MrBowl

TSP Pro

- Reaction score

- 47

- AutoTracker

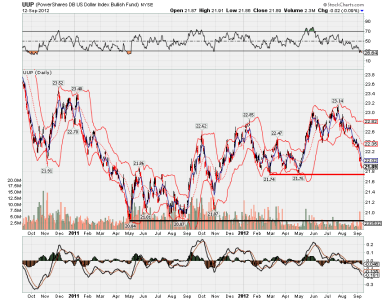

I moved to the G Fund because I felt that the German courts would throw a wet blanket on Draghi's party and that the Fed would only talk tough and not announce any action.

It seems like September being a traditionally bad month is pretty hit-and-miss. Also, the Fed usually does not like being political and has no desire to take actions that could affect an election, so I doubt they will act. But, this day and age, not doing anything could also be called influencing the election, so who knows... Anyway, if i'm right on those then the markets will likely tumble and September will end up as a down month. Any other outcome and I may just end up jumping back in on Thurs or Fri.

It seems like September being a traditionally bad month is pretty hit-and-miss. Also, the Fed usually does not like being political and has no desire to take actions that could affect an election, so I doubt they will act. But, this day and age, not doing anything could also be called influencing the election, so who knows... Anyway, if i'm right on those then the markets will likely tumble and September will end up as a down month. Any other outcome and I may just end up jumping back in on Thurs or Fri.