% my tracker

-Top

TopNotch

Investor

- Reaction score

- 1

Looking towards the end of the first quarter. Much better than the 4th quarter of 18 eh? I didn't see as much volatility as I thought for FEB or MAR as markets continued to rise. That being said we saw two big events last two weeks. FED and YIELD. I talk a lot more about these in the weekly video that I put out. So far I started out slow for 2018 but I think there will be room to catch up especially with the F fund now being a bit more competitive when swing trading. Yet to be seen but I think we could start to see the left shoulder form for a bullish pattern. I will have to wait and see. Going with that attitude I will make a SHORT term move to the F until the markets are done with consolidating from this correction/bear market plunge? To get a clear picture moving forward. Hope to take some advantage from the consolidation.

Currently 100% F

ITF's left for MAR 1

Yearly return 8.10% (Auto track) 7.35% my tracker

-Top

Currently 100% F

ITF's left for MAR 1

Yearly return 8.10% (Auto track) 7.35% my tracker

-Top

TopNotch

Investor

- Reaction score

- 1

Been around for some time and instead of explain my post of what I am doing with my account. I just will put in my video here. I use CCM, tsp talk, finviz, and free stock charts to make my decisions with my TSP. When I say we I mean I... I always mess that up. I'll take any advice from market TSP vets to try and do better with my account. Thanks.

https://youtu.be/j7Blz4s_NrI

Currently 100% S

IFT's left for MAY 2

Yearly return 11.60% (auto-tracker) 11.80% (my tracker)

-Top

https://youtu.be/j7Blz4s_NrI

Currently 100% S

IFT's left for MAY 2

Yearly return 11.60% (auto-tracker) 11.80% (my tracker)

-Top

TopNotch

Investor

- Reaction score

- 1

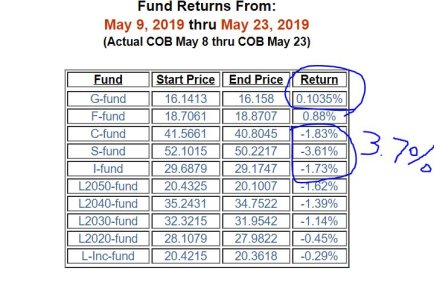

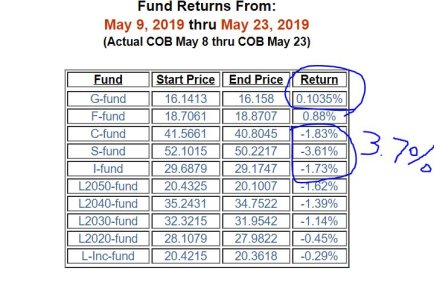

Finally saw markets take a bit of a break. How long will it last? We will have to wait and see. My move made on the 9th of May was a good move THUS far... Problem is you have to get out at the right time AND get back in at the right time. With only two ITF's a month it makes it very hard. I am hoping to make up some ground when I get back in. Watching and waiting.

Video for the week.

Currently 100% G

IFT's left for MAY 1

Yearly return 9.21% (auto-tracker) 9.40% (my tracker)

-Top

Video for the week.

Currently 100% G

IFT's left for MAY 1

Yearly return 9.21% (auto-tracker) 9.40% (my tracker)

-Top

TopNotch

Investor

- Reaction score

- 1

Markets had a down week this week. Glad I made my move when I did. I am not sure when I should be getting back in though. That is half the battle.

Based off Friday's close I should have gained over 3% on the markets! That is a really good move and usually I like to shoot for about 2%. I still don't see a good entry point though and I will wait a little longer. With AGG or the F fund picking up nicely I may move there for SHORT term since I have one move left this month and be ready for next month. If you want more info on my moves or why I did them you can check out my video. https://youtu.be/rMN2kbfPV4Q

Currently 100% G

IFT's left for MAY 1

Yearly return 9.25% (auto-tracker) 9.44% (my tracker)

-Top

Based off Friday's close I should have gained over 3% on the markets! That is a really good move and usually I like to shoot for about 2%. I still don't see a good entry point though and I will wait a little longer. With AGG or the F fund picking up nicely I may move there for SHORT term since I have one move left this month and be ready for next month. If you want more info on my moves or why I did them you can check out my video. https://youtu.be/rMN2kbfPV4Q

Currently 100% G

IFT's left for MAY 1

Yearly return 9.25% (auto-tracker) 9.44% (my tracker)

-Top

TopNotch

Investor

- Reaction score

- 1

A pretty nasty May for our C,S, and I funds. Tech charts don't look like we are getting out anytime soon BUT tech charts also prove to be slow when charts rally back hard. Quick Volatility can take the best by surprise. TopNotch (me) did pretty well this month by moving funds from S to G around the 9th of May and they from G to F towards the end of May. TopNotch is now above all TSP funds except the C and S. We are getting very close to overtaking those funds as well. It would be important though to ensure we capture what we worked hard for on the month of May but I am not really ready just yet to jump back in. That could be a mistake. In my video this week I go through why charts are not looking the best tech wise. Also I will try and include a picture that paints a clear idea of just how well TopNotch moves worked out.

