Another low volume trading day, but this time the early gap higher stuck as the market kept the bulk of its gains today. The dollar traded 0.7% lower in anticipation of tomorrow's FOMC announcement, which certainly helped the I fund.

I'm going to cut it short tonight as the real market catalysts are almost upon us and anything can happen in very short time frames. Here's today's charts:

Back to buys for NAMO and NYMO.

NAHL and NYHL are also on buys.

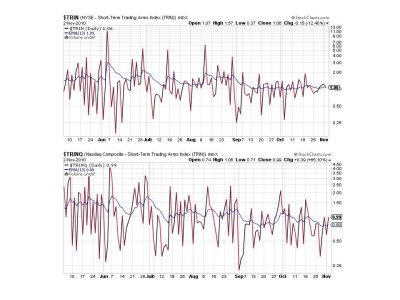

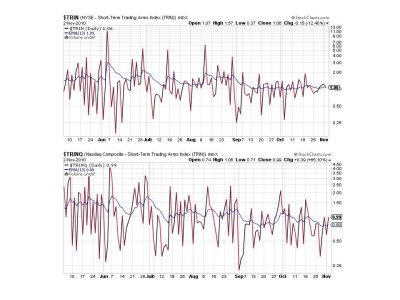

One buy and one sell for TRIN and TRINQ.

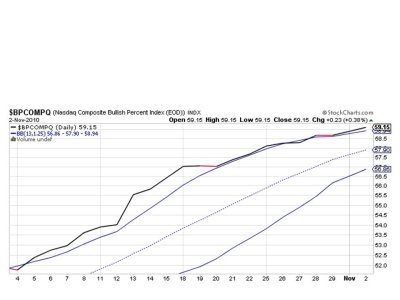

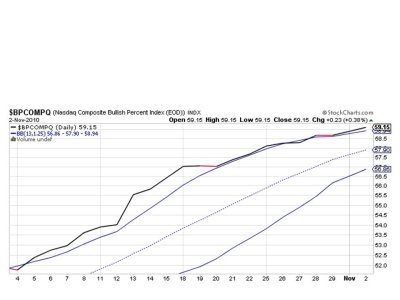

BPCOMPQ remains on a buy and is putting a bit more separation between it and that upper bolly.

So we have 6 of 7 signals now flashing buys, which keeps the system on a buy.

I am not surprised by today's rally ahead of the big news events. What really matters is how the market fares once it's over. With that I'm off to watch the election results. See you tomorrow.

I'm going to cut it short tonight as the real market catalysts are almost upon us and anything can happen in very short time frames. Here's today's charts:

Back to buys for NAMO and NYMO.

NAHL and NYHL are also on buys.

One buy and one sell for TRIN and TRINQ.

BPCOMPQ remains on a buy and is putting a bit more separation between it and that upper bolly.

So we have 6 of 7 signals now flashing buys, which keeps the system on a buy.

I am not surprised by today's rally ahead of the big news events. What really matters is how the market fares once it's over. With that I'm off to watch the election results. See you tomorrow.