-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

S-fund Challenge! Guesses

- Thread starter ebbnflow

- Start date

ebbnflow

Ebbchart

- Reaction score

- 30

Well, son of a Birch!

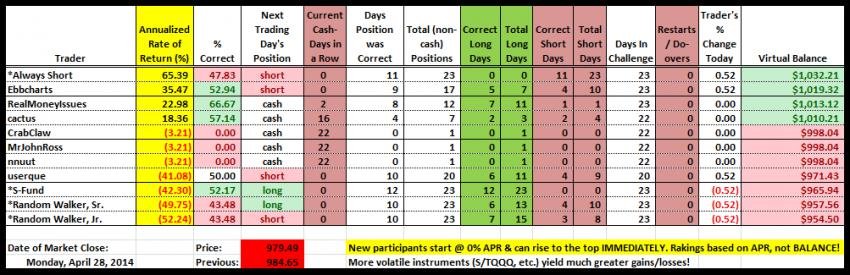

Unofficial (Apr. 28, 2014): C +0.32%; S -0.55%; I -0.10%.

Short Patterns (S-fund): 2/grn-grn-red (51.9%); 8/red-grn-red (52.4%).

Cash Patterns (S-fund): 4/grn-red-grn (53.3%); 6/red-red-grn (53.9%); 7/red-grn-grn (53.1%).

Long Patterns (S-fund): 1/grn-grn-grn (55.8%); 3/grn-red-red (56.9%); 5/red-red-red (60.1%).

S&P 500: 55.0% (7-yr. win percentage).

Strategy: short <= 53%; cash > 53% and <= 55.0%; long > 55.0%.

Accuracy: 9/14 (64%). Long: 5/7 (71%). Short: 4/7 (57%). Cash: green (2 up, 2 down); red (2 up, 3 down).

Tuesday: Pattern 4/grn-red-grn. Win Percentage (CSI 54.0%): C 55.1%, S 53.3% (TP WP: 0/2), I 53.7%.

Forecast: long C-fund; short S-fund; cash I-fund.

Tuesday's pattern 4 is short instead of cash because of a triple pattern on the ebbchart (Apr. 25-29). The 3rd day of triple pattern 4-4-4 is 0/2 in win percentage (see double-patterns chart below).

I would have been better off in cash.

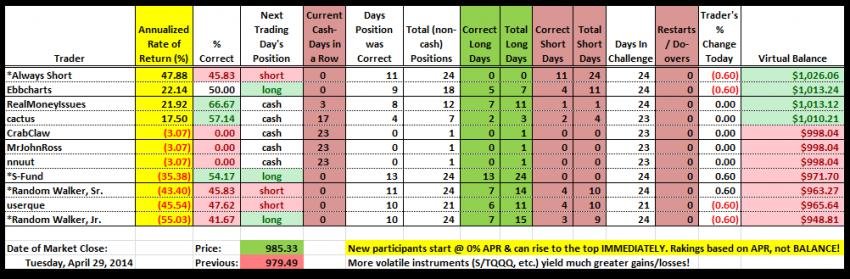

Unofficial (Apr. 29, 2014): C +0.48%; S +0.58%; I +0.65%.

Short Patterns (S-fund): 2/grn-grn-red (51.9%); 8/red-grn-red (52.4%).

Cash Patterns (S-fund): 4/grn-red-grn (53.5%); 6/red-red-grn (53.9%); 7/red-grn-grn (53.1%).

Long Patterns (S-fund): 1/grn-grn-grn (55.8%); 3/grn-red-red (56.9%); 5/red-red-red (60.1%).

S&P 500: 55.1% (7-yr. win percentage).

Strategy: short <= 53%; cash > 53% and <= 55.1%; long > 55.1%.

Accuracy: 9/15 (60%). Long: 5/8 (63%). Short: 4/7 (57%). Cash: green (2 up, 2 down); red (2 up, 3 down).

Wednesday: Pattern 5/red-red-red. Win Percentage (CSI 59.7%): C 60.7%, S 60.1%, I 58.4%.

