Steel_Magnolia

TSP Analyst

- Reaction score

- 20

Good to have your visit, J my friend, and Mcglives, thank you for the caring welcome back!

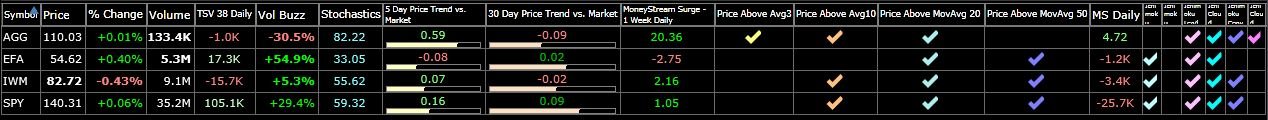

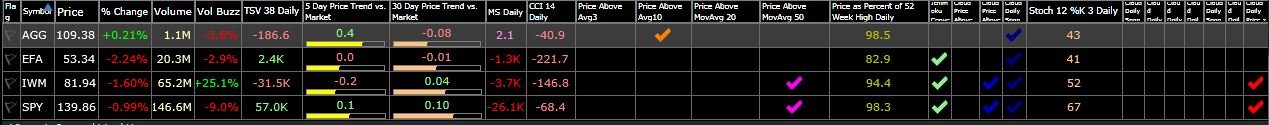

Here is what my charts look like today. As you can see on the charts, AGG (F fund analog) came out of the Bollinger squeeze to the down side and is also below the 18 and 45 day moving averages. Nothing much to recommend it for TSP Funders. EFA (I fund analog) is barely above the 45 dma but below the 18 dma so nothing to recommend it either. IWM (S fund analog) is barely above both 18 and 45 dma but too close to those lines for me. So pride of place goes to SPY (C fund analog), which is well above the 45 dma and above the 18 dma although too close to it for my comfort level.

The top board shows none of the funds above a 75 stochastic, all have a negative weekly Money Stream, and the MS (money stream) Daily shows all but AGG to be in negative figures. Given all those facts, if I had the choice I think I'd be right here:

The G Fund Garage!

Lady

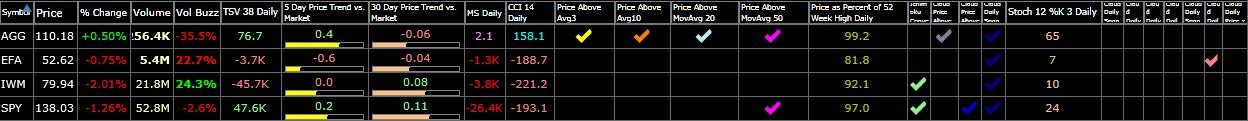

Here is what my charts look like today. As you can see on the charts, AGG (F fund analog) came out of the Bollinger squeeze to the down side and is also below the 18 and 45 day moving averages. Nothing much to recommend it for TSP Funders. EFA (I fund analog) is barely above the 45 dma but below the 18 dma so nothing to recommend it either. IWM (S fund analog) is barely above both 18 and 45 dma but too close to those lines for me. So pride of place goes to SPY (C fund analog), which is well above the 45 dma and above the 18 dma although too close to it for my comfort level.

The top board shows none of the funds above a 75 stochastic, all have a negative weekly Money Stream, and the MS (money stream) Daily shows all but AGG to be in negative figures. Given all those facts, if I had the choice I think I'd be right here:

The G Fund Garage!

Lady