-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

MrJohnRoss' Account Talk

- Thread starter MrJohnRoss

- Start date

MrJohnRoss

Market Veteran

- Reaction score

- 58

Hahaha! Was just thinking about some of my market positions, when I thought... "Hope is not a strategy". Then I realized where that idea came from.

Well done John, well done.

Well done John, well done.

MrJohnRoss

Market Veteran

- Reaction score

- 58

Moved to the lilly pad, just in case this turns out to be the start of a normal ~10% correction.

MrJohnRoss

Market Veteran

- Reaction score

- 58

Mysterious Algorithm Was 4% of Trading Activity Last Week

"The ultimate goal of many of these programs is to gum up the system so it slows down the quote feed to others and allows the computer traders (with their co-located servers at the exchanges) to gain a money-making arbitrage opportunity."

In other words... screw the little man.

I would outlaw HFT if I were in charge.

"The ultimate goal of many of these programs is to gum up the system so it slows down the quote feed to others and allows the computer traders (with their co-located servers at the exchanges) to gain a money-making arbitrage opportunity."

In other words... screw the little man.

I would outlaw HFT if I were in charge.

wavecoder

TSP Pro

- Reaction score

- 24

Moved to the lilly pad, just in case this turns out to be the start of a normal ~10% correction.

or it might be another 10 day sideways trend, lol

MrJohnRoss

Market Veteran

- Reaction score

- 58

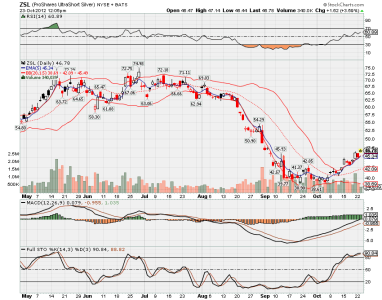

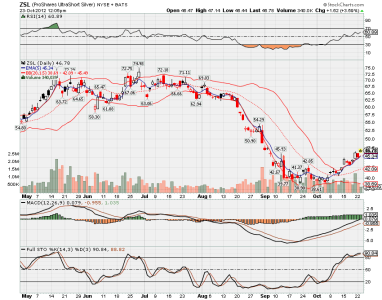

There's money to be made in precious metals, even when they go down in price. You do have to be careful, because precious metals prices are so volatile. With high risk comes high reward.

Here's a chart of ZSL, which is a 200% inverse silver ETF. With the price of silver (and gold) down quite a bit in the last week, you can see how paying attention to this trade could have paid off.

The question is, taking a look at the below chart, would you be a buyer of ZSL at the current price?

Personally, I think ZSL has further upside to go, but we could see a pullback as early as tomorrow, since we may have an overbought (+4.65%) condition today.

Good luck!

Here's a chart of ZSL, which is a 200% inverse silver ETF. With the price of silver (and gold) down quite a bit in the last week, you can see how paying attention to this trade could have paid off.

The question is, taking a look at the below chart, would you be a buyer of ZSL at the current price?

Personally, I think ZSL has further upside to go, but we could see a pullback as early as tomorrow, since we may have an overbought (+4.65%) condition today.

Good luck!

wavecoder

TSP Pro

- Reaction score

- 24

I'm not sure if I'd buy it at its current price, generally once the stochastics reading goes into overbought territory, i start waiting for a short opportunity, or pullback for next buy opp. looking at the chart, the best time to buy would have been early october (just looking at bullish stochastic cross + positive macd divergence, if you use those to initiate buy signals)

of course that's just my opinion, but it does look like there's more upside to chase on this one, just I personally wouldn't do that (of course our trading strategies might be different)

of course that's just my opinion, but it does look like there's more upside to chase on this one, just I personally wouldn't do that (of course our trading strategies might be different)

MrJohnRoss

Market Veteran

- Reaction score

- 58

Agreed, Sniper. I had been watching this ETF for a couple of days, but didn't act on it. I think it may be too late.

Longer term, I believe precious metals will go higher than Felix Baumgartner. This would have just been a bet on a short term pullback in precious metals, which may have run it's course.