Forecast: long C-fund; long S-fund; long I-fund.

If I only had one more IFT available...

ebbnflow

Ebbchart

- Reaction score

- 30

Oh, Ebb's saying DOWN...OK, change mine to UP for 4-29-14

Just kiddin' Ebb, we've got one more down day.

Could have made up some ground today, userque. Well, it's a long campaign and there's always tomorrow.

userque

TSP Legend

- Reaction score

- 36

I would have been better off in cash.

...

Hey, your system is doing excellent so far

userque

TSP Legend

- Reaction score

- 36

Could have made up some ground today, userque. Well, it's a long campaign and there's always tomorrow.

No worries,

The final NN I previously built did well in realistic back-testing over a recent ten day period (80% correct). I would settle with that network for this challenge but for testing the swing trading one.

You'd be well advised to get as big of a head-start as possible

ebbnflow

Ebbchart

- Reaction score

- 30

No worries,I'm still in the R&D phase. Recently just started playing with a swing trading NN right now. It's not really trying to catch the day-to-day wiggles. We'll see how it does.

The final NN I previously built did well in realistic back-testing over a recent ten day period (80% correct). I would settle with that network for this challenge but for testing the swing trading one.

You'd be well advised to get as big of a head-start as possible

Glad to see you finalizing your NN for the S-fund Challenge!

Be warned though, I have the cheat codes (patterns with probabilities) and I'm not afraid to use 'em.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

Re: S-fund Challenge!

Up for tomorrow(5/1) and probably tomorrow only... I guess we'll see how the price action goes...

Up for tomorrow(5/1) and probably tomorrow only... I guess we'll see how the price action goes...

Last edited:

ebbnflow

Ebbchart

- Reaction score

- 30

Re: S-fund Challenge!

Twitter twumbles, eBay falls by the wayside, but who cares when we have bullish pattern 5/red-red-red on our side.

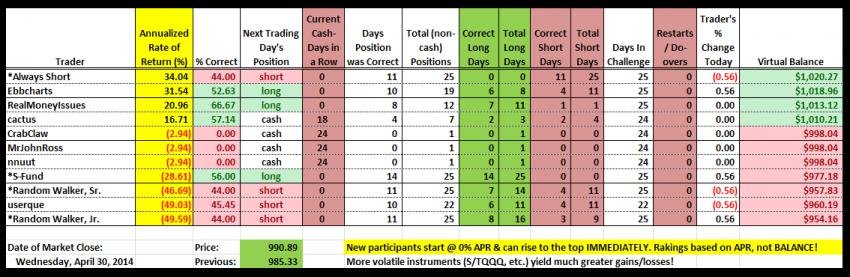

Unofficial (Apr. 30, 2014): C +0.30%; S +0.58%; I +0.29%.

Short Patterns (S-fund): 2/grn-grn-red (51.9%); 8/red-grn-red (52.4%).

Cash Patterns (S-fund): 4/grn-red-grn (53.5%); 6/red-red-grn (53.9%); 7/red-grn-grn (53.1%).

Long Patterns (S-fund): 1/grn-grn-grn (55.8%); 3/grn-red-red (56.9%); 5/red-red-red (60.3%).

S&P 500: 55.1% (7-yr. win percentage).

Strategy: short <= 53%; cash > 53% and <= 55.1%; long > 55.1%.

Accuracy: 10/16 (63%). Long: 6/8 (75%). Short: 4/8 (50%). Cash: green (2 up, 2 down); red (2 up, 3 down).

Thursday: Pattern 3/grn-red-red. Win Percentage (CSI 56.5%): C 57.2%, S 56.9%, I 55.4%.

Forecast: long C-fund; long S-fund; long I-fund.

[/QUOTE]

[/QUOTE]

I would have been better off in cash. *

Unofficial (Apr. 29, 2014): C +0.48%; S +0.58%; I +0.65%.

Short Patterns (S-fund): 2/grn-grn-red (51.9%); 8/red-grn-red (52.4%).

