-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

MrJohnRoss' Account Talk

- Thread starter MrJohnRoss

- Start date

MrJohnRoss

Market Veteran

- Reaction score

- 58

DCA is a type of blind investing and that alone makes it interesting - it allows fate to rule.

Here's a white paper on Enhanced Dollar Cost Averaging. I haven't read it (yet), but might be worth investigating.

Good luck!

MrJohnRoss

Market Veteran

- Reaction score

- 58

MrJohnRoss

Market Veteran

- Reaction score

- 58

MrJohnRoss

Market Veteran

- Reaction score

- 58

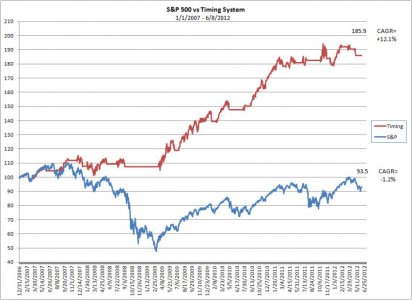

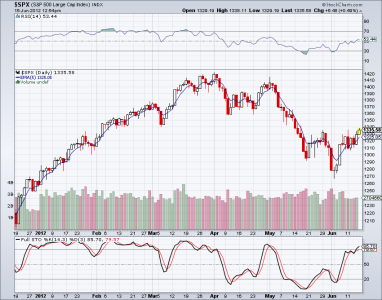

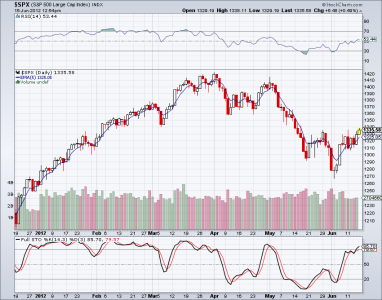

My Timing System has switched to a "Buy" signal. However, I am NOT moving back into equities at this time. I truly believe that this is a short term bounce up, and will be short lived. In my opinion, the European banking situation is just too big of a trap to think that the markets will skyrocket higher.

I'll remain in the relative safety of the F Fund for now, and am selling my short positions in my 401k account, and moving to cash. In the meantime, I'll be waiting for the market to roll back over, so I can purchase another short position.

Good luck to us!

I'll remain in the relative safety of the F Fund for now, and am selling my short positions in my 401k account, and moving to cash. In the meantime, I'll be waiting for the market to roll back over, so I can purchase another short position.

Good luck to us!

JamesE

TSP Strategist

- Reaction score

- 4

Did you see where Spain is asking for this little bailout to fortify their banks in a hedge against this weekends Greek elections? Oh man, if that doesn't go well, look out below....

On a side note, I had to bail today. There's almost nobody left in stocks in the top 50. I'm going to start following the folks up 15% or more, they obviously know something .

.

On a side note, I had to bail today. There's almost nobody left in stocks in the top 50. I'm going to start following the folks up 15% or more, they obviously know something

MrJohnRoss

Market Veteran

- Reaction score

- 58

Did you see where Spain is asking for this little bailout to fortify their banks in a hedge against this weekends Greek elections? Oh man, if that doesn't go well, look out below....

On a side note, I had to bail today. There's almost nobody left in stocks in the top 50. I'm going to start following the folks up 15% or more, they obviously know something.

Yeah, I like this headline: "Not long ago €100 billion, or $125B, would buy you a month or two of goodwill. But not anymore..."

MrJohnRoss

Market Veteran

- Reaction score

- 58

Since the market slowly died all day, then fell off a cliff at the end, I decided to hold my short positions in my 401k. With the market meltdown, SQQQ was up 4.99% today. If you're holding TZA, you made 6.37%. Wow! Another good day for the bears.

As I've stated time and again, you do not want to be long in this environment. Use market rallies to cut your equity exposure.

As I've stated time and again, you do not want to be long in this environment. Use market rallies to cut your equity exposure.

Khotso

Market Veteran

- Reaction score

- 27

Out of curiosity (I don't know much about shooting but am interested in learning), when did you take you short positions (when your system gave a sell signal?)? And how have those shorts fared over that period? Presuming of course you don't mind me asking.

MrJohnRoss

Market Veteran

- Reaction score

- 58

Out of curiosity (I don't know much about shooting but am interested in learning), when did you take you short positions (when your system gave a sell signal?)? And how have those shorts fared over that period? Presuming of course you don't mind me asking.

I'm using SQQQ, but there are a number of "inverse" ETF's you can purchase just like a stock that will go up in value when the market goes down. My sell signal was on 5/8. Here's how you would have done during that time with several popular ETF's:

RWM +4.7%

QID +7.3%

TWM +9.2%

SQQQ +10.7%

TZA +13.5%

FAZ +21.1%

Khotso

Market Veteran

- Reaction score

- 27

I'm using SQQQ, but there are a number of "inverse" ETF's you can purchase just like a stock that will go up in value when the market goes down. My sell signal was on 5/8. Here's how you would have done during that time with several popular ETF's:

RWM +4.7%

QID +7.3%

TWM +9.2%

SQQQ +10.7%

TZA +13.5%

FAZ +21.1%

Wow! Interesting. Thanks for the response JohnRoss. I imagine these inverse ETFs can backfire pretty quickly as well, true?

