felixthecat

TSP Analyst

- Reaction score

- 41

- AutoTracker

No point in getting out now...even if it goes lower. :nuts:

Definitely investors are getting a taste of what it is like when volatility returns to spank the market but good. As alot of the old timers can testify it can get a whole lot worse than just a measly 1-2 percent down day. Try 3-4 percent down days. That will really make you sick to your stomach.

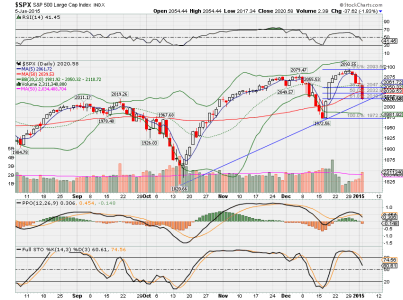

Another thing...when we use charts or consistency or past performance, trends, or any other type of market analysis, these do not take into account exterior events like being nuked, oil collapsing fast, FED making a sudden interest rate increases, terrorism and the like...so these well thought out plans to move in and out don't work out like we hope. If your in...hopefully tomorrow will be a better day. If your out...wait it out until the market regains footing. I took the plunge today hoping for a rebound later in the day on Tuesday. Right now, not sure if that was a good move...but we will see. :worried: