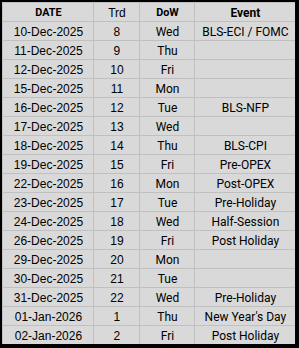

Statistically speaking, and partially due to the data delay caused by Fed shutdown, this might be one of the busiest phases of the year(s).

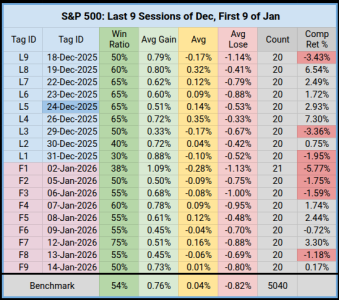

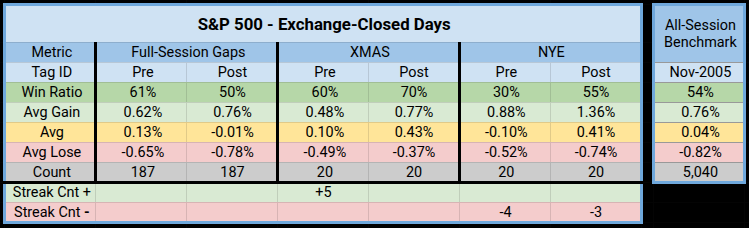

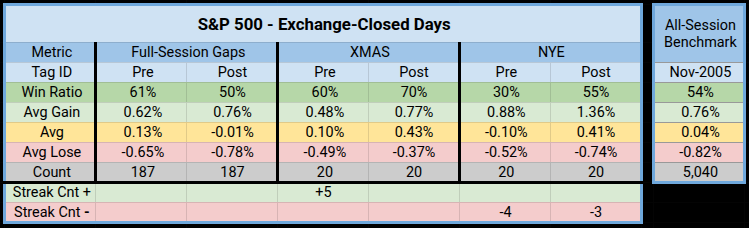

One of the things which makes this month unique, is the 24-Dec half session followed by the Christmas Close.

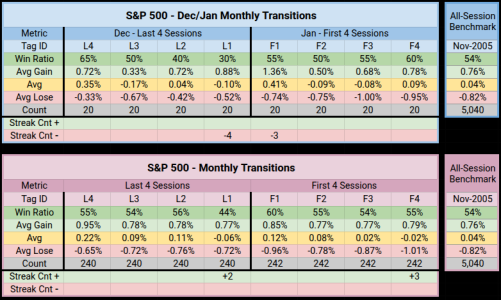

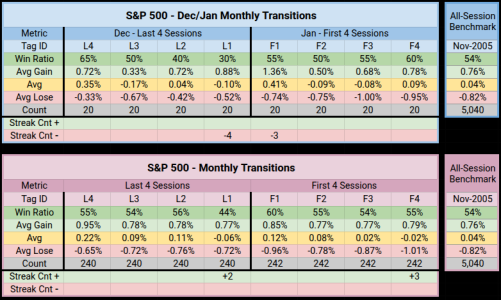

For the Dec/Jan Transition

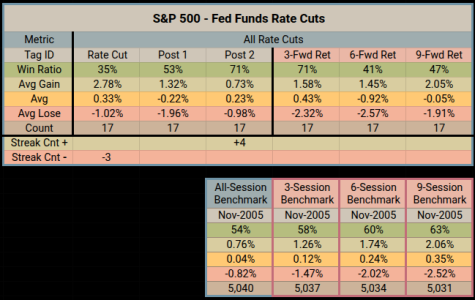

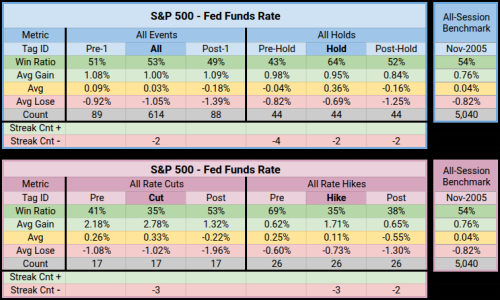

If there is one event this month that is going to get all the shine, it's the FOMC meeting. For All Sessions, the Pre-Session, Event, and Post-Session are all under the 20-Year Benchmark.

When We Hold Rates, the Pre/Post Sessions are weak, while the event day has some good returns.

When we Cut rates, we have to use some statistical caution, we can see very low win ratios contrasted with above average gains. This is a highly elevated set of stats for a 3-Session Pocket.

Let me preface, I'm not an economist, and aside from tracking stats, this is my weakest area of expertise.

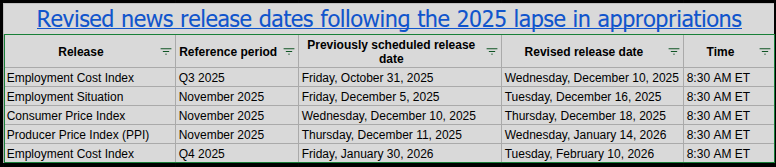

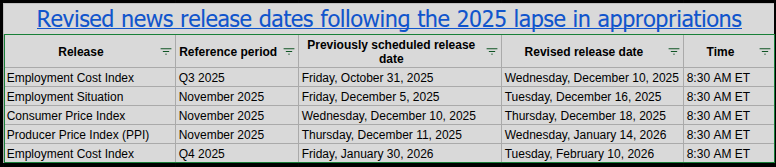

What we do know, the Fed Shutdown is delaying Data releases.

What we don't know

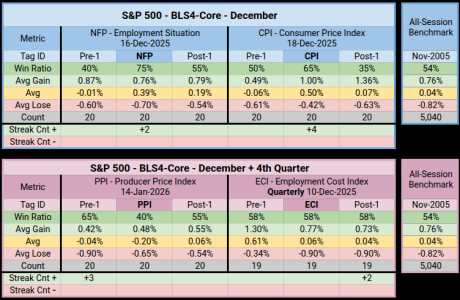

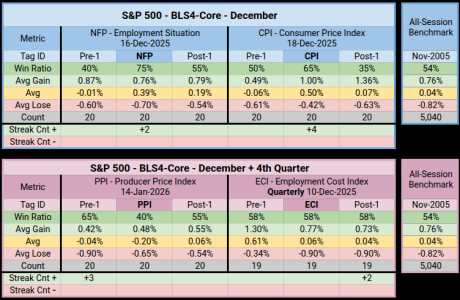

These BLS 4-Core are not sorted by date, but by Market Impact.

These stats are for the Month of December and ECI 4th Quarter, even though the next PPI in in Jan, this is Dec stats we are looking at.

I have a particular interest in the 9-Jan NFP & 14-Jan PPI, since the (Dec PPI release was canceled).

My speculation is this may prove to be a market-Churning Light-Volume phase, until we get past the the MLK Holiday.

This leaves the stats for Next Week's Options Expiration, I'll post those next Monday, in this Blog.

Thanks for reading...Jason.

- December enters a heavy data gauntlet: ECI, FOMC, NFP, and CPI all hit before trading thins.

- Once we get past the Friday 15-Dec Pre-OPEX, (the last 9-Sessions) half of the daily log-volume is in the Bottom 20% of the 20-year range.

One of the things which makes this month unique, is the 24-Dec half session followed by the Christmas Close.

- 20-Years of Full-session gaps (mostly holidays) show a split profile, Pre tends to rise, while Post is flat to slightly negative.

- Xmas trading stays firm, both Pre and Post lean positive with solid average gains.

- NYE is mixed, the Pre-Session has been weak, but Post snaps back with a stronger upside bias.

For the Dec/Jan Transition

- The final stretch of December (L4→L1) progressively gets weaker.

- The first January session (F1) shows the strongest gains in the entire sequence.

- To be fair, trading session 4 is the strongest of this set, still over the past 20 years if has a -4.50% compounded return.

- As you would expect, the more data we use the more it normalizes, making tea-reading more difficult.

- Still, F1 again stands out as the transition pivot, the only session showing persistent upside across both datasets.

If there is one event this month that is going to get all the shine, it's the FOMC meeting. For All Sessions, the Pre-Session, Event, and Post-Session are all under the 20-Year Benchmark.

When We Hold Rates, the Pre/Post Sessions are weak, while the event day has some good returns.

When we Cut rates, we have to use some statistical caution, we can see very low win ratios contrasted with above average gains. This is a highly elevated set of stats for a 3-Session Pocket.

- These contrast were often crisis-triggered events.

- 07-Oct-2008 Pre-Cut Session loss of -5.7%

- 08-Oct-2008 saw a .5% Cut with a -1.13% loss

- 09-Oct-2008 saw a Post-Cut loss of -7.62%

- From these 3X 17, or 51 sessions, 31 were extreme returns ranking in the Top/Bottom 20%

- 07-Oct-2008 Pre-Cut Session loss of -5.7%

- 04-May-2022 gave us a .5% Hike with a 2.99% gain followed by a Post-Hike Session loss of -3.56%

- 15-June-2022 saw a .75% Hike with a 1.46% gain followed by a Post-Hike Session loss of -3.25%

- Of this 3X 20 or 60 sessions, the total average is -.12%

Let me preface, I'm not an economist, and aside from tracking stats, this is my weakest area of expertise.

What we do know, the Fed Shutdown is delaying Data releases.

What we don't know

- We will the data be good, bad, or trusted?

- Since it was released late, will this mean it's less relevant?

- How will it be priced in?

These BLS 4-Core are not sorted by date, but by Market Impact.

These stats are for the Month of December and ECI 4th Quarter, even though the next PPI in in Jan, this is Dec stats we are looking at.

I have a particular interest in the 9-Jan NFP & 14-Jan PPI, since the (Dec PPI release was canceled).

My speculation is this may prove to be a market-Churning Light-Volume phase, until we get past the the MLK Holiday.

- But Light Volume does not always mean Low Volatility...

This leaves the stats for Next Week's Options Expiration, I'll post those next Monday, in this Blog.

Thanks for reading...Jason.

Last edited: