MrJohnRoss

Market Veteran

- Reaction score

- 58

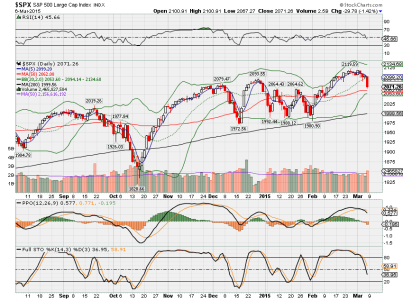

Updated 1 hour chart of the S&P 500:

View attachment 32662

Just catching up on the markets today, as I had a big project that lasted all day. Was pleasantly surprised to see how well the markets performed. S&P back up near an all time high, and the Nasdaq finally closed above 5,000, which bode well for TQQQ, which was up 2.70% today. Not bad. The MOSI turned back up today, but it's still skirting along the edge of the trigger line for a sell signal. The next day or two will be important to see if this rally will last a little bit longer, or if the cycle timing band has gotten too far stretched. I'm guessing that the rally won't last too much longer. I'll keep my eyes peeled for the tell tale signs...

Just getting a chance to look at the markets. The S&P dropped hard out of the gate, kissed the lower regression channel line, then promptly bounced higher. The market is having a hard time declining, but I'm seeing more and more evidence of stocks rolling over, especially high flyers. The Transports have failed to make new highs, and the Utilities have been getting crushed since the last week of January. The Dow theory is in trouble if the Transports can't confirm new highs for the market. I'm still hanging on, but very near the exits, just in case...