MrJohnRoss

Market Veteran

- Reaction score

- 58

Wow! Interesting. Thanks for the response JohnRoss. I imagine these inverse ETFs can backfire pretty quickly as well, true?

They're extremely volatile. Use with extreme caution. If you're betting on the downside, and the market goes up, you can lose a lot of money very quickly. I've seen 10% moves up and down in a single day in some of these ETF's.

RealMoneyIssues

TSP Legend

- Reaction score

- 101

They're extremely volatile. Use with extreme caution. If you're betting on the downside, and the market goes up, you can lose a lot of money very quickly. I've seen 10% moves up and down in a single day in some of these ETF's.

Volatile... uh, yup... One day last year I lost 15% in one day being on the wrong side of the market... Keep your sticky pants handy!!

Khotso

Market Veteran

- Reaction score

- 27

Volatile... uh, yup... One day last year I lost 15% in one day being on the wrong side of the market... Keep your sticky pants handy!!

Yikes! Thanks for sharing. I'll think long and hard -- and definitely learn a whole lot more before playing in that arena then.

MrJohnRoss

Market Veteran

- Reaction score

- 58

Facing a dilemma...

My technical indicators moved to a "Buy" signal on 6/6, and I've chosen to stay in cash due to the impending fallout from the European financial mess. Meanwhile, the market has consolidated over the last week, and now appears to be breaking to the upside. Using a mechanical timing system can be a wonderful thing, but if you think you can outsmart it because of external (fundamental) factors, you'll likely find yourself in a tricky position, which is where I am now.

If I stay in cash because it makes absolutely no sense at all that the markets are moving higher on fears of a European financial catastrophe, I might be sitting here for days/weeks/months while the markets climb 5-10-15%. Then what? Buy in at the top?? No, it's better to admit that you were wrong, and get back on track with your timing system, than to sit here for weeks, knowing you were wrong, regardless of the fundamental mess in Europe.

(That's why I like this forum... I can journal my mistakes in public. It's almost therapeutic.)

I've decided to close out my 25% short positions in my 401k (at a small loss), and will likely move to the C Fund on Monday (C Fund is currently outperforming the S Fund). I'll continue to hold my long positions in my 401k and Roth.

Good luck everyone!

My technical indicators moved to a "Buy" signal on 6/6, and I've chosen to stay in cash due to the impending fallout from the European financial mess. Meanwhile, the market has consolidated over the last week, and now appears to be breaking to the upside. Using a mechanical timing system can be a wonderful thing, but if you think you can outsmart it because of external (fundamental) factors, you'll likely find yourself in a tricky position, which is where I am now.

If I stay in cash because it makes absolutely no sense at all that the markets are moving higher on fears of a European financial catastrophe, I might be sitting here for days/weeks/months while the markets climb 5-10-15%. Then what? Buy in at the top?? No, it's better to admit that you were wrong, and get back on track with your timing system, than to sit here for weeks, knowing you were wrong, regardless of the fundamental mess in Europe.

(That's why I like this forum... I can journal my mistakes in public. It's almost therapeutic.)

I've decided to close out my 25% short positions in my 401k (at a small loss), and will likely move to the C Fund on Monday (C Fund is currently outperforming the S Fund). I'll continue to hold my long positions in my 401k and Roth.

Good luck everyone!

Boghie

Market Veteran

- Reaction score

- 363

MrJohnRoss,

There is no requirement to be 100% in or 100% out of the market. Like you, I don't see the excitement. It really feels as if da'Boyz are slowly moving out of equities. Whether because of Europe or the U.S. election or simply because they are setting up their summer vacation I do not know. What I am doing is reducing risk a bit, staying in a bit so I catch some potential returns, and saving one magic IFT bullet for a buy in opportunity...

There is no requirement to be 100% in or 100% out of the market. Like you, I don't see the excitement. It really feels as if da'Boyz are slowly moving out of equities. Whether because of Europe or the U.S. election or simply because they are setting up their summer vacation I do not know. What I am doing is reducing risk a bit, staying in a bit so I catch some potential returns, and saving one magic IFT bullet for a buy in opportunity...

MrJohnRoss

Market Veteran

- Reaction score

- 58

MrJohnRoss,

There is no requirement to be 100% in or 100% out of the market. Like you, I don't see the excitement. It really feels as if da'Boyz are slowly moving out of equities. Whether because of Europe or the U.S. election or simply because they are setting up their summer vacation I do not know. What I am doing is reducing risk a bit, staying in a bit so I catch some potential returns, and saving one magic IFT bullet for a buy in opportunity...

I hear ya, Boghie. I tend to be more aggressive, and like to go all in with my TSP moves. Learned the hard way not to go all in with triple leveraged ETF's in my 401k. One of these days I'll develop a system that will get me in at the very bottom, and get me out at the very top! Hahaha! :laugh: Until then, I'll use my trend following system, which has been pretty accurate.

MrJohnRoss

Market Veteran

- Reaction score

- 58

Don't forget that this is a quadruple witching options expiration week/day and the action can be a little strange. I think we'll get a better feel for what's going on next week. Good luck!

Agree. Not sure if the elections in Greece will change anything, but you never know how the market will react. If the market is down 200 points at the open on Monday on European market fears, I may hold off on that IFT...

As RMI says, only time will tell!

Similar threads

- Replies

- 0

- Views

- 82

- Replies

- 0

- Views

- 151

- Replies

- 0

- Views

- 166