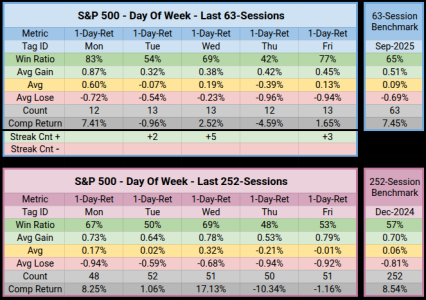

Day of Week Stats:

Across 63-Sessions

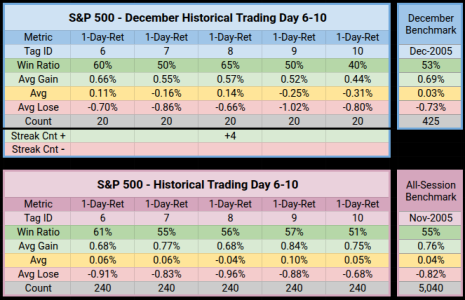

When we evaluate Trading Day of the Month, it's a general trend, but not always consistent due to how many sessions each month has.

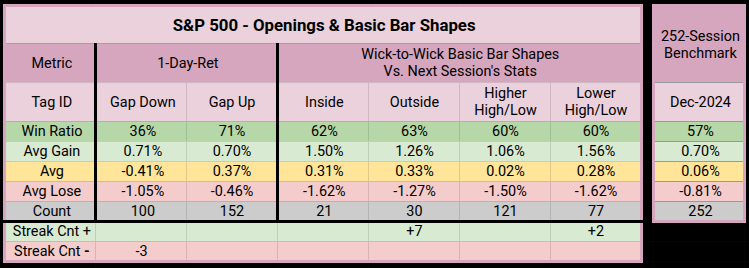

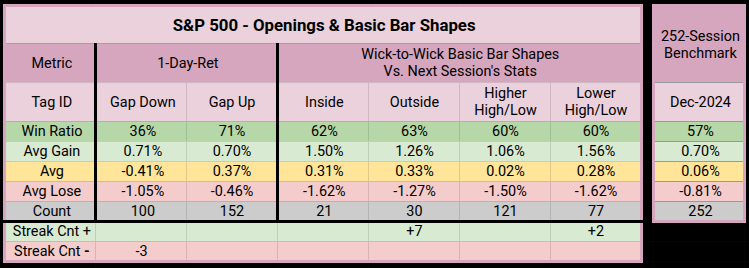

The best stats are the opening gaps, great for going with the flow of the open.

Tomorrow, I'll post the end of year stats, covering the busiest statistical month of the year.

The holiday season

Monthly Transitions

BLS (Bureau of Labor Statistics)

FOMC (Federal Open Market Committee)

OPEX (Options Expiration)

Have a great session.... Jason

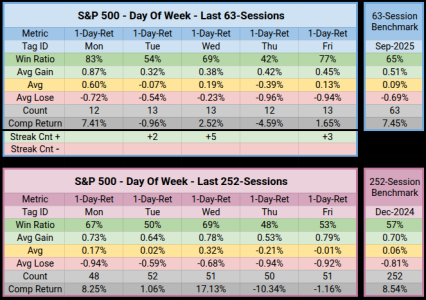

Across 63-Sessions

- Monday continues to dominate, with a 83% Win Ratio and .60% average return.

- Wednesday rides a 5-Session win streak

- Wednesday earns the most green.

- Mon-Wed have earned 26.44% while Thur-Fri have lost -11.49%

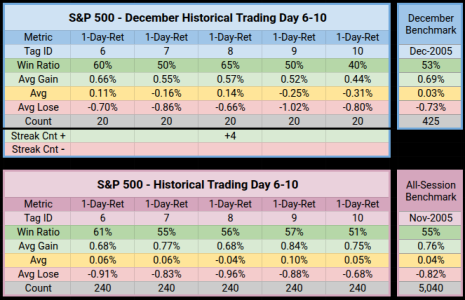

When we evaluate Trading Day of the Month, it's a general trend, but not always consistent due to how many sessions each month has.

- All of December Trading Day 8 looks healthy with the best average return in this 6-10 session pocket.

- In contrast, all of Trading Day 8 over the past 240 months have a negative average return.

- If there were a 4-Horseman of Trading Sessions to avoid, it's Trading Days 4, 8, 13, 14

The best stats are the opening gaps, great for going with the flow of the open.

- Since we are in a general uptrend, Gap ups at the open have a 71% edge, meaning if we gap up, we are mostly likely to close up.

- This is the weakest of the 4 Wick-to-Wick shapes, due to the lower Average of gains.

Tomorrow, I'll post the end of year stats, covering the busiest statistical month of the year.

The holiday season

Monthly Transitions

BLS (Bureau of Labor Statistics)

FOMC (Federal Open Market Committee)

OPEX (Options Expiration)

Have a great session.... Jason

Last edited: