The top callers are out again. Not on this board, but others. Many day-traders just cannot accept this rally. Instead of playing the long side of an obvious bull move on steroids, they keep looking to short with the grandiose expectations of the mother of all declines.

Good luck with that. I seriously doubt it will be obvious when it happens. Assuming it happens.

So now OPEX is upon us (tomorrow) and there are expectations of selling on any level. Of course we're due, but since when has the market cared what the bears think?

So will we have an OPEX surprise tomorrow with follow-through next week or will it be business as usual with dip buyers stepping in to provide support? We won't know the answer immediately, even if we do see some selling tomorrow, as OPEX is not typical market action.

But you know how I'll be gauging it, and with that let's look at the charts:

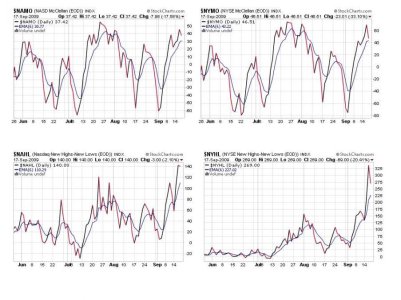

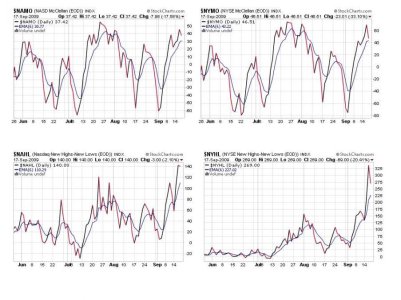

After a modest to moderate sell-off today we can see some deterioration in these four charts, but each signal is still flashing a buy.

TRIN and TRINQ are both flashing sell signals, so I'm expecting possible weakness from this, but not necessarily enough to get a full-blown Seven Sentinels sell signal. BPCOMPQ is still decidedly bullish today. You can see how far it pushed above the bollinger band yesterday and really hasn't given up any ground today, although the bollies are beginning to flare out a little.

I do not have updated data yet to give you the charts on the Top 25% going into tomorrow, but I can show you what they looked like this morning.

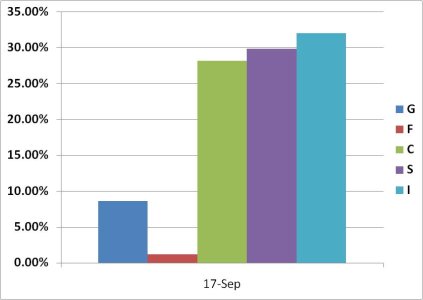

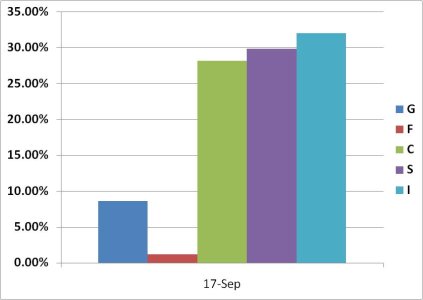

Here we see a decline in Cash holdings (G) fund with a corresponding rise in equity holdings.

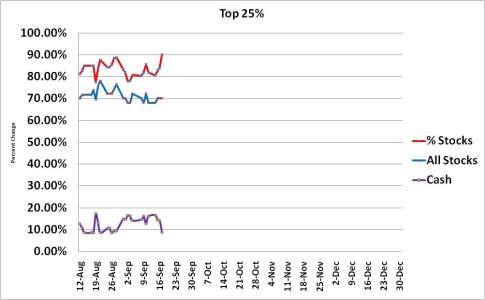

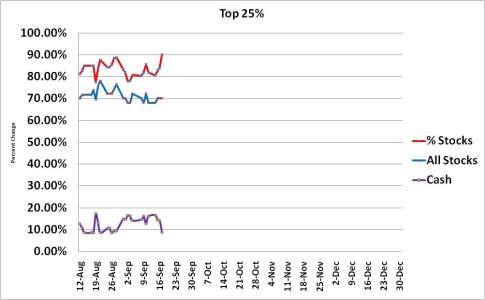

It's even more obvious in this chart. Our top performers are still buying this rally. The Top 25% now have 90.17% of their collective funds spread out in all three equity funds. This group has certainly boarded the train in a big way.

If I get tonight's data early enough, I'll post the Top 25% position going into tomorrow. But don't expect any surprises. There's not a lot of fear in this bunch.

As for me, I won't sell until the Seven Sentinels gives me a sell signal. I'm hoping that's not any time soon. Good luck all!

Good luck with that. I seriously doubt it will be obvious when it happens. Assuming it happens.

So now OPEX is upon us (tomorrow) and there are expectations of selling on any level. Of course we're due, but since when has the market cared what the bears think?

So will we have an OPEX surprise tomorrow with follow-through next week or will it be business as usual with dip buyers stepping in to provide support? We won't know the answer immediately, even if we do see some selling tomorrow, as OPEX is not typical market action.

But you know how I'll be gauging it, and with that let's look at the charts:

After a modest to moderate sell-off today we can see some deterioration in these four charts, but each signal is still flashing a buy.

TRIN and TRINQ are both flashing sell signals, so I'm expecting possible weakness from this, but not necessarily enough to get a full-blown Seven Sentinels sell signal. BPCOMPQ is still decidedly bullish today. You can see how far it pushed above the bollinger band yesterday and really hasn't given up any ground today, although the bollies are beginning to flare out a little.

I do not have updated data yet to give you the charts on the Top 25% going into tomorrow, but I can show you what they looked like this morning.

Here we see a decline in Cash holdings (G) fund with a corresponding rise in equity holdings.

It's even more obvious in this chart. Our top performers are still buying this rally. The Top 25% now have 90.17% of their collective funds spread out in all three equity funds. This group has certainly boarded the train in a big way.

If I get tonight's data early enough, I'll post the Top 25% position going into tomorrow. But don't expect any surprises. There's not a lot of fear in this bunch.

As for me, I won't sell until the Seven Sentinels gives me a sell signal. I'm hoping that's not any time soon. Good luck all!