Longer term, I believe precious metals will go higher than Felix Baumgartner. This would have just been a bet on a short term pullback in precious metals, which may have run it's course.

MrJohnRoss

Market Veteran

- Reaction score

- 58

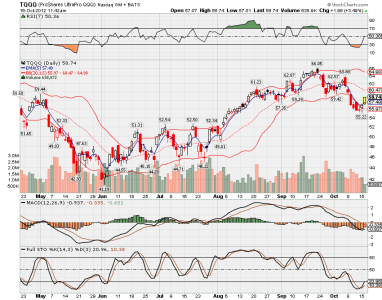

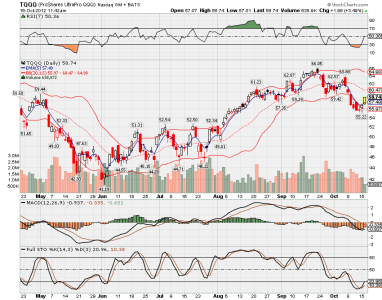

Surprised to see this much market strength today. I like AAPL at this point, as we are seeing at least a short term bounce. In order to take maximum advantage of the strength in AAPL, and the market in general, I bought a 1/2 position in TQQQ, which is a triple upside Nasdaq QQQ play. I know the market likes to make as many people as possible lose money, but this should give me enough exposure to make some money without going all in. If the market strength continues over the next few days, I may increase my positions, and head back into equities in the TSP.

Good luck!

Good luck!

MrJohnRoss

Market Veteran

- Reaction score

- 58

Interesting article tying the Presidential debate to your investments:

Jim Cramer Says Sell Coal Stocks Before Tonight's Debate

Apparently, he is expecting a strong performance from BHO, uh oh.

Jim Cramer Says Sell Coal Stocks Before Tonight's Debate

Apparently, he is expecting a strong performance from BHO, uh oh.

wavecoder

TSP Pro

- Reaction score

- 24

Interesting article tying the Presidential debate to your investments:

Jim Cramer Says Sell Coal Stocks Before Tonight's Debate

Apparently, he is expecting a strong performance from BHO, uh oh.

It's possible, I expect this debate to be a little more even than last time. He's had 2 weeks to prepare for this one, and knows more what to expect from his challenger this time around. Not trying to discuss politics, but it's a likely scenario that the president will be more ready than last time

MrJohnRoss

Market Veteran

- Reaction score

- 58

Sold my 1/2 position in TQQQ early this morning for a loss of 4.9%. Sometimes black swans fly in (aka Google) and mess up the best laid plans. That puts me back in a 100% cash position in all my accounts. I'll be studying the charts carefully this weekend to determine if it is time to bet on the upside. My guess is that there isn't evidence yet to bet on a turn around. The market closed very near the bottom for the day, so that does not bode well. Monday will be interesting, indeed.

In the meantime, I continue to work on different timing systems, and studying pattern combinations.

Here's a shot of one of the more promising ones:

[TABLE="width: 636"]

[TR]

[TD][/TD]

[TD]2012

[/TD]

[TD][/TD]

[TD][/TD]

[TD][/TD]

[TD][/TD]

[TD]Holding

[/TD]

[TD][/TD]

[TD][/TD]

[TD]Model

[/TD]

[/TR]

[TR]

[TD][/TD]

[TD][/TD]

[TD][/TD]

[TD][/TD]

[TD]BUY

[/TD]

[TD]SELL

[/TD]

[TD]% Gain

[/TD]

[TD]DAYS

[/TD]

[TD]$ 10,000.00

[/TD]

[TD]% Gain

[/TD]

[/TR]

[TR]

[TD="align: right"]1

[/TD]

[TD="align: right"]12/30/2011

[/TD]

[TD="align: right"]2/10/2012

[/TD]

[TD]TNA

[/TD]

[TD]44.88

[/TD]

[TD]59.17

[/TD]

[TD]31.8%

[/TD]

[TD]28

[/TD]

[TD]$ 13,184.05

[/TD]

[TD]31.8%

[/TD]

[/TR]

[TR]

[TD="align: right"]2

[/TD]

[TD="align: right"]2/10/2012

[/TD]

[TD="align: right"]3/8/2012

[/TD]

[TD]TZA

[/TD]

[TD]19.5

[/TD]

[TD]19.68

[/TD]

[TD]0.9%

[/TD]

[TD]18

[/TD]

[TD]$ 13,305.75

[/TD]

[TD]33.1%

[/TD]

[/TR]

[TR]

[TD="align: right"]3

[/TD]

[TD="align: right"]3/8/2012

[/TD]

[TD="align: right"]3/28/2012

[/TD]

[TD]TNA

[/TD]

[TD]57.15

[/TD]

[TD]63.58

[/TD]

[TD]11.3%

[/TD]

[TD]14

[/TD]

[TD]$ 14,802.79

[/TD]

[TD]48.0%

[/TD]

[/TR]

[TR]

[TD="align: right"]4

[/TD]

[TD="align: right"]3/28/2012

[/TD]

[TD="align: right"]4/12/2012

[/TD]

[TD]TZA

[/TD]

[TD]17.38

[/TD]

[TD]18.95

[/TD]

[TD]9.0%

[/TD]

[TD]10

[/TD]

[TD]$ 16,139.98

[/TD]

[TD]61.4%

[/TD]

[/TR]

[TR]

[TD="align: right"]5

[/TD]

[TD="align: right"]4/12/2012

[/TD]

[TD="align: right"]5/3/2012

[/TD]

[TD]TNA

[/TD]

[TD]54.72

[/TD]

[TD]56.77

[/TD]

[TD]3.7%

[/TD]

[TD]15

[/TD]

[TD]$ 16,744.64

[/TD]

[TD]67.4%

[/TD]

[/TR]

[TR]

[TD="align: right"]6

[/TD]

[TD="align: right"]5/3/2012

[/TD]

[TD="align: right"]5/21/2012

[/TD]

[TD]TZA

[/TD]

[TD]18.71

[/TD]

[TD]21.71

[/TD]

[TD]16.0%

[/TD]

[TD]12

[/TD]

[TD]$ 19,429.51

[/TD]

[TD]94.3%

[/TD]

[/TR]

[TR]

[TD="align: right"]7

[/TD]

[TD="align: right"]5/21/2012

[/TD]

[TD="align: right"]6/21/2012

[/TD]

[TD]TNA

[/TD]

[TD]48.08

[/TD]

[TD]47.67

[/TD]

[TD]-0.9%

[/TD]

[TD]22

[/TD]

[TD]$ 19,263.82

[/TD]

[TD]92.6%

[/TD]

[/TR]

[TR]

[TD="align: right"]8

[/TD]

[TD="align: right"]6/21/2012

[/TD]

[TD="align: right"]7/26/2012

[/TD]

[TD]TZA

[/TD]

[TD]20.82

[/TD]

[TD]19.4

[/TD]

[TD]-6.8%

[/TD]

[TD]24

[/TD]

[TD]$ 17,949.96

[/TD]

[TD]79.5%

[/TD]

[/TR]

[TR]

[TD="align: right"]9

[/TD]

[TD="align: right"]7/26/2012

[/TD]

[TD="align: right"]8/22/2012

[/TD]

[TD]TNA

[/TD]

[TD]49.37

[/TD]

[TD]56.22

[/TD]

[TD]13.9%

[/TD]

[TD]19

[/TD]

[TD]$ 20,440.48

[/TD]

[TD]104.4%

[/TD]

[/TR]

[TR]

[TD="align: right"]10

[/TD]

[TD="align: right"]8/22/2012

[/TD]

[TD="align: right"]9/4/2012

[/TD]

[TD]TZA

[/TD]

[TD]16.64

[/TD]

[TD]15.94

[/TD]

[TD]-4.2%

[/TD]

[TD]8

[/TD]

[TD]$ 19,580.61

[/TD]

[TD]95.8%

[/TD]

[/TR]

[TR]

[TD="align: right"]11

[/TD]

[TD="align: right"]9/4/2012

[/TD]

