Alright here's some observations for today...

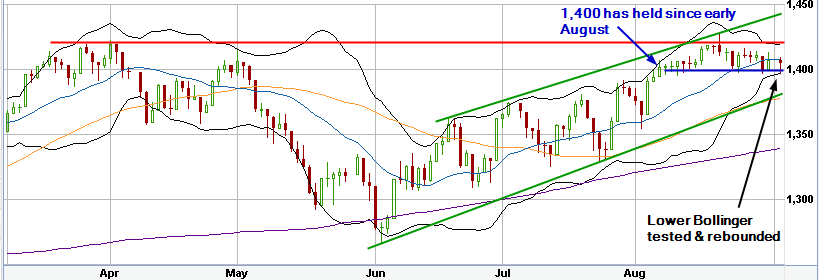

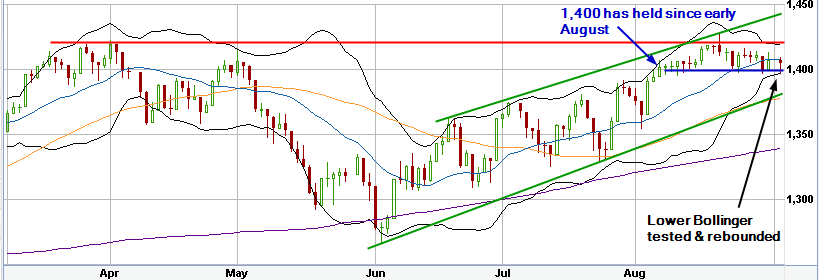

The S&P chart still doesn't look bad. The lower Bollinger was tested, and rebounded nicely. The 1400 level seems to be resistance since early August, was tested for the 5th time since then, and held. Nothing really to see much here, other than the intraday swing was a big one.

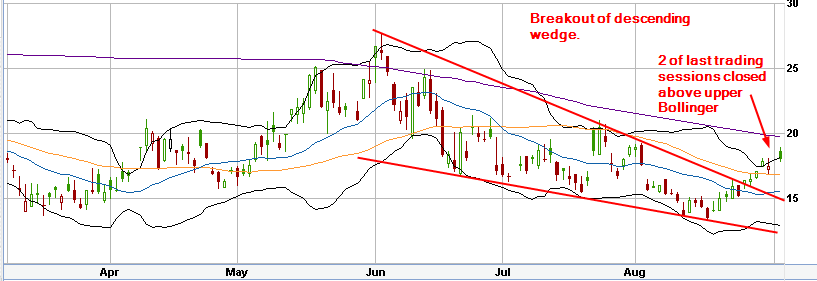

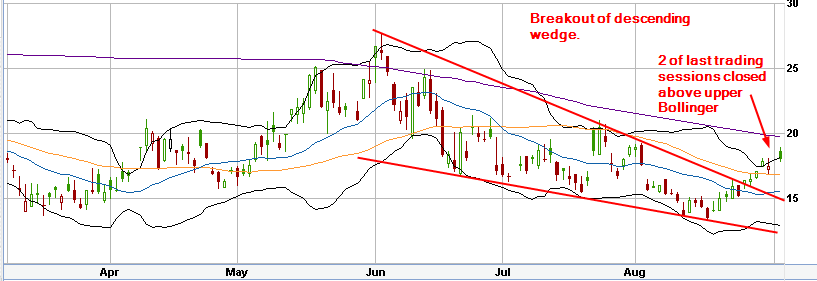

Next chart is the VIX, which I was positive would be on the downswing to start this week off, and I was wrong. Last week friday's move looked like a topping pattern but today's close is once again breaking outside of the top bollinger band. It has already broken out of a descending wedge, and how high it goes from here I don't know. But this one I'm definitely keeping my eye on. If it goes downward, look for it to test the 16 mark.

