MrJohnRoss

Market Veteran

- Reaction score

- 58

After a very long day at work, just now getting a chance to post. Not really liking what I'm seeing with the markets. There seems to be a lot of nervousness by investors, and rightly so.

I am liking what I'm seeing with the metals and miners, which seem to be gaining strength to the upside.

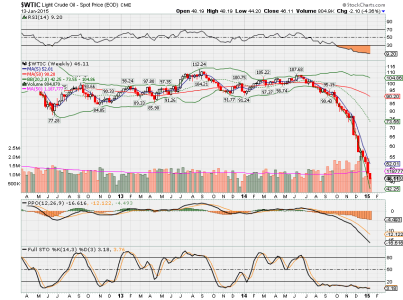

I also rolled the dice on Friday with a chunk of some DWTI, the 3X leveraged bet on downside Crude Oil. It was up a healthy +14.85% today. Yee! :nuts:

I'll be tied up tomorrow morning, so I may not get a chance to make an IFT if things look bad. Seriously considering moving to the sidelines, tho. Hopefully we'll get a little bit of a bounce here.

Tomorrow is historically a "Neutral" day, with the following odds of a positive close:

DJIA: 57%

S&P500: 57%

Nasdaq: 62%

R1K: 60%

R2K: 69%

Seems like pretty good odds to me, but that hasn't always transpired this year, has it?

Let's see what tomorrow brings...

Good luck!

I am liking what I'm seeing with the metals and miners, which seem to be gaining strength to the upside.

I also rolled the dice on Friday with a chunk of some DWTI, the 3X leveraged bet on downside Crude Oil. It was up a healthy +14.85% today. Yee! :nuts:

I'll be tied up tomorrow morning, so I may not get a chance to make an IFT if things look bad. Seriously considering moving to the sidelines, tho. Hopefully we'll get a little bit of a bounce here.

Tomorrow is historically a "Neutral" day, with the following odds of a positive close:

DJIA: 57%

S&P500: 57%

Nasdaq: 62%

R1K: 60%

R2K: 69%

Seems like pretty good odds to me, but that hasn't always transpired this year, has it?

Let's see what tomorrow brings...

Good luck!