MrJohnRoss

Market Veteran

- Reaction score

- 58

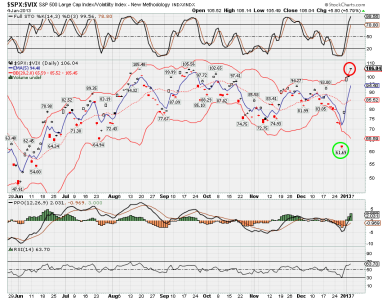

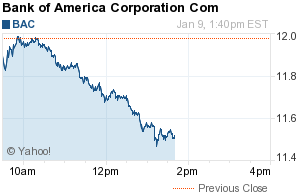

Well there's a surprise.... not. My timing system moved back to a buy position. Momentum is too strong to stay away. I'll be going back into equities before the IFT deadline tomorrow morning. Will do my analysis tonight to see which fund has the best momentum, and will jump back in. Tough to miss out on today's action, but I need to follow my system through thick and thin. I fell off the wagon a few times this last year, and it cost me. +11.48 on the Auto Tracker in 2012 is good, but I would have done a lot better had I followed every move my system produced. Lesson learned.