It certainly appears the character of this market is changing. After yesterday's hard sell-off, I was anticipating we'd see some measure of a rally attempt. And we did, but it was from much lower than yesterday's closing prices and it wasn't evenly distributed as the S&P closed a modest 0.13%, while the broader market (Wilshire 4500) got whacked for 0.95%. Those represent our C and S funds. The Nasdaq was clipped for -0.77%, while the DOW was nearly flat at a -0.02%. It should be noted that closing prices were well off their lows of the day, but today's action wasn't bullish in the bigger picture.

China was at the forefront of the selling pressure early on as they reported that their economy had expanded at a whopping 9.8% last quarter. Inflation fears are once again in focus, which is putting more pressure on China to tighten it's monetary policy.

There was also no shortage of domestic data to digest. Initial jobless claims came in at 404,000, below estimates of 425,000. The four-week moving average moved lower 411,750. Continuing claims fell 3.86 million.

December existing home sales jumped 12.3% to an annualized rate of 5.28 million. This was much higher than estimates of about 4.80 million and appeared to show a pent-up demand.

December leading indicators were up 1.0%, which was better than the 0.6% increase that was anticipated.

The January Philadelphia Fed Index posted a 19.3, which was a bit short of the anticipated 20.0.

The dollar bounced today, achieving an overall gain of 0.2%. The Yen was the main reason for the bounce as it fell 1.2%.

Treasuries were unloaded today. This was due to weak demand from a $13 billion auction of 10-year TIPS.

The Seven Sentinels issued a sell signal yesterday and as a result the system went to 100% G fund at the close today. Here's today's charts:

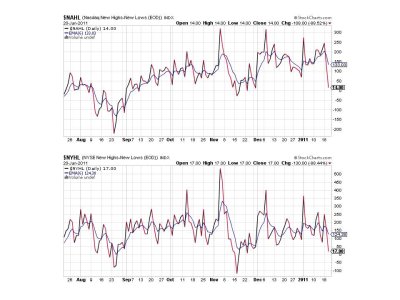

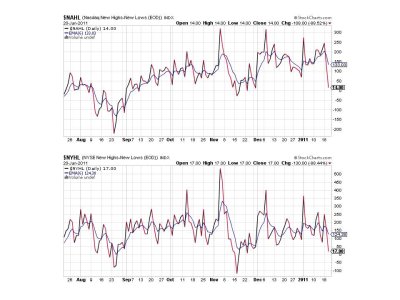

The negative action got some more momentum today as both NAMO and NYMO fell deeper into negative territory. They remain in a sell condition.

NAHL and NYHL also fell lower and remained on sells.

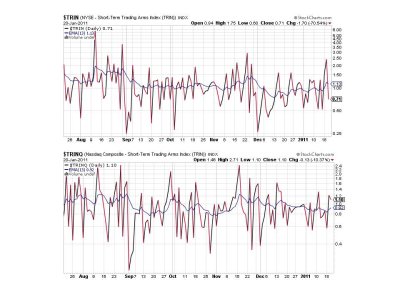

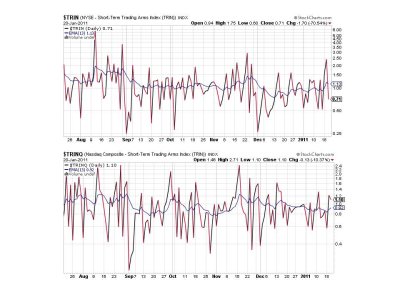

TRIN managed to flip back to a buy, but TRINQ did not.

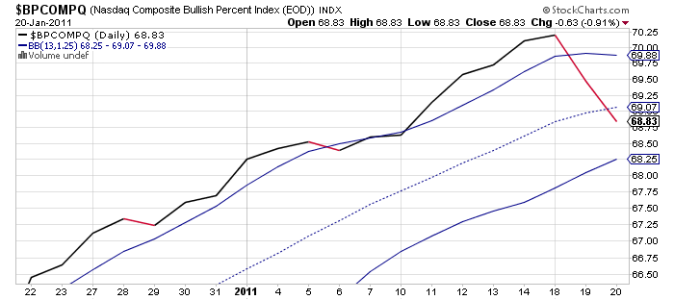

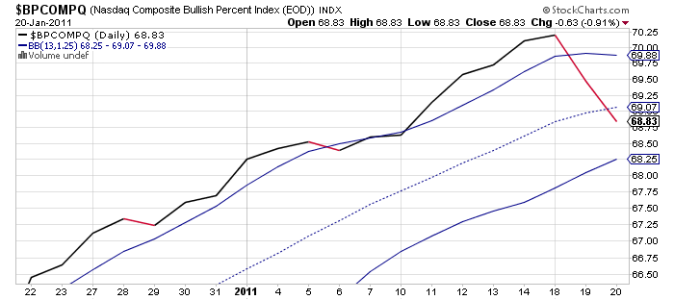

Here is perhaps the biggest tell of all. BPCOMPQ fell again and looks decidedly bearish after months of up and sideways movement. Remember, this signal finally crossed into overbought territory in the past week, so it's not entirely surprising to see this weakness.

So the Seven Sentinels remain in a sell condition. Will this be a short term period of weakness? It could be. The Fed is still pumping POMO so I'm not anticipating a long-lasting sell signal. However, how deep this weakness takes us is more unclear to me. Tomorrow is OPEX so anything can happen, but I'm of the opinion any further hard selling will wait until at least next week. Regardless of what happens though, the current action needs to be respected, so caution is warranted as we move forward.

China was at the forefront of the selling pressure early on as they reported that their economy had expanded at a whopping 9.8% last quarter. Inflation fears are once again in focus, which is putting more pressure on China to tighten it's monetary policy.

There was also no shortage of domestic data to digest. Initial jobless claims came in at 404,000, below estimates of 425,000. The four-week moving average moved lower 411,750. Continuing claims fell 3.86 million.

December existing home sales jumped 12.3% to an annualized rate of 5.28 million. This was much higher than estimates of about 4.80 million and appeared to show a pent-up demand.

December leading indicators were up 1.0%, which was better than the 0.6% increase that was anticipated.

The January Philadelphia Fed Index posted a 19.3, which was a bit short of the anticipated 20.0.

The dollar bounced today, achieving an overall gain of 0.2%. The Yen was the main reason for the bounce as it fell 1.2%.

Treasuries were unloaded today. This was due to weak demand from a $13 billion auction of 10-year TIPS.

The Seven Sentinels issued a sell signal yesterday and as a result the system went to 100% G fund at the close today. Here's today's charts:

The negative action got some more momentum today as both NAMO and NYMO fell deeper into negative territory. They remain in a sell condition.

NAHL and NYHL also fell lower and remained on sells.

TRIN managed to flip back to a buy, but TRINQ did not.

Here is perhaps the biggest tell of all. BPCOMPQ fell again and looks decidedly bearish after months of up and sideways movement. Remember, this signal finally crossed into overbought territory in the past week, so it's not entirely surprising to see this weakness.

So the Seven Sentinels remain in a sell condition. Will this be a short term period of weakness? It could be. The Fed is still pumping POMO so I'm not anticipating a long-lasting sell signal. However, how deep this weakness takes us is more unclear to me. Tomorrow is OPEX so anything can happen, but I'm of the opinion any further hard selling will wait until at least next week. Regardless of what happens though, the current action needs to be respected, so caution is warranted as we move forward.