Below is a picture showing just how well TopNotch did. I can't say it was all me there is always a little luck in the equation

Currently 100% F

IFT's left for JUNE 2

Yearly return 9.87% (auto-tracker) 9.99% (my tracker)

-Top

Below is a picture showing just how well TopNotch did. I can't say it was all me there is always a little luck in the equation

Currently 100% F

IFT's left for JUNE 2

Yearly return 9.87% (auto-tracker) 9.99% (my tracker)

-Top

Last edited:

TopNotch

Investor

- Reaction score

- 1

June answer May with a roar! Were you invested for the ride! I was. I move funds towards the beginning of this month and it worked out well! Check out my video below. FYI I forgot to move funds on the auto tracker this month so things are a little off now.  bummed about that but I am a part of a number of TSP groups so go figure I miss something every once in a while. I need to make me a list when I make IFT moves of my tracking sites!!!

bummed about that but I am a part of a number of TSP groups so go figure I miss something every once in a while. I need to make me a list when I make IFT moves of my tracking sites!!!

Currently 50% C 50% S

IFT's left for JULY 2

Yearly return 11.25% (auto-tracker) 14.53% (my tracker)

-Top

Currently 50% C 50% S

IFT's left for JULY 2

Yearly return 11.25% (auto-tracker) 14.53% (my tracker)

-Top

quickee from novice: GENERAL LINKAGES?Learning point for me, why does Tom look at the Dow Transportation Index so much in the commentary. How does that relate to TSP stocks??? Looking for answers on this thanks.

DOW = C FUND

NASDAQ = S FUND,

FURTHER NOTES?

- Reaction score

- 2,450

Short answer...historically it tends to lead market direction.

That's about it. It's a very economically sensitive index that tends to lead the other indices, in theory.

I'm not a "Dow Theorist" per se, people that trade solely based on the Transports and the Dow relationship, but many are, and like support and resistance lines can be self-fulfilling prophesies, buy and sell signals in the Dow Theory can be too.

The day to day moves aren't a main concen, but the technical health of the Transports, particularly in relation to other indices, can be a negative or positive divergence indicator for the rest of the market.

https://thedowtheory.com/resources/traditional-dow-theory/basics/

- Reaction score

- 2,450

Notice at market peaks the Transports tends to rollover first, sometimes by weeks. Also, the last two new highs in the S&P 500 are not being confirmed by the Transports. Instead we see lower highs. It's certainly not a day trading indicator, but rather says more about the strength, or lack there of, the rally in the Dow and S&P.

Mcqlives

Market Veteran

- Reaction score

- 24

quickee from novice: GENERAL LINKAGES?

DOW = C FUND

NASDAQ = S FUND,

FURTHER NOTES?

Nope.

C = SnP

S = Wilshire 4500 (DWCPF; next 4500 largest companies after the SnP)

See below link for those, plus I fund (EFA) and F fund (AGG)

https://finance.yahoo.com/quote/%5EDWCPF?p=^DWCPF

Mcqlives

Market Veteran

- Reaction score

- 24

Nope.

C = SnP

S = Wilshire 4500 (DWCPF; next 4500 largest companies after the SnP)

See below link for those, plus I fund (EFA) and F fund (AGG)

https://finance.yahoo.com/quote/%5EDWCPF?p=^DWCPF

Sorry...that was only for "S" fund...use this link

^GSPC,^DWCPF,EFA,AGG | Stock Prices | Quote Comparison - Yahoo Finance

TopNotch

Investor

- Reaction score

- 1

Notice at market peaks the Transports tends to rollover first, sometimes by weeks. Also, the last two new highs in the S&P 500 are not being confirmed by the Transports. Instead we see lower highs. It's certainly not a day trading indicator, but rather says more about the strength, or lack there of, the rally in the Dow and S&P.

Thanks for reply.

- Reaction score

- 2,450

A couple of airlines are flying high, and in particular JB Hunt Trucking, are contributing to the big day for the Transports today.

https://finance.yahoo.com/quote/JBHT?p=JBHT

https://finance.yahoo.com/quote/JBHT?p=JBHT

- Reaction score

- 2,450

A couple of airlines are flying high, and in particular JB Hunt Trucking, are contributing to the big day for the Transports today.

Wednesday may be a different story after CXS earnings after the bell Tuesday.

Similar threads

- Replies

- 0

- Views

- 290

- Article

- Replies

- 1

- Views

- 498