[TD="align: right"]9/19/2012

[/TD]

[TD]TNA

[/TD]

[TD]62.15

[/TD]

[TD]65.71

[/TD]

[TD]5.7%

[/TD]

[TD]11

[/TD]

[TD]$ 20,702.20

[/TD]

[TD]107.0%

[/TD]

[/TR]

[TR]

[TD="align: right"]12

[/TD]

[TD="align: right"]9/19/2012

[/TD]

[TD="align: right"]10/11/2012

[/TD]

[TD]TZA

[/TD]

[TD]13.99

[/TD]

[TD]15.2

[/TD]

[TD]8.6%

[/TD]

[TD]16

[/TD]

[TD]$ 22,492.74

[/TD]

[TD]124.9%

[/TD]

[/TR]

[/TABLE]

This is a TON of work, but has to be checked by hand, year by year, day by day.

Even though only 75% of the trades were winners (9/12), the YTD return of 124.9% is nothing to sneeze at.

Hope to continue my testing and get something implemented in the near future.

Good luck everyone!

In the meantime, I continue to work on different timing systems, and studying pattern combinations.

Here's a shot of one of the more promising ones:

[TABLE="width: 636"]

[TR]

[TD][/TD]

[TD]2012

[/TD]

[TD][/TD]

[TD][/TD]

[TD][/TD]

[TD][/TD]

[TD]Holding

[/TD]

[TD][/TD]

[TD][/TD]

[TD]Model

[/TD]

[/TR]

[TR]

[TD][/TD]

[TD][/TD]

[TD][/TD]

[TD][/TD]

[TD]BUY

[/TD]

[TD]SELL

[/TD]

[TD]% Gain

[/TD]

[TD]DAYS

[/TD]

[TD]$ 10,000.00

[/TD]

[TD]% Gain

[/TD]

[/TR]

[TR]

[TD="align: right"]1

[/TD]

[TD="align: right"]12/30/2011

[/TD]

[TD="align: right"]2/10/2012

[/TD]

[TD]TNA

[/TD]

[TD]44.88

[/TD]

[TD]59.17

[/TD]

[TD]31.8%

[/TD]

[TD]28

[/TD]

[TD]$ 13,184.05

[/TD]

[TD]31.8%

[/TD]

[/TR]

[TR]

[TD="align: right"]2

[/TD]

[TD="align: right"]2/10/2012

[/TD]

[TD="align: right"]3/8/2012

[/TD]

[TD]TZA

[/TD]

[TD]19.5

[/TD]

[TD]19.68

[/TD]

[TD]0.9%

[/TD]

[TD]18

[/TD]

[TD]$ 13,305.75

[/TD]

[TD]33.1%

[/TD]

[/TR]

[TR]

[TD="align: right"]3

[/TD]

[TD="align: right"]3/8/2012

[/TD]

[TD="align: right"]3/28/2012

[/TD]

[TD]TNA

[/TD]

[TD]57.15

[/TD]

[TD]63.58

[/TD]

[TD]11.3%

[/TD]

[TD]14

[/TD]

[TD]$ 14,802.79

[/TD]

[TD]48.0%

[/TD]

[/TR]

[TR]

[TD="align: right"]4

[/TD]

[TD="align: right"]3/28/2012

[/TD]

[TD="align: right"]4/12/2012

[/TD]

[TD]TZA

[/TD]

[TD]17.38

[/TD]

[TD]18.95

[/TD]

[TD]9.0%

[/TD]

[TD]10

[/TD]

[TD]$ 16,139.98

[/TD]

[TD]61.4%

[/TD]

[/TR]

[TR]

[TD="align: right"]5

[/TD]

[TD="align: right"]4/12/2012

[/TD]

[TD="align: right"]5/3/2012

[/TD]

[TD]TNA

[/TD]

[TD]54.72

[/TD]

[TD]56.77

[/TD]

[TD]3.7%

[/TD]

[TD]15

[/TD]

[TD]$ 16,744.64

[/TD]

[TD]67.4%

[/TD]

[/TR]

[TR]

[TD="align: right"]6

[/TD]

