12/10/25

Stocks were mixed yesterday in front of today's FOMC meeting and decision on interest rates. JP Morgan dragged down the Dow, but otherwise the indices were rather flat. Yields and the dollar were up again yesterday. Small caps led as the Russell 2000 made a new all time high, and the I-fund was down commensurate with the S&P 500 loss.

JP Morgan gave the market some concern in front of today's FOMC meeting, and it was responsible most of the loss in the Dow yesterday. Otherwise, market breadth was actually positive yesterday, especially in the Nasdaq, thanks to tech stocks and small caps doing relatively well.

The 10-year Treasury Yield was up again, but it didn't quite reach Monday's high, so it felt like another stall below the 200-day average. Heading into today's Fed decision on rates, this could either be a tell, or a head fake. It looks like rates want to go higher, meanwhile the market is anticipating a 90% chance of an interest rate cut from the Fed today.

The dollar was up as it continues its bounce off the 50-day average, but yesterday's high filled in a gap from December 3, and that could pose some resistance after the recent breakdown below support (red line.)

Many analysts are concerned that an interest rate cut is not needed and could actually be a bad idea with inflation still running on the warm side. I don't know enough to make a call about whether or not the economy needs a rate cut, but looking back, the current CPI is trading near the high end of the inflation rate range from 2009 up until COVID stimulus hit the market, and yet interest rates are still higher now than any time from 2009 to COVID, when inflation was at this level. And, before 2018, the Fed Funds rate was below 1.0% the entire time, so moving from 3.75% - 4.00% to 3.50% - 3.75% doesn't seem like it would cause much trouble. If it does, they could just hike again, right?

The S&P 500 (C-fund) was down slightly yesterday but it is still within about 1% of an all-time high. It is somewhat rare for the Fed to be cutting rates with the S&P 500 near an all time high, but it isn't unprecedented. This looks like a possible right shoulder of an inverted H&S pattern, but there's no telling how big or small that shoulder might end up.

The Russell 2000 poked its head up to just barely make a new all time high for the small caps. The Russell is not our S-fund, but all stocks in the Russell are in the S-fund. There are other midcaps in there as well, and midcaps have been lagging the small caps recently.

Longer-term, this small caps chart looks to be on the brink of something big, despite being at the top of a long range. It's a good looking cup and handle formation which generally breakout to the upside eventually, and the eventual target of a breakout from a C&H this size would be over 300.

So the Fed is likely cutting rates today, but any kind of hawkish statement about future cuts could sink the market. On the other hand, any dovish commentary about the prospects of lower rates ahead could start the Santa Claus rally early this year.

My biggest concern is the strained relationship between President Trump and soon to be ex Fed Chair Jerome Powell, and the rest of the Federal reserve Governors, and how that relationship might influence their decision and policy statement today. The Federal Reserve is supposed to be apolitical, but that's probably easier said than done considering Trump's poking over the years.

The decision on rates will be announced at 2PM ET today, with a press conference with Powell afterward.

The DWCPF Index (S-Fund) was down for a third straight day yesterday, but that was on the heals of a massive rally off the November lows, so it seems reasonable to see some digestion leading up to today's Fed meeting. It actually looks like there's plenty of room on the downside if the digestion wants to play out enough to fill in a full right shoulder. That doesn't have to happen before a breakout, but it's certainly a possibility.

ACWX (I-fund) was down slightly yesterday as the dollar continues to creep higher, but as I mentioned above, the UUP chart may have hit some resistance yesterday, so we'll see if the strong dollar headwind can reverse course. The F-flag is intact and the prior top is still holding as resistance.

BND (bonds / F-fund) fell again and it continues to test the 50-day average after falling through the red support line on Monday. This could be a pre-Fed fake out. If the Fed gives us a dovish opinion, this could move right back up. Otherwise, the breakdown will be for real.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.

Stocks were mixed yesterday in front of today's FOMC meeting and decision on interest rates. JP Morgan dragged down the Dow, but otherwise the indices were rather flat. Yields and the dollar were up again yesterday. Small caps led as the Russell 2000 made a new all time high, and the I-fund was down commensurate with the S&P 500 loss.

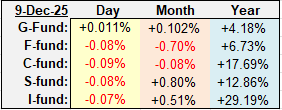

| Daily TSP Funds Return More returns |

JP Morgan gave the market some concern in front of today's FOMC meeting, and it was responsible most of the loss in the Dow yesterday. Otherwise, market breadth was actually positive yesterday, especially in the Nasdaq, thanks to tech stocks and small caps doing relatively well.

