MrJohnRoss

Market Veteran

- Reaction score

- 58

Using Fibonacci retracement levels, this market up-move reversal has reached the 50% level. It may be done here, or if it stops at the 61.8% level, it would put the S&P up-move ending around 1424 before heading back down.

This would also suggest a total down move (1.38, 1.5 or 1.618%) to one of these levels on the S&P: 1294, 1278, or 1262.

It will be interesting to see if this starts to play out this week.

Good luck!

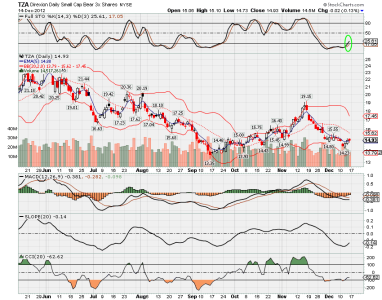

So, was 1424 the top of the rally? If so, Fibonacci was spot on again. From the graph below, looks like the top hit 1423.74. Not too shabby.

It certainly appears that the Stocahstics oscillator is beginning to roll over and head back down. The faster %K line has crossed the slower %D line. Once it crosses the 80 line, you'll likely see an acceleration of selling.

Now is not the time to be buying into this market, in my opinion. I may have missed this rally, but I have a feeling it may go up in smoke before too long.

Sounds like the republicrats can't figure out how to come to an agreement, so the fiscal cliff looks more and more likely. All bets are off if we suddenly get news from Washington that a deal has been reached, but I'm certainly not counting on it. If that were the case, my guess is we would see an immediate rally lasting a day or two, until the smoke clears. From there, it could be time for a mini Santa Clause rally.

Good luck!