quabit

Market Tracker

- Reaction score

- 24

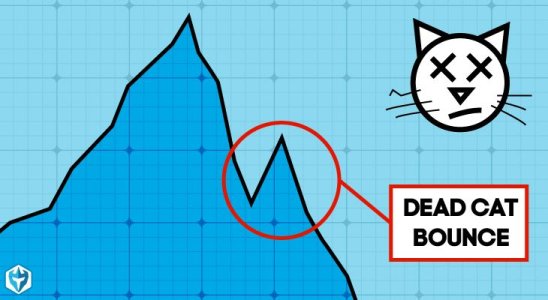

No FOMO here. Patiently waiting for the retest...

There are gaps above and below which way do we go? Both directions need filled but which ones gets done first. Wish I knew but I'm with you and hoping to see the ones below get filled with a retest. It's hard though with big money pockets Powell turning on all the presses and waiting for a retest could take a very long time. Look how long it took to fill the one from Oct 20 and I may be wrong but there might have been one left from initial Powell Put in Dec/Jan 19. To be honest this is why the 2 trade limit sucks. I know I was out early in the month and even when the price got to where I considered ok I was out of trades hoping to make it to Apr however Big Money Powell stepped in again. Guess this is another lesson I needed to learn in being patient. Thank you Sir may I have another.