-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

MrJohnRoss' Account Talk

- Thread starter MrJohnRoss

- Start date

jpcavin

TSP Legend

- Reaction score

- 97

What was today's catalyst? Obviously some very good news.

Why Shares of Arena Pharmaceuticals, Inc. Skyrocketed Today (ARNA) I meant, what are your thoughts going forward?

Cactus

TSP Pro

- Reaction score

- 38

... And on the S Fund side the Wilshire 4500 is butting up against the 50 DMA from below. I'm concerned this is a one day dead cat bounce and we could head back down tomorrow. :blink:2030 has now become near-term resistance. This is not a good sign.

MrJohnRoss

Market Veteran

- Reaction score

- 58

Maybe people realized that they were back to work and that low oil prices won't hurt us and they wanted to make money.

Hopefully tomorrow will be up again on the way to a tremendous up close on Friday!

I'm still finding it hard to realize I'm back to work... :toung:

... er, I mean, I just luv my job!

MrJohnRoss

Market Veteran

- Reaction score

- 58

Why Shares of Arena Pharmaceuticals, Inc. Skyrocketed Today (ARNA) I meant, what are your thoughts going forward?

Well, seeing as it's basically just drifted lower all year until today, I'd say today's news is a game changer. Very high volume is also a good sign. Perhaps the mutual funds and hedge fund managers will start plowing in.

Hopefully you'll start hearing *cha-ching! cha-ching!*

MrJohnRoss

Market Veteran

- Reaction score

- 58

... And on the S Fund side the Wilshire 4500 is butting up against the 50 DMA from below. I'm concerned this is a one day dead cat bounce and we could head back down tomorrow. :blink:

Yessir, me too. If the S&P can't break resistance tomorrow or Friday, I'd be very careful out there.

MrJohnRoss

Market Veteran

- Reaction score

- 58

Tried to locate Comet Lovejoy tonight, but couldn't locate it. Anyone able to spot it yet??

MrJohnRoss

Market Veteran

- Reaction score

- 58

Tomorrows probability of an up day:

DJIA: 38%

S&P500: 48%

Nasdaq: 52%

R1K: 49%

R2K: 57%

Tomorrow is considered a "Neutral" day.

Dow futures are currently up +128.

DJIA: 38%

S&P500: 48%

Nasdaq: 52%

R1K: 49%

R2K: 57%

Tomorrow is considered a "Neutral" day.

Dow futures are currently up +128.

Just took a naked eye gander and couldn't see it either. Maybe the bright moon is obscuring it.Tried to locate Comet Lovejoy tonight, but couldn't locate it. Anyone able to spot it yet??

MrJohnRoss

Market Veteran

- Reaction score

- 58

Today will complete the "First Five Days" early warning system for the year. It'll be interesting to see how today shapes up. So far, we're down -1.60%.

bmneveu

TSP Pro

- Reaction score

- 92

Today will complete the "First Five Days" early warning system for the year. It'll be interesting to see how today shapes up. So far, we're down -1.60%.

Sorry if I missed it. Could you explain the warning system?

MrJohnRoss

Market Veteran

- Reaction score

- 58

- Reaction score

- 872

Tried to locate Comet Lovejoy tonight, but couldn't locate it. Anyone able to spot it yet??

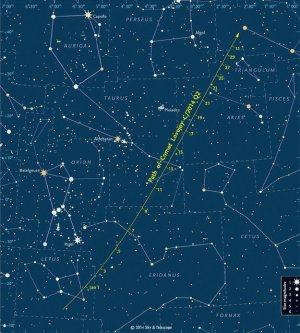

A detailed finder chart shows where to look for Comet Lovejoy during January 2015. The dates' tick marks indicate the position at 0:00 Universal Time (7 p.m. on the previous date Eastern Standard Time).

Here is a link to an article about the comet. Green Comet Lovejoy Now Visible in 'Heavenly River' of Stars: Where to Look

Unless you are in a very dark site (no lights) you will need a pair of binoculars to see the comet. Find the Constellation Orion and slowly scan right of the Belt of Orion. Good luck I haven't seen it because of the cloud cover.

jpcavin

TSP Legend

- Reaction score

- 97

A detailed finder chart shows where to look for Comet Lovejoy during January 2015. The dates' tick marks indicate the position at 0:00 Universal Time (7 p.m. on the previous date Eastern Standard Time).