Cash Patterns (S-fund): 4/grn-red-grn (53.5%); 6/red-red-grn (53.9%); 7/red-grn-grn (53.1%).

Long Patterns (S-fund): 1/grn-grn-grn (55.8%); 3/grn-red-red (56.9%); 5/red-red-red (60.1%).

S&P 500: 55.1% (7-yr. win percentage).

Strategy: short <= 53%; cash > 53% and <= 55.1%; long > 55.1%.

Accuracy: 9/15 (60%). *Long: 5/7 (71%). *Short: 4/8 (50%). Cash: green (2 up, 2 down); red (2 up, 3 down). *Corrected.

Wednesday: Pattern 5/red-red-red. Win Percentage (CSI 59.7%): C 60.7%, S 60.1%, I 58.4%.

Forecast: long C-fund; long S-fund; long I-fund.

If I only had one more IFT available...

Twitter twumbles, eBay falls by the wayside, but who cares when we have bullish pattern 5/red-red-red on our side.

Unofficial (Apr. 30, 2014): C +0.30%; S +0.58%; I +0.29%.

Short Patterns (S-fund): 2/grn-grn-red (51.9%); 8/red-grn-red (52.4%).

Cash Patterns (S-fund): 4/grn-red-grn (53.5%); 6/red-red-grn (53.9%); 7/red-grn-grn (53.1%).

Long Patterns (S-fund): 1/grn-grn-grn (55.8%); 3/grn-red-red (56.9%); 5/red-red-red (60.3%).

S&P 500: 55.1% (7-yr. win percentage).

Strategy: short <= 53%; cash > 53% and <= 55.1%; long > 55.1%.

Accuracy: 10/16 (63%). Long: 6/8 (75%). Short: 4/8 (50%). Cash: green (2 up, 2 down); red (2 up, 3 down).

Thursday: Pattern 3/grn-red-red. Win Percentage (CSI 56.5%): C 57.2%, S 56.9%, I 55.4%.

Forecast: long C-fund; long S-fund; long I-fund.

ebbnflow

Ebbchart

- Reaction score

- 30

Re: S-fund Challenge!

Twitter twumbles, eBay falls by the wayside, but who cares when we have bullish pattern 5/red-red-red on our side.

Unofficial (Apr. 30, 2014): C +0.30%; S +0.58%; I +0.29%.

Short Patterns (S-fund): 2/grn-grn-red (51.9%); 8/red-grn-red (52.4%).

Cash Patterns (S-fund): 4/grn-red-grn (53.5%); 6/red-red-grn (53.9%); 7/red-grn-grn (53.1%).

Long Patterns (S-fund): 1/grn-grn-grn (55.8%); 3/grn-red-red (56.9%); 5/red-red-red (60.3%).

S&P 500: 55.1% (7-yr. win percentage).

Strategy: short <= 53%; cash > 53% and <= 55.1%; long > 55.1%.

Accuracy: 10/16 (63%). Long: 6/8 (75%). Short: 4/8 (50%). Cash: green (2 up, 2 down); red (2 up, 3 down).

Thursday: Pattern 3/grn-red-red. Win Percentage (CSI 56.5%): C 57.2%, S 56.9%, I 55.4%.

Forecast: long C-fund; long S-fund; long I-fund.

[/QUOTE]

[/QUOTE]

I would have been better off in cash.

Unofficial (Apr. 29, 2014): C +0.48%; S +0.58%; I +0.65%.

Short Patterns (S-fund): 2/grn-grn-red (51.9%); 8/red-grn-red (52.4%).

Cash Patterns (S-fund): 4/grn-red-grn (53.5%); 6/red-red-grn (53.9%); 7/red-grn-grn (53.1%).

Long Patterns (S-fund): 1/grn-grn-grn (55.8%); 3/grn-red-red (56.9%); 5/red-red-red (60.1%).

S&P 500: 55.1% (7-yr. win percentage).

Strategy: short <= 53%; cash > 53% and <= 55.1%; long > 55.1%.