[TD="align: right"]5/3/2012

[/TD]

[TD="align: right"]5/21/2012

[/TD]

[TD]TZA

[/TD]

[TD]18.71

[/TD]

[TD]21.71

[/TD]

[TD]16.0%

[/TD]

[TD]12

[/TD]

[TD]$ 19,429.51

[/TD]

[TD]94.3%

[/TD]

[/TR]

[TR]

[TD="align: right"]7

[/TD]

[TD="align: right"]5/21/2012

[/TD]

[TD="align: right"]6/21/2012

[/TD]

[TD]TNA

[/TD]

[TD]48.08

[/TD]

[TD]47.67

[/TD]

[TD]-0.9%

[/TD]

[TD]22

[/TD]

[TD]$ 19,263.82

[/TD]

[TD]92.6%

[/TD]

[/TR]

[TR]

[TD="align: right"]8

[/TD]

[TD="align: right"]6/21/2012

[/TD]

[TD="align: right"]7/26/2012

[/TD]

[TD]TZA

[/TD]

[TD]20.82

[/TD]

[TD]19.4

[/TD]

[TD]-6.8%

[/TD]

[TD]24

[/TD]

[TD]$ 17,949.96

[/TD]

[TD]79.5%

[/TD]

[/TR]

[TR]

[TD="align: right"]9

[/TD]

[TD="align: right"]7/26/2012

[/TD]

[TD="align: right"]8/22/2012

[/TD]

[TD]TNA

[/TD]

[TD]49.37

[/TD]

[TD]56.22

[/TD]

[TD]13.9%

[/TD]

[TD]19

[/TD]

[TD]$ 20,440.48

[/TD]

[TD]104.4%

[/TD]

[/TR]

[TR]

[TD="align: right"]10

[/TD]

[TD="align: right"]8/22/2012

[/TD]

[TD="align: right"]9/4/2012

[/TD]

[TD]TZA

[/TD]

[TD]16.64

[/TD]

[TD]15.94

[/TD]

[TD]-4.2%

[/TD]

[TD]8

[/TD]

[TD]$ 19,580.61

[/TD]

[TD]95.8%

[/TD]

[/TR]

[TR]

[TD="align: right"]11

[/TD]

[TD="align: right"]9/4/2012

[/TD]

[TD="align: right"]9/19/2012

[/TD]

[TD]TNA

[/TD]

[TD]62.15

[/TD]

[TD]65.71

[/TD]

[TD]5.7%

[/TD]

[TD]11

[/TD]

[TD]$ 20,702.20

[/TD]

[TD]107.0%

[/TD]

[/TR]

[TR]

[TD="align: right"]12

[/TD]

[TD="align: right"]9/19/2012

[/TD]

[TD="align: right"]10/11/2012

[/TD]

[TD]TZA

[/TD]

[TD]13.99

[/TD]

[TD]15.2

[/TD]

[TD]8.6%

[/TD]

[TD]16

[/TD]

[TD]$ 22,492.74

[/TD]

[TD]124.9%

[/TD]

[/TR]

[/TABLE]

This is a TON of work, but has to be checked by hand, year by year, day by day.

Even though only 75% of the trades were winners (9/12), the YTD return of 124.9% is nothing to sneeze at.

Hope to continue my testing and get something implemented in the near future.

Good luck everyone!

MrJohnRoss

Market Veteran

- Reaction score

- 58

We got the pullback in ZSL (inverse silver ETF), just as I anticipated in my previous post. Although I did not purchase a position in this trade, it appears that momentum is going very well for those that did.

Eventually, gold and silver will turn around and head higher. When they do, you will want to jump on board that train. I'll be watching ZSL and AGQ very carefully over the next few days and weeks.

Good luck!

Eventually, gold and silver will turn around and head higher. When they do, you will want to jump on board that train. I'll be watching ZSL and AGQ very carefully over the next few days and weeks.

Good luck!