View attachment 31912

Here is a link to an article about the comet. Green Comet Lovejoy Now Visible in 'Heavenly River' of Stars: Where to Look

Unless you are in a very dark site (no lights) you will need a pair of binoculars to see the comet. Find the Constellation Orion and slowly scan right of the Belt of Orion. Good luck I haven't seen it because of the cloud cover.

Will these work? It's all I have. :laugh:

Amazon.com: Fisher-Price Kid-Tough Binoculars: Toys & Games

MrJohnRoss

Market Veteran

- Reaction score

- 58

A detailed finder chart shows where to look for Comet Lovejoy during January 2015. The dates' tick marks indicate the position at 0:00 Universal Time (7 p.m. on the previous date Eastern Standard Time).

View attachment 31912

Here is a link to an article about the comet. Green Comet Lovejoy Now Visible in 'Heavenly River' of Stars: Where to Look

Unless you are in a very dark site (no lights) you will need a pair of binoculars to see the comet. Find the Constellation Orion and slowly scan right of the Belt of Orion. Good luck I haven't seen it because of the cloud cover.

Thanks nasa, I used that same map last night to try to locate it, but couldn't find it with my naked eyes, or either one of my binoculars. There may be too many lights in my location.

MrJohnRoss

Market Veteran

- Reaction score

- 58

The market has not held on to support levels, and continues it's free-fall. I sold off my TQQQ, BIB and CURE, but something held me back from performing an IFT to G. My thinking is we should be getting near a buy point soon, unless we are entering a more severe correction. I'm holding off to see what the rest of today and tomorrow brings.

Two days ago, I was literally a click away from performing an IFT into G, but I held back. We're at a disadvantage having to base our IFT decisions on what's happened well before the market closes. It turns out that the IFT deadline on Jan 6th was pretty much the bottom of this latest pull-back, and the recovery began almost immediately thereafter. Thank goodness I came to my senses before clicking my mouse. :toung:

Whipsaw

Market Veteran

- Reaction score

- 257

Two days ago, I was literally a click away from performing an IFT into G, but I held back. We're at a disadvantage having to base our IFT decisions on what's happened well before the market closes. It turns out that the IFT deadline on Jan 6th was pretty much the bottom of this latest pull-back, and the recovery began almost immediately thereafter. Thank goodness I came to my senses before clicking my mouse. :toung:

Having gotten out at the bottom/wrong time too many times, I am apt to hold on a down slope (there is risk in holding on too long also).

haha....I did exactly opposite of that. Thought I was being smart by buying in after the first drop. It was so big I thought the next day would surely pull back a bit. When the drop accelerated the next day I panicked at noon and pulled back to G thinking the world was ending.

All said and done, instead of being the hero I lost about 2500 bucks and I'm out for the month using up my two IFT's. So now I'm in G going like I did for the last 5 years or so.

Maybe if I'm going to make bets like I did I just need to do it with smaller positions so it doesn't become such an emotional nightmare.

All said and done, instead of being the hero I lost about 2500 bucks and I'm out for the month using up my two IFT's. So now I'm in G going like I did for the last 5 years or so.

Maybe if I'm going to make bets like I did I just need to do it with smaller positions so it doesn't become such an emotional nightmare.

MrJohnRoss

Market Veteran

- Reaction score

- 58

Having gotten out at the bottom/wrong time too many times, I am apt to hold on a down slope (there is risk in holding on too long also).

haha....I did exactly opposite of that. Thought I was being smart by buying in after the first drop. It was so big I thought the next day would surely pull back a bit. When the drop accelerated the next day I panicked at noon and pulled back to G thinking the world was ending.

All said and done, instead of being the hero I lost about 2500 bucks and I'm out for the month using up my two IFT's. So now I'm in G going like I did for the last 5 years or so.

Maybe if I'm going to make bets like I did I just need to do it with smaller positions so it doesn't become such an emotional nightmare.

Exactly, there's always that tug of war between: "We've come down far enough for a rebound", and, "This slide could continue down for another week or two".

Similar threads

- Replies

- 0

- Views

- 85

- Article

- Replies

- 0

- Views

- 126