I'm liking what's going on with AAPL lately. After a run that brought the price to over $700 recently, AAPL is finally taking a well deserved rest.

For those of you who are experts with Fibonacci analysis, please pardon my inexperience, but here's what I think may play out in the coming weeks.

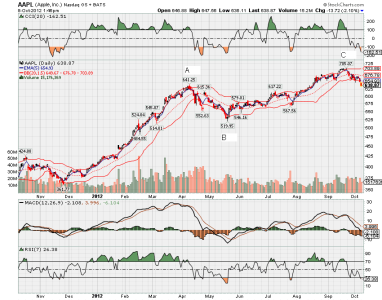

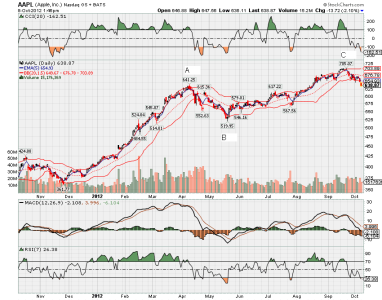

The chart above looks at AAPL over the past year. We had a nice run up from the $361 level up to $641 in early April (the point marked "A").

From there, AAPL took a well deserved rest, and fell all the way to the $519 level on May 18 (point "B"). That was a retracement of approx 0.81.

Two things to note here: Near high point "A", the MACD had a bearish crossover, and the 20 day EMA soon began heading lower.

At low point "B", the MACD soon crossed back up indicating a bullish formation, and the 20 day EMA (lagging indicator) gradually moved higher as well.

You can also see how the CCI, the RSI, and the Bollinger Bands behaved at these price extremes as well.

From that 5/18 low point until the high of $705 (point "C") on Sept 21, the stock gained a healthy 35%.

If the stock behaves going forward like it did this past year, here's what may play out...

A retracement of 0.81 from the high at point "C" would send the stock down to around $571.70.

I believe Fibonacci followers use a value of 0.786, which would put the stock a little lower... around $554.

I would look for the stock to bounce around a bit on it's way down, and perhaps find support near the $567 level, which appears to be a significant "line in the sand".

If we use the past time frame for future analysis, we could see this unfold by the end of October, around five and a half weeks from the peak on 9/21.

If the cycle repeats, buying in around the $567 level (watch for the MACD to bottom out and turn higher to confirm your long position), and riding the wave up another 35% would have you exit around $765. It might also be possible to catch a wave like we had from the $361 level in Nov 2011 to the $641 level set in Apr 2012. That wave provided a nice 77% gain, and would have you exit around $1,003. Markets love to pause at round numbers, and many analysts have said AAPL at $1,000 is only a matter of time.

In any event, I'll be watching what happens with the stock over the coming weeks, and if we get a good opportunity, I may hop on board.

Happy trading!