The 10-year Treasury Yield was up again, but it didn't quite reach Monday's high, so it felt like another stall below the 200-day average. Heading into today's Fed decision on rates, this could either be a tell, or a head fake. It looks like rates want to go higher, meanwhile the market is anticipating a 90% chance of an interest rate cut from the Fed today.

The dollar was up as it continues its bounce off the 50-day average, but yesterday's high filled in a gap from December 3, and that could pose some resistance after the recent breakdown below support (red line.)

Many analysts are concerned that an interest rate cut is not needed and could actually be a bad idea with inflation still running on the warm side. I don't know enough to make a call about whether or not the economy needs a rate cut, but looking back, the current CPI is trading near the high end of the inflation rate range from 2009 up until COVID stimulus hit the market, and yet interest rates are still higher now than any time from 2009 to COVID, when inflation was at this level. And, before 2018, the Fed Funds rate was below 1.0% the entire time, so moving from 3.75% - 4.00% to 3.50% - 3.75% doesn't seem like it would cause much trouble. If it does, they could just hike again, right?

The S&P 500 (C-fund) was down slightly yesterday but it is still within about 1% of an all-time high. It is somewhat rare for the Fed to be cutting rates with the S&P 500 near an all time high, but it isn't unprecedented. This looks like a possible right shoulder of an inverted H&S pattern, but there's no telling how big or small that shoulder might end up.

The Russell 2000 poked its head up to just barely make a new all time high for the small caps. The Russell is not our S-fund, but all stocks in the Russell are in the S-fund. There are other midcaps in there as well, and midcaps have been lagging the small caps recently.

Longer-term, this small caps chart looks to be on the brink of something big, despite being at the top of a long range. It's a good looking cup and handle formation which generally breakout to the upside eventually, and the eventual target of a breakout from a C&H this size would be over 300.

So the Fed is likely cutting rates today, but any kind of hawkish statement about future cuts could sink the market. On the other hand, any dovish commentary about the prospects of lower rates ahead could start the Santa Claus rally early this year.

My biggest concern is the strained relationship between President Trump and soon to be ex Fed Chair Jerome Powell, and the rest of the Federal reserve Governors, and how that relationship might influence their decision and policy statement today. The Federal Reserve is supposed to be apolitical, but that's probably easier said than done considering Trump's poking over the years.

The decision on rates will be announced at 2PM ET today, with a press conference with Powell afterward.

The DWCPF Index (S-Fund) was down for a third straight day yesterday, but that was on the heals of a massive rally off the November lows, so it seems reasonable to see some digestion leading up to today's Fed meeting. It actually looks like there's plenty of room on the downside if the digestion wants to play out enough to fill in a full right shoulder. That doesn't have to happen before a breakout, but it's certainly a possibility.

ACWX (I-fund) was down slightly yesterday as the dollar continues to creep higher, but as I mentioned above, the UUP chart may have hit some resistance yesterday, so we'll see if the strong dollar headwind can reverse course. The F-flag is intact and the prior top is still holding as resistance.

BND (bonds / F-fund) fell again and it continues to test the 50-day average after falling through the red support line on Monday. This could be a pre-Fed fake out. If the Fed gives us a dovish opinion, this could move right back up. Otherwise, the breakdown will be for real.

Thanks so much for reading! We'll see you back here tomorrow.

Tom Crowley

Read more in today's TSP Talk Plus Report. We post more charts, indicators and analysis, plus discuss the allocations of the TSP and ETF Systems. For more information on how to gain access and a list of the benefits of being a subscriber, please go to: www.tsptalk.com/plus.php

Questions, comments, or issues with today's commentary? We can discuss it in the Forum.

Daily Market Commentary Archives

For more info our other premium services, please go here... www.tsptalk.com/premiums.php

To get weekly or daily notifications when we post new commentary, sign up HERE.

Posted daily at www.tsptalk.com/comments.php

The legal stuff: This information is for educational purposes only! This is not advice or a recommendation. We do not give investment advice. Do not act on this data. Do not buy, sell or trade the funds mentioned herein based on this information. We may trade these funds differently than discussed above. We use additional methods and strategies to determine fund positions.