Accuracy: 9/15 (60%). *Long: 5/7 (71%). *Short: 4/8 (50%). Cash: green (2 up, 2 down); red (2 up, 3 down). *Corrected.

Wednesday: Pattern 5/red-red-red. Win Percentage (CSI 59.7%): C 60.7%, S 60.1%, I 58.4%.

Forecast: long C-fund; long S-fund; long I-fund.

If I only had one more IFT available...

Twitter twumbles, eBay falls by the wayside, but who cares when we have bullish pattern 5/red-red-red on our side.

Unofficial (Apr. 30, 2014): C +0.30%; S +0.58%; I +0.29%.

Short Patterns (S-fund): 2/grn-grn-red (51.9%); 8/red-grn-red (52.4%).

Cash Patterns (S-fund): 4/grn-red-grn (53.5%); 6/red-red-grn (53.9%); 7/red-grn-grn (53.1%).

Long Patterns (S-fund): 1/grn-grn-grn (55.8%); 3/grn-red-red (56.9%); 5/red-red-red (60.3%).

S&P 500: 55.1% (7-yr. win percentage).

Strategy: short <= 53%; cash > 53% and <= 55.1%; long > 55.1%.

Accuracy: 10/16 (63%). Long: 6/8 (75%). Short: 4/8 (50%). Cash: green (2 up, 2 down); red (2 up, 3 down).

Thursday: Pattern 3/grn-red-red. Win Percentage (CSI 56.5%): C 57.2%, S 56.9%, I 55.4%.

Forecast: long C-fund; long S-fund; long I-fund.

ebbnflow

Ebbchart

- Reaction score

- 30

Twitter twumbles, eBay falls by the wayside, but who cares when we have bullish pattern 5/red-red-red on our side.

Unofficial (Apr. 30, 2014): C +0.30%; S +0.58%; I +0.29%.

Short Patterns (S-fund): 2/grn-grn-red (51.9%); 8/red-grn-red (52.4%).

Cash Patterns (S-fund): 4/grn-red-grn (53.5%); 6/red-red-grn (53.9%); 7/red-grn-grn (53.1%).

Long Patterns (S-fund): 1/grn-grn-grn (55.8%); 3/grn-red-red (56.9%); 5/red-red-red (60.3%).

S&P 500: 55.1% (7-yr. win percentage).

Strategy: short <= 53%; cash > 53% and <= 55.1%; long > 55.1%.

Accuracy: 10/16 (63%). Long: 6/8 (75%). Short: 4/8 (50%). Cash: green (2 up, 2 down); red (2 up, 3 down).

Thursday: Pattern 3/grn-red-red. Win Percentage (CSI 56.5%): C 57.2%, S 56.9%, I 55.4%.

Forecast: long C-fund; long S-fund; long I-fund.

Pattern 3/grn-red-red pulled through for the S-fund today.

Unofficial (May 01, 2014): C -0.01%; S +0.23%; I +0.36%.

Short Patterns (S-fund): 2/grn-grn-red (51.9%); 8/red-grn-red (52.4%).

Cash Patterns (S-fund): 4/grn-red-grn (53.5%); 6/red-red-grn (53.9%); 7/red-grn-grn (53.1%).

Long Patterns (S-fund): 1/grn-grn-grn (55.8%); 3/grn-red-red (57.1%); 5/red-red-red (60.3%).

S&P 500: 55.1% (7-yr. win percentage).

Strategy: short <= 53%; cash > 53% and <= 55.1%; long > 55.1%.

Accuracy: 11/17 (65%). Long: 7/9 (78%). Short: 4/8 (50%). Cash: green (2 up, 2 down); red (2 up, 3 down).

Friday: Pattern 1/grn-grn-grn. Win Percentage (CSI 52.9%): C 53.3%, S 55.8%, I 49.6%.

Forecast: cash C-fund; long S-fund; short I-fund.

Similar threads

- Replies

- 0

- Views

- 175

- Replies

- 0

- Views

- 114

- Replies

- 0

- Views

- 139

- Replies

- 0

- Views

- 128