MrJohnRoss

Market Veteran

- Reaction score

- 58

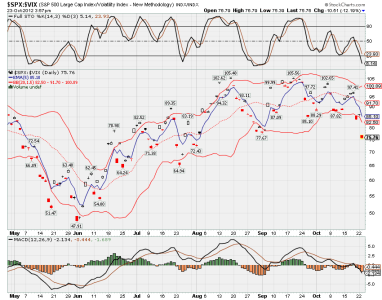

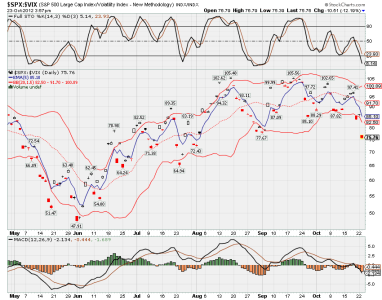

Very happy to be sitting in the G Fund these last few days. However, based on this next chart, I would be willing to bet that tomorrow will be an up day.

I'm not going to be making any trading decisions based on this, but any time that the price of $SPX divided by the price of $VIX goes THIS FAR below the BB, we almost always see a snap back rally.

We'll see what happens tomorrow.

Good luck!

I'm not going to be making any trading decisions based on this, but any time that the price of $SPX divided by the price of $VIX goes THIS FAR below the BB, we almost always see a snap back rally.

We'll see what happens tomorrow.

Good luck!

MrJohnRoss

Market Veteran

- Reaction score

- 58

My YTD TSP return according to the Autotracker is 12.40%. Not breaking any records, but I'm pleased so far with that stat.

Here's how the rest of the funds have performed so far this year:

[TABLE="width: 155"]

[TR]

[TD]C Fund

[/TD]

[TD]14.08%

[/TD]

[/TR]

[TR]

[TD]S Fund

[/TD]

[TD]13.17%

[/TD]

[/TR]

[TR]

[TD]I Fund

[/TD]

[TD]11.27%

[/TD]

[/TR]

[TR]

[TD]F Fund

[/TD]

[TD]3.98%

[/TD]

[/TR]

[TR]

[TD]G Fund

[/TD]

[TD]1.21%

[/TD]

[/TR]

[/TABLE]

By the way, the C Fund is down a little over 4% from it's high on Sep 14, with perhaps more downside to follow. Heck, it won't even be called a "Market Correction" until it's down at least 10%.

Now, imagine if those YTD stock and bond returns were all negative this year. It could happen! In which case, that +1.21% gain in the cash fund would look pretty good to most people.

Very thankful that we've had an up year, so we can capitalize on these market gains!

Good luck everyone!

Here's how the rest of the funds have performed so far this year:

[TABLE="width: 155"]

[TR]

[TD]C Fund

[/TD]

[TD]14.08%

[/TD]

[/TR]

[TR]

[TD]S Fund

[/TD]

[TD]13.17%

[/TD]

[/TR]

[TR]

[TD]I Fund

[/TD]

[TD]11.27%

[/TD]

[/TR]

[TR]

[TD]F Fund

[/TD]

[TD]3.98%

[/TD]

[/TR]

[TR]

[TD]G Fund

[/TD]

[TD]1.21%

[/TD]

[/TR]

[/TABLE]

By the way, the C Fund is down a little over 4% from it's high on Sep 14, with perhaps more downside to follow. Heck, it won't even be called a "Market Correction" until it's down at least 10%.

Now, imagine if those YTD stock and bond returns were all negative this year. It could happen! In which case, that +1.21% gain in the cash fund would look pretty good to most people.

Very thankful that we've had an up year, so we can capitalize on these market gains!

Good luck everyone!

MrJohnRoss

Market Veteran

- Reaction score

- 58

MrJohnRoss

Market Veteran

- Reaction score

- 58

With today's market strength, the charts say it's time to move back into equities. The I Fund has been outperforming the other stock funds since June, so I am putting 50% in I. The S Fund got a bit oversold relative to I, so I'm placing the other 50% in S. Hopefully with Sandy behind us, and the election uncertainty (hopefully) about to end, we can begin to look forward to a year end rally.

Similar threads

- Replies

- 0

- Views

- 87

- Replies

- 0

- Views

- 152

- Replies

- 0

- Views

- 166