MrJohnRoss

Market Veteran

- Reaction score

- 58

MR JR,

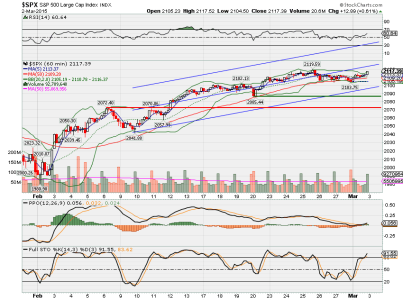

Let me ask you a question, if I jump out of stocks tomorrow, into G let's say; will that be a move for Feb or March, since it takes place on Monday?

An IFT made before 12:00 Noon Eastern Time will transfer your funds the same day. Otherwise your transfer will occur the following business day, in this instance, Monday March 2nd.