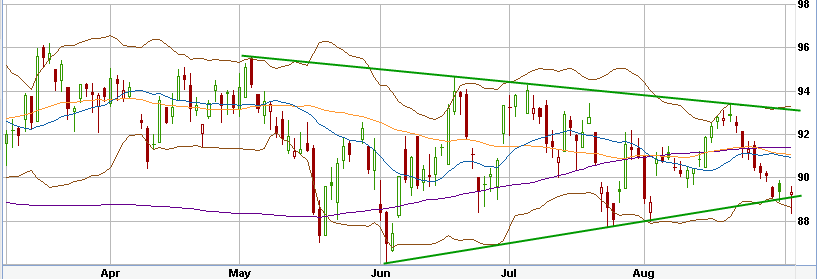

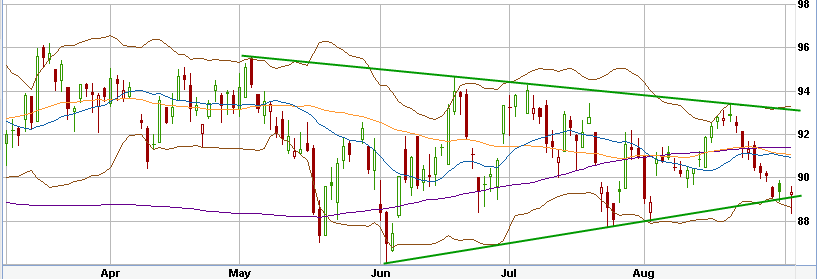

The Transportation Index seems to be holding its triangle pattern, but what bothers me is that today's low broke through the pattern. This is something I'm going to keep my eye on. On the bright side, it closed within the boundary.

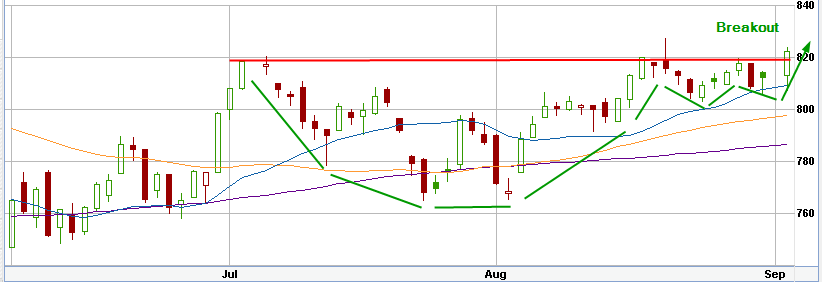

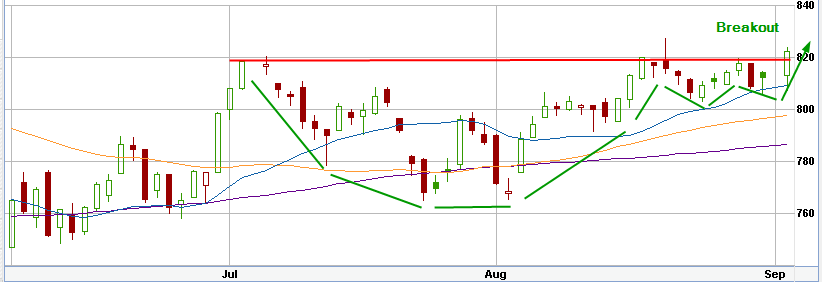

Small caps were by far today's major (only) winner, with the Russell 200 breaking out above the 820 level. A week ago, I posted a graph of the RUT forming a cup and handle. The breakout wasn't as clean as I expected, but it managed to do it nonetheless. Tomorrow is a confirmation whether the breakout will be for real, or a fakeout.

Overall, the VIX/S&P and IYT graphs give me some warning signals, but no screaming sell signal yet. For those who are playing high risk, this could be a possible bottom picking opportunity. The RUT movement was strange, as small caps greatly outperformed the broad market, which is one reason why I'm a little wary on this breakout. Usually failed breakouts are followed by large losses, so I'm definitely going to watch what happens in the next few days.

With that said, I'm likely going to switch my funds to a safer location on the 6th because I'll be taking a 2 week vacation (even if things are looking good). My girlfriend will kill me if I spend any time during our trip looking at the stock market, but there's no way I can do that if my money's not in cash :laugh:. Under normal circumstances, I would probably protect my gains if the S&P failed to hold 1400, as that looks like the most significant resistance point in the last month's time.