12/09/25

We had a modest pullback on Monday, heading into the 2-day Fed meeting, which starts today. A pop in yields yesterday put some pressure on stocks, but Friday's negative reversal day set the tone that we could see some bearish follow through yesterday. The S&P 500 had been up 9 of the prior 10 trading days, so we'll see how long it takes the bulls to buy the dip.

History suggests that as we head into into the middle of December, we could see a lull before an end of year rally. Of course that is not always how it works and we're more likely the get thrown a curveball by the market than to see things play out exactly the way our chart and indicators suggest, but on average this is what December looks like, and December 8th has been the start of that lull.

Source: sentimentrader.com

A Fed FOMC meeting could throw a wrench into any typical action, but it's always something. We know the Fed is most likely going to cut the Fed Funds rate tomorrow (87% probability), after a few weeks where that was not looking likely. The stock market rallied when the odds of a cut went back up in November, and the S&P was up 9 of 10 trading days before yesterday, but there is still some concerns that this will be a -- phrase of the day -- "hawkish cut", similar to the October rate cut.

On that day the S&P 500 (C-fund) peaked and the more hawkish outlook, despite the cut, led to a sharp pullback. So buyers may get an opportunity in the coming days to do some stock picking as 2-3 day pullback are likely good opportunities, but again, if the Fed gets too hawkish, the entire outlook could shift. Are you comfortable now?

Kevin Hassett, the National Economic Council Director, is the current favorite to be the next Fed Chair, and he is a Trump ally who shares Trump's views on moving interest rates lower. On CNBC yesterday Rick Reider, who was / is also in the running to be the next Chair of the Federal Reserve, said he believes rates should be coming down closer to 3% -- the Fed Funds Rate is currently 3.75% - 4.0% -- but he hinted that the current Board of Governors is not exactly enamored with Trump, and they may not be as dovish as many are expecting.

That may be what yesterday's market was telling us because, while we are expecting a cut, there is a small chance that they won't, or several members may dissent from the decision to cut leaving hawkish question marks for the future action.

Yields spiked yesterday, and they can go up many reasons, but we did notice the inverted head and shoulders pattern and thought that this was a possibility. Was this a move from investors concerned about the Fed not cutting this week, because yields would not be going up if there was a lot of concern about the labor market, which has been showing signs of weakness, although the data hasn't been very clear and because of the shutdown, the data has been very limited, and we don't get the next monthly report until the 16th, well after this week's Fed meeting.

The chart could have some resistance near 4.2% after closing at 4.17% yesterday.

My thinking is dips can be bought because the set up is there for reasons I have posted in recent commentaries, but with so much riding on what the Fed does this week, I don't have a good feel for how much of a pullback we might get, if at all, if they do disappoint - either by not cutting, or cutting but delivering a hawkish message like in October.

The DWCPF Index (S-Fund) followed up Friday negative reversal day with a pullback. Nothing too serious yet, but there is a chance it could try to retest the 50-day average while forming a right shoulder, and a hawkish outlook from the Fed could trigger something like that. Otherwise, we could be seeing a test of the recent highs if the headlines don't get in the way.

ACWX (I-fund) was down but remains in that F-flag formation. Again, these can be bullish for a while before breaking down, but unfortunately they do tend to eventually break down. That is unless the triple top can get taken out and the old resistance line turns into support. The Fed has that kind of power, especially if they move the dollar down in any meaningful way with their actions.

BND (bonds / F-fund) fell below the bottom of that support line, but the 50-day average held and it reversed up to close off the lows. This looks like it wants to go lower, as head and shoulders patterns tend to do, but it may all depend on the Fed. Is this telling us the Fed is going to be more hawkish by breaking down, or is this a fake out to get bond investors leaning the wrong way?

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

We had a modest pullback on Monday, heading into the 2-day Fed meeting, which starts today. A pop in yields yesterday put some pressure on stocks, but Friday's negative reversal day set the tone that we could see some bearish follow through yesterday. The S&P 500 had been up 9 of the prior 10 trading days, so we'll see how long it takes the bulls to buy the dip.

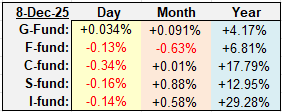

| Daily TSP Funds Return More returns |

History suggests that as we head into into the middle of December, we could see a lull before an end of year rally. Of course that is not always how it works and we're more likely the get thrown a curveball by the market than to see things play out exactly the way our chart and indicators suggest, but on average this is what December looks like, and December 8th has been the start of that lull.

Source: sentimentrader.com

A Fed FOMC meeting could throw a wrench into any typical action, but it's always something. We know the Fed is most likely going to cut the Fed Funds rate tomorrow (87% probability), after a few weeks where that was not looking likely. The stock market rallied when the odds of a cut went back up in November, and the S&P was up 9 of 10 trading days before yesterday, but there is still some concerns that this will be a -- phrase of the day -- "hawkish cut", similar to the October rate cut.

On that day the S&P 500 (C-fund) peaked and the more hawkish outlook, despite the cut, led to a sharp pullback. So buyers may get an opportunity in the coming days to do some stock picking as 2-3 day pullback are likely good opportunities, but again, if the Fed gets too hawkish, the entire outlook could shift. Are you comfortable now?

Kevin Hassett, the National Economic Council Director, is the current favorite to be the next Fed Chair, and he is a Trump ally who shares Trump's views on moving interest rates lower. On CNBC yesterday Rick Reider, who was / is also in the running to be the next Chair of the Federal Reserve, said he believes rates should be coming down closer to 3% -- the Fed Funds Rate is currently 3.75% - 4.0% -- but he hinted that the current Board of Governors is not exactly enamored with Trump, and they may not be as dovish as many are expecting.

That may be what yesterday's market was telling us because, while we are expecting a cut, there is a small chance that they won't, or several members may dissent from the decision to cut leaving hawkish question marks for the future action.

Yields spiked yesterday, and they can go up many reasons, but we did notice the inverted head and shoulders pattern and thought that this was a possibility. Was this a move from investors concerned about the Fed not cutting this week, because yields would not be going up if there was a lot of concern about the labor market, which has been showing signs of weakness, although the data hasn't been very clear and because of the shutdown, the data has been very limited, and we don't get the next monthly report until the 16th, well after this week's Fed meeting.

The chart could have some resistance near 4.2% after closing at 4.17% yesterday.

My thinking is dips can be bought because the set up is there for reasons I have posted in recent commentaries, but with so much riding on what the Fed does this week, I don't have a good feel for how much of a pullback we might get, if at all, if they do disappoint - either by not cutting, or cutting but delivering a hawkish message like in October.

The DWCPF Index (S-Fund) followed up Friday negative reversal day with a pullback. Nothing too serious yet, but there is a chance it could try to retest the 50-day average while forming a right shoulder, and a hawkish outlook from the Fed could trigger something like that. Otherwise, we could be seeing a test of the recent highs if the headlines don't get in the way.

ACWX (I-fund) was down but remains in that F-flag formation. Again, these can be bullish for a while before breaking down, but unfortunately they do tend to eventually break down. That is unless the triple top can get taken out and the old resistance line turns into support. The Fed has that kind of power, especially if they move the dollar down in any meaningful way with their actions.

BND (bonds / F-fund) fell below the bottom of that support line, but the 50-day average held and it reversed up to close off the lows. This looks like it wants to go lower, as head and shoulders patterns tend to do, but it may all depend on the Fed. Is this telling us the Fed is going to be more hawkish by breaking down, or is this a fake out to get bond investors leaning the wrong way?

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.