End of Week Analysis, Aug 13-17

Finally, some action on the market! The last 2 trading days of the week saw above average volume, gaining over 100 points over the last few days. Nothing I would call high volume, but it's a start, and investors are gaining confidence in this rally. The charts are starting to look a little interesting.

The DOW crept over the resistance line of 13,250, so next week is the confirmation whether this is a breakout or fakeout. I can't be 100% convinced of a breakout until the next pullback tests the new high as resistance, which will probably happen sometime this week.

The Transportation Average (IYT) is looking promising, showing a continuation pattern of an uptrend on this 9-month chart.

The VIX was the most interesting reading to me. A ST downward wedge may be an indicator that may move up (bearish for the S&P) in the near-term, but a longer term trend is showing a possible descending triangle. Can the VIX go even lower? Quite possibly.

Well, I predicted a big move was coming last week, but it didn't happen. This week though, the picture is clear with the forces in action, that something has to be coming soon. The DOW is at a critical resistance level, and in my opinion, this week is big for giving us an indicator which direction it is moving in. Keeping my position in C/S funds for the upcoming week!

In my current stock portfolio, I took a major hit from Marvell's earnings report. I could have settled for an 8-9% profit, instead risked holding through earnings, and ended up losing 10%, a 20% swing. Rookie mistake, was hoping for the homerun instead of taking a guaranteed winning play. Greed got the best of me this time, and hopefully I learned my lesson for good. On a brighter note, OCZ ripped to 5.26 in a matter of days. I put a stop loss of 5.05 in to lock at least 10% profits on this trade.

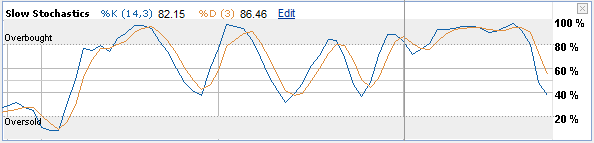

I could never make much sense of OCZ's graph, but these are just some notes for fun.