11/26/25

Stocks continued their rebound on Tuesday with small caps again leading the way, while yields and the dollar slipped lower. The S&P 500 is at a very important level, and maybe the positive holiday week bias will help, but the bears may have something to say about it today. Wednesdays are bullish during Thanksgiving week, but the S&P does better on the Friday after Thanksgiving when the Wednesday before is down.

The PPI wholesale inflation data this morning came in a little higher than expected but ADP employment data was soft, so it may have been a wash as far as the Fed's outlook on interest rates. However, White House National Economic Council Director Kevin Hassett has become the favorite as the next Fed chair to replace Powell. Hassett is considered more likely to push for a lower-rate, and yields fell yesterday partially on this information.

The 10-year Treasury Yield briefly fell below 4% for the first time in a month, closing just above it, but it is heading in the direction of this year's lows made in April just below 3.9%.

The dollar was also down and the 0.28% decline was enough to have the I-fund keep pace with the S&P 500's gain. However, it did reverse higher to close off the lows after filling in a gap. There is another gap above.

The S&P 500 (C-fund) has rallied for three straight days right into historically bullish Wednesday before Thanksgiving, but it is up against some potentially tough resistance. Where it heads from here could make or break the relief rally.

For those of you who may have a transaction left in November:

Going back to 1988 (37 years):

The S&P 500 was up 25 times and down 12 times on the Wednesday before Thanksgiving.

The S&P 500 was up 21 times and down 16 times on the Friday after Thanksgiving (a little surprising that it was not better.)

When the S&P 500 was down on the Wednesday before Thanksgiving Day, the Friday after Thanksgiving Day was positive 10 out of 12 times.

More recently:

From tsp.gov: Holiday Closing: Some financial markets will be closed on Thursday, November 27, in observance of Thanksgiving Day. The Thrift Savings Plan will also be closed. Transactions that would have been processed Thursday night (November 27) will be processed Friday night (November 28) at Friday's closing share prices.

Enjoy your holiday! I will post a brief commentary on Friday.

The DWCPF Index (S-Fund) had another big day and that helped move it back above the 50-day EMA, but there is a little bit more resistance in the way. This looks like "V" bottom after the pullback, but let's see how it behaves in that 2475 area - perhaps the last line of defense for the bears before this attempts a move back to the old highs.

ACWX (I-fund) was up nicely as the dollar fell lower. As I mentioned above, the dollar did close off its lows after filling a gap, so I don't know how much the I-fund can count on the dollar continuing to help out here. ACWX is back above its 50-day average, but similar to the S&P 500 chart, it will have to move above some old broken support if it wants to get back into its ascending channel.

BND (bonds / F-fund) nearly touched its recent highs again with the 10-year Treasury yield falling to 4% yesterday. This looks good for the F-fund.

Thanks so much for reading! Have a Happy Thanksgiving!! I'll be back on Friday with a brief update.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Stocks continued their rebound on Tuesday with small caps again leading the way, while yields and the dollar slipped lower. The S&P 500 is at a very important level, and maybe the positive holiday week bias will help, but the bears may have something to say about it today. Wednesdays are bullish during Thanksgiving week, but the S&P does better on the Friday after Thanksgiving when the Wednesday before is down.

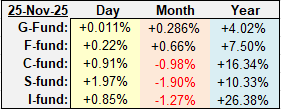

| Daily TSP Funds Return More returns |

The PPI wholesale inflation data this morning came in a little higher than expected but ADP employment data was soft, so it may have been a wash as far as the Fed's outlook on interest rates. However, White House National Economic Council Director Kevin Hassett has become the favorite as the next Fed chair to replace Powell. Hassett is considered more likely to push for a lower-rate, and yields fell yesterday partially on this information.

The 10-year Treasury Yield briefly fell below 4% for the first time in a month, closing just above it, but it is heading in the direction of this year's lows made in April just below 3.9%.

The dollar was also down and the 0.28% decline was enough to have the I-fund keep pace with the S&P 500's gain. However, it did reverse higher to close off the lows after filling in a gap. There is another gap above.

The S&P 500 (C-fund) has rallied for three straight days right into historically bullish Wednesday before Thanksgiving, but it is up against some potentially tough resistance. Where it heads from here could make or break the relief rally.

For those of you who may have a transaction left in November:

Going back to 1988 (37 years):

The S&P 500 was up 25 times and down 12 times on the Wednesday before Thanksgiving.

The S&P 500 was up 21 times and down 16 times on the Friday after Thanksgiving (a little surprising that it was not better.)

When the S&P 500 was down on the Wednesday before Thanksgiving Day, the Friday after Thanksgiving Day was positive 10 out of 12 times.

More recently:

From tsp.gov: Holiday Closing: Some financial markets will be closed on Thursday, November 27, in observance of Thanksgiving Day. The Thrift Savings Plan will also be closed. Transactions that would have been processed Thursday night (November 27) will be processed Friday night (November 28) at Friday's closing share prices.

Enjoy your holiday! I will post a brief commentary on Friday.

The DWCPF Index (S-Fund) had another big day and that helped move it back above the 50-day EMA, but there is a little bit more resistance in the way. This looks like "V" bottom after the pullback, but let's see how it behaves in that 2475 area - perhaps the last line of defense for the bears before this attempts a move back to the old highs.

ACWX (I-fund) was up nicely as the dollar fell lower. As I mentioned above, the dollar did close off its lows after filling a gap, so I don't know how much the I-fund can count on the dollar continuing to help out here. ACWX is back above its 50-day average, but similar to the S&P 500 chart, it will have to move above some old broken support if it wants to get back into its ascending channel.

BND (bonds / F-fund) nearly touched its recent highs again with the 10-year Treasury yield falling to 4% yesterday. This looks good for the F-fund.

Thanks so much for reading! Have a Happy Thanksgiving!! I'll be back on Friday with a brief update.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.