Looks good from a distance, but lift the hood and we got problems. At least that's how it looks right now.

So we saw a 1.7% rally today, which appeared to be triggered after Fed Chairman Bernanke indicated that he expects better growth in 2011, and further stated the Fed is ready to use "unconventional measures if it proves necessary, especially if the outlook were to deteriorate significantly."

Then treasuries got hammered as the stock market took off.

I said in yesterday's blog that the Seven Sentinels suggested a short term bottom may have been put in, and so far that seems to be the case. But comments delivered by the Fed Chair often trigger very short-lived movement in the indexes. I would not be comfortable just yet with the long side. Especially as today was Friday and market participants have the weekend to ponder the situation a little more.

Let's take a look at the charts:

NAMO and NYMO both triggered buy signals today, but remain below the zero line.

One would think internals would have improved after today, but NAHL and NYHL don't suggest that at all. Very little movement here, but they do remain on a buy.

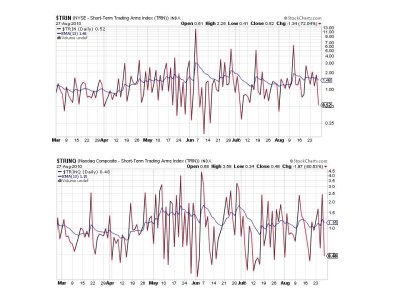

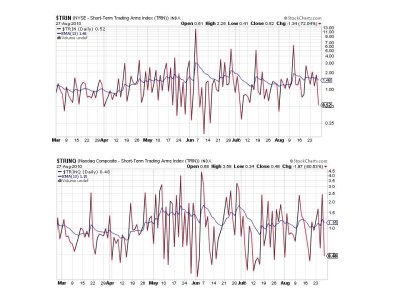

TRIN and TRINQ are both flashing buys, but indicate a very overbought market in the short term.

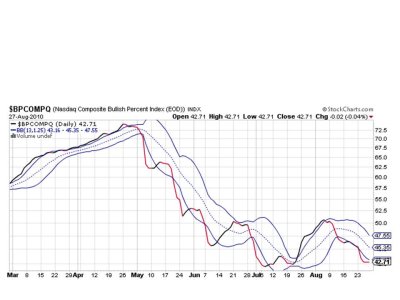

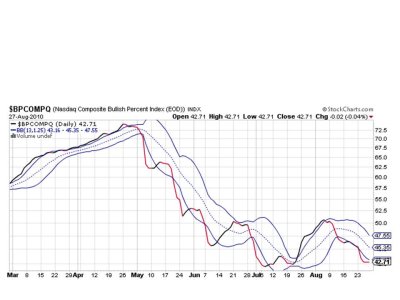

BPCOMPQ didn't hardly budge and remains on a sell.

So we have 6 of 7 signals flashing buys, but the system remains on a sell.

The charts do not instill any confidence in me that a new up-leg has begun. Certainly not one with any substance. Look for a pop Monday morning followed by selling pressure as the day wears on. That's my prediction for Monday.

See you this weekend when I post the Tracker charts.

So we saw a 1.7% rally today, which appeared to be triggered after Fed Chairman Bernanke indicated that he expects better growth in 2011, and further stated the Fed is ready to use "unconventional measures if it proves necessary, especially if the outlook were to deteriorate significantly."

Then treasuries got hammered as the stock market took off.

I said in yesterday's blog that the Seven Sentinels suggested a short term bottom may have been put in, and so far that seems to be the case. But comments delivered by the Fed Chair often trigger very short-lived movement in the indexes. I would not be comfortable just yet with the long side. Especially as today was Friday and market participants have the weekend to ponder the situation a little more.

Let's take a look at the charts:

NAMO and NYMO both triggered buy signals today, but remain below the zero line.

One would think internals would have improved after today, but NAHL and NYHL don't suggest that at all. Very little movement here, but they do remain on a buy.

TRIN and TRINQ are both flashing buys, but indicate a very overbought market in the short term.

BPCOMPQ didn't hardly budge and remains on a sell.

So we have 6 of 7 signals flashing buys, but the system remains on a sell.

The charts do not instill any confidence in me that a new up-leg has begun. Certainly not one with any substance. Look for a pop Monday morning followed by selling pressure as the day wears on. That's my prediction for Monday.

See you this weekend when I post the Tracker charts.