MrJohnRoss

Market Veteran

- Reaction score

- 58

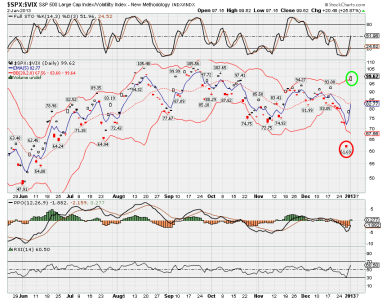

maybe didn't want to hold over the weekend is my guess. a lot can happen over the weekend in especially a news-driven market

Possibly. But I think his system is based on technicals, which is